2019 Forecast: Industry growth slows as business horizon clouds

Momentum is expected to slow in response to a clouding business and political horizon as the boating industry anticipates its eighth consecutive year of single-digit growth.

Tariffs, the health of the U.S. economy, the possibility of recession causing another downturn and interest rates affecting consumer confidence were all concerns stated by Boating Industry readers in this year’s industry forecast survey.

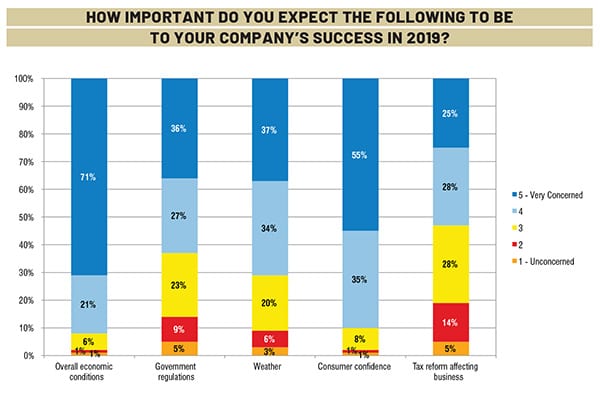

Overall economic conditions were the top concern stated by readers, with 72 percent of respondents reporting the issue was “very important” to their overall business success in 2019.

Consumer confidence was the next most important survey issue at 55 percent.

The National Marine Manufacturers Association (NMMA) is projecting a 3 percent increase in unit sales next year, according to President Thom Dammrich. “We’ve been growing at 5 percent to 6 percent the last two or three years,” Dammrich said. “We could do better than 3 percent, but I think we are going to be a little bit conservative, because we are getting deep into the cycle. I think 2018 will finish up 4 percent to 5 percent on units. Dollars will probably be up 10 percent to 11 percent.”

NMMA is starting to see dealer inventories increasing, Dammrich added. That’s one of several red flags that bear watching as the industry enters a new year.

Availability of product, floorplan issues, and product pricing are big concerns, according to one Boating Industry survey respondent.

“The industry has priced product out of reach for the middle-class boater,” the Ohio-based respondent wrote. “The guy who bought the ‘starter’ boat and allowed the boat builders and motor companies to grow has been removed from the market. We need to target a younger crowd with price point boating products.”

Tariffs and trade wars implemented by the Trump Administration are producing concern, along with other economic issues.

“Our margins are already squeezed,” wrote a Florida-based respondent. “If interest rates climb and demand slows, it could get ugly, and fast.”

Another Florida-based survey respondent had a different economic perspective:

“The current political climate is friendly to business. Regarding the long term, I’m cautiously optimistic.”

Mid- to single-digit growth will continue in 2019, said Peter Houseworth, Info-Link’s director of client services.

“We’ve had eight consecutive years of growth, and that’s unprecedented in boating industry history,” Houseworth said. “From a new unit perspective, we’ve now eclipsed the initial stages of the 2008 downturn.”

People didn’t leave this industry in droves when things got tough, Houseworth contends. They just adjusted and kept going.

Ryan Kloppe, director of sales at Statistical Surveys, Inc., agreed with Houseworth’s growth assessments.

“Last year was our seventh consecutive year of growth, and we are going to get an eighth year in 2019,” Kloppe said. “We are now eclipsing pre-recession numbers in many segments.”

In 2018, SSI predicted 3 percent to 5 percent growth.

“You can tighten that up a little bit, and look at 3 percent to 4 percent growth in 2019,” Kloppe said. “Outboards are in high demand right now. That trend is only going to continue.”

SSI continually sees that trend in its national propulsion data, Kloppe added.

“Ninety percent of what we saw when we attended last year’s Fort Lauderdale Boat Show was outboards. Looking up and down the docks, it was hard to spot a sterndrive,” he said.

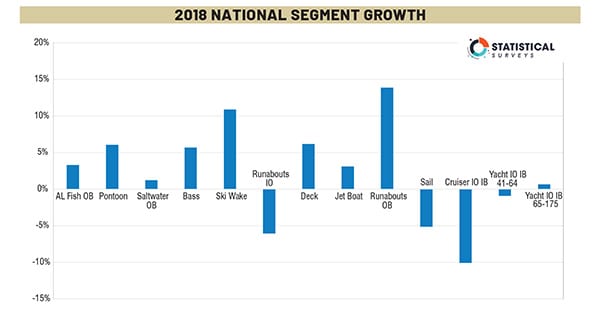

Segment by segment

The biggest driver of the aluminum fish segment is boats 16-feet and up, Kloppe said. “That’s going to grow over 5 percent in 2018. They will probably top 50,000 units.”

