2022 Forecast: Growth on the horizon, despite challenges

By Adam Quandt

Over the last couple of years, change has been just about the only constant. From temporary factory shutdowns to adapting to completely new ways of doing work and so much more, the recreational boating industry has continued to weather an ever-evolving storm.

While tackling challenge after challenge and change after change, the industry has met unprecedented demand as boating became the outdoor recreation of choice.

“Following record sales in 2020, recreational boating remained the leading outdoor recreation sector in the U.S. in 2021 with new powerboat sales exceeding 300,000 units for only the second time in 15 years,” said Frank Hugelmeyer, president of the National Marine Manufacturers Association (NMMA). “The pandemic created shifts in how Americans prioritize their time, and boating is an activity they’re doing with family and friends to escape from stresses on land, all while creating fun and adventure. As a result, U.S. marine manufacturing, which provides an estimated 691,000 jobs across the country, is standing out as an example of economic resilience.”

In early January 2022, NMMA reported that U.S. new powerboat retail unit sales are expected to surpass 300,000 units for the second consecutive year and only an estimated 4-6% below the record highs set in 2020.

The U.S. Department of Commerce’s Bureau of Economic Analysis reported that recreational boating and fishing took place as the number one contributor to the $689 billion outdoor recreation economy, surpassing RVing, hiking and other outdoor recreational activities.

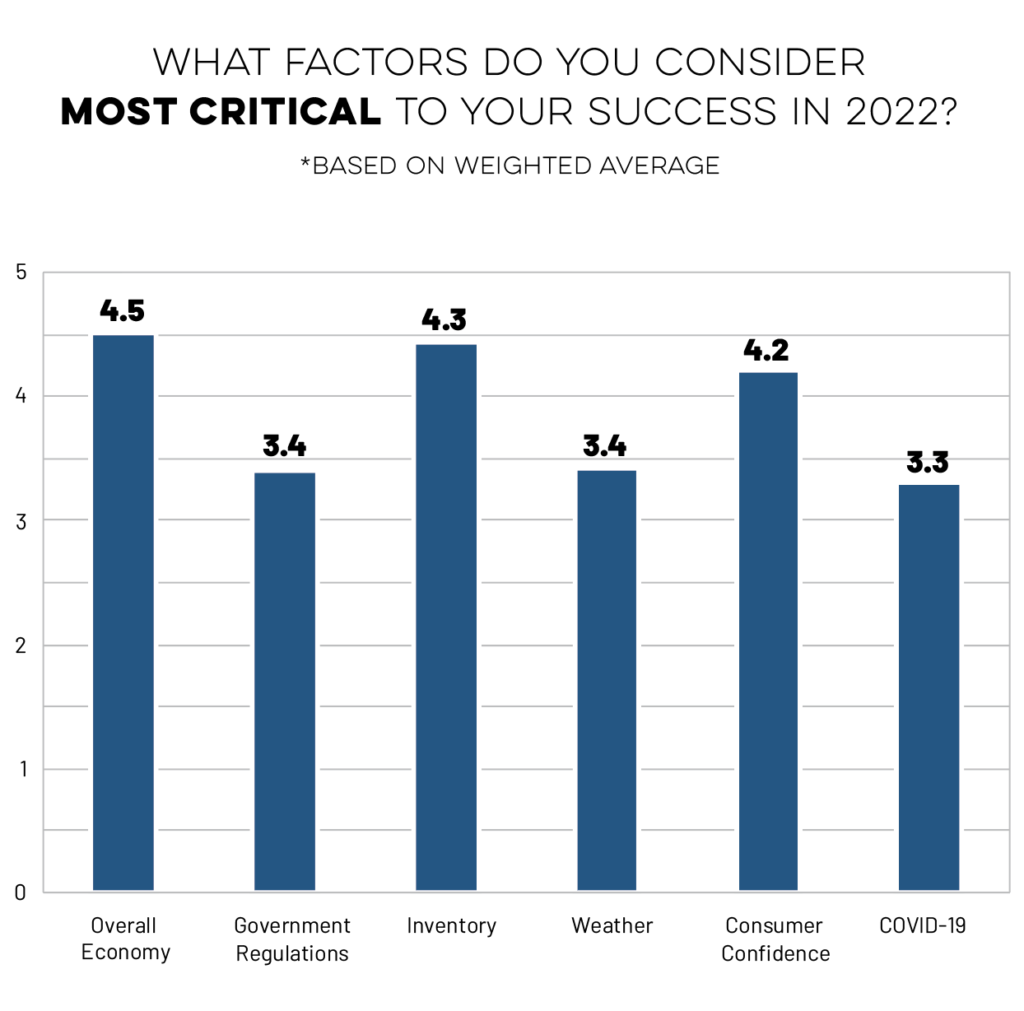

As we look to the year ahead, change isn’t quite so constant in how the industry is planning to face 2022. Respondents to the annual Boating Industry forecast survey once again ranked inventory and the overall economy as the top factors critical to their business’ success in the coming year.

