Tow boat market has posted near double-digit growth for the past five years

They’re colorful. They’re eye-grabbing. And they continue to attract buyers, for both the boats themselves and for those high-margin accessories. For all the changes that have occurred over the past five years, inboard-powered ski and wake boats continue to post year-over-year sales growth in the high single-digit or low double-digit range, putting smiles on the faces of boat builders and dealers alike.

The numbers don’t lie

The National Marine Manufacturer’s Association notes that overall sales of tow boats have been growing steadily over the past five years. According to its 2015 Recreational Boating Statistical Abstract, NMMA notes that sales of inboard-powered ski and wake boats totaled 7,800 units in the 2015 calendar year. This represents a 9.85 percent sales increase over the 7,100 units reported sold in 2014, and steady growth when measured against the 6,100, 5,500 and 4,850 boats sold in 2013, 2012 and 2011 respectively. Not many other segments in the boating industry can boast five straight years of similar increases.

Much of this growth appears to be coming at the expense of traditional sterndrive-powered bowriders. Although the 4,850 ski and wake boats sold in 2011 represent less than half the total sales volume of sterndrive-powered bowriders that year (11,870 units), by 2015 the gap had narrowed significantly, with tow boats growing to 7,800 units while sterndrive-powered runabouts