Pontoons remain a key driver for the marine industry, and that’s going to continue in 2019, Kloppe said. “Pontoons will top 56,000 units in 2018. They just keep getting better, and have truly become a crossover boat. It’s the same thing with saltwater outboards.”

According to Kloppe, boats supplied to that market will continue to represent a moderate growth segment.

“Sea Ray, Cobalt, Monterey, and Crownline are coming full force with outboards, just to name a few boat builders. Buyers are going to have multiple choices for a fiberglass outboard.”

SSI’s data is showing sterndrives down 5 percent to 6 percent for 2018. “While there are regional pockets that do differently, I would say it’s going to be very similar in 2019.”

The bass boat segment continues to expand. “We saw 6 percent growth in 2018,” Kloppe said. “I would say 2019 is going to mirror that to a large extent and reach 10,000 units.”

Ski and wake boats are going to probably have double-digit growth when numbers for 2018 are finalized,” Kloppe said. “That will continue into 2019. Jet boat unit growth will be around 3 to 4 percent, and sail continues to decline almost on the same path as sterndrives.”

Kloppe said SSI is preparing to expand the 16- to 40-foot reporting category because boat sizes continue to increase.

“We are only going to see more and more of that,” he said. “We are going to have to wait until March 2019 before making a final adjustment, and moving it up to 45 feet, but the same thing is happening with the saltwater segment that we track right now. People are building bigger boats. We are concerned about tracking the larger outboards.”

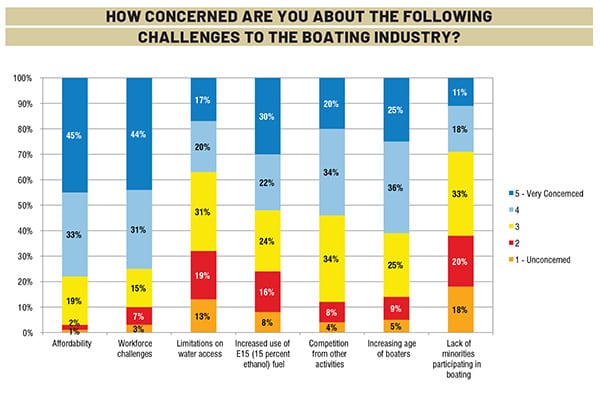

The continued impact of tariffs is the No. 1 industry issue of concern, according to Kloppe. Affordability is a close second.

The unknown factor on tariffs produces a holding pattern, and a holding pattern is not good for year-over-year growth, Kloppe contends.

“Affordability has always been on the industry forefront, and when you have size growth in every segment, that increases dollars spent on each unit,” Kloppe said. “We are still seeing growth, and people are still buying units, but inventory planning is becoming critical. Some analysts are already talking about down cycle indicators in late 2019 and during 2020 that replicate 2008 and 2009,” he concluded.

Houseworth said Info-Link is watching for key data indicators that might provide advance warning of a growth-busting downturn.

“We are in a much better position than we were regarding the last downturn,” Houseworth advised. “Many lessons were learned, and a lot of people who are still in the industry remember it well. We continue to watch our days inventory, and it’s clean as a whistle. Things are moving through exactly the way that they should. There hasn’t been any build up that we can sense. There’s a lot more building to order, and the distribution channel is a lot more efficient than it used to be.”

The industry has had a good year, said NMMA’s Dammrich.

“We are seeing more engagement in our advocacy efforts and response to our industry promotion efforts than we have ever seen,” Dammrich said. “We need more industry engagement. We have the potential to be a real powerhouse in terms of advocacy if we can get everyone engaged by contacting their members of Congress.”

NNMA remains disappointed Section 232 tariffs on aluminum and steel were in place at year’s end and had not been removed in Canada and the EU.

“We will continue to be a loud voice for resolution of that,” Dammrich said, adding the Trump Administration’s tariffs involving China are going to involve a long, long haul that could last years. “It continues adversely impact the industry,” he said.