Almost 70% of survey respondents placed inventory as the most important factor to consider success in 2022, closely followed by 63% of respondents ranking the overall economy as their top factor.

The focus on inventory comes as no surprise as the industry faces the new year. An unprecedented high demand for new boats amid supply chain disruptions across the nation and world impacted boat builders and dealers like never before and placed limits on growth in 2021.

In partnership with Oregon State University’s Center for the Outdoor Recreation Economy (CORE) and the Outdoor Industry Association, the Outdoor Recreation Roundtable (ORR) conducted a survey on COVID-19 impacts on the outdoor recreation economy, which closed in October 2021.

Survey results reported that 91% of respondents are experiencing difficulty with production and distribution, with 48% experiencing significant impacts.

Looking ahead, well over half (66.7%) of this year’s survey respondents reported that they don’t anticipate boat supply to align with customer demand until sometime in 2023, with just over 18% anticipating inventory to meet demand sometime in Q3 2022.

Challenges ahead

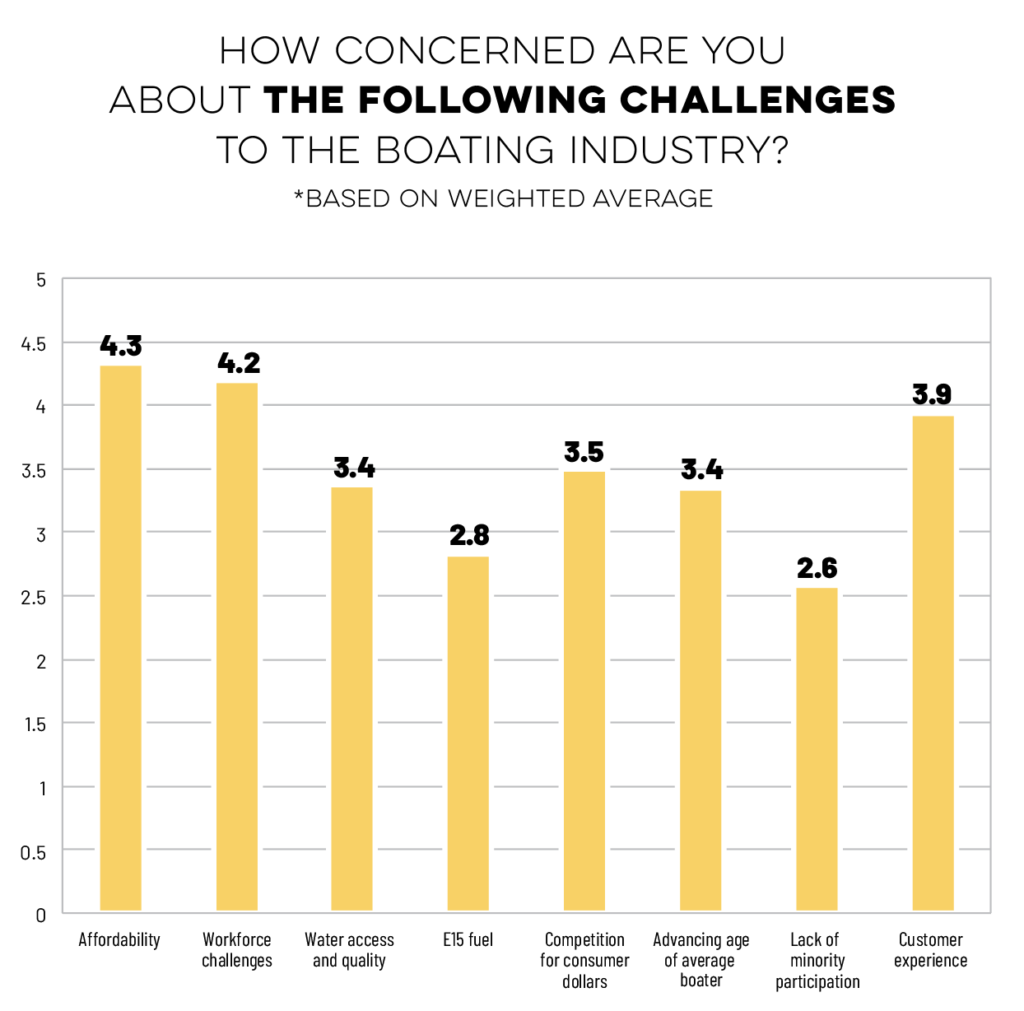

On top of inventory shortages, Boating Industry readers provided insight to other challenges the industry will be up against in 2022.

Unsurprisingly, workforce challenges ranked among the highest concerns for survey respondents, with roughly 48% of industry members ranking it as their most important concern in challenges facing the industry in 2022.

“The outdoor recreation industry has incredible potential, both as a driver of economic opportunity and as a means of making outdoor activity more welcoming and accessible,” Lee Davis, executive director for CORE said in a recent news release. “Right now, the industry is being held back by a growing skills gap and an ad hoc training structure.”

CORE and the ORR recently partnered – along with other leading recreation organizations – on new research efforts supporting workforce development needs.

Like last year’s results, affordability once again took the top spot as the most concerning challenge facing the industry, with just over 52% of respondents placing it at the top of their list for 2022.

The “customer experience” rounded out the top three concerns for survey respondents as the industry moves into 2022.

“Dealers are selling boats like crazy, but we’re also getting calls from dealers with concerns of cranking boats out so fast, they’re worried they’re no longer providing the level of customer service they would like,” Marine Retailers Association of America’s (MRAA) certification manager Liz Keener told Boating Industry during a dive into the customer experience through the pandemic.

Expectations

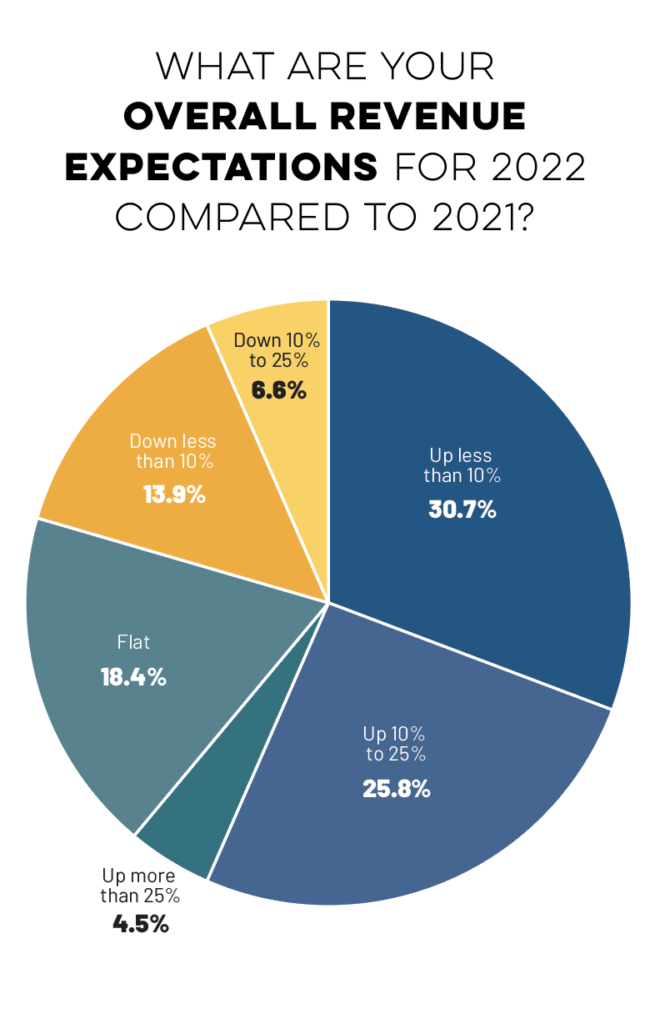

Overall, expectations in the industry for 2022 are reporting to be high. Over half of survey respondents (61%) expect revenue to be up for the year ahead, with 30% expecting revenue to be up less than 10%, just under 25% expecting increases between 10-25%, and 4.5% of respondents expecting revenue to be up more than 25%.

On the flip side, just under 18.5% of respondents expect revenue to remain flat for 2022, largely due to the uncertainty surrounding inventory issues in the coming year.

“Being organized and keeping our orders forecasted in advance should allow us to have a good sales season,” one survey respondent said. “Business is very trying right now due to all the units coming in missing something a dealer must stay organized handle business in today’s environment.”

As of early January, NMMA is projecting new boat sales to surpass 2021 totals by as much as 3%.

“We expect strong momentum for boating and new boat sales to endure through 2022 as Americans from all walks of life explore the great outdoors and turn to the unique joys of being on the water,” Hugelmeyer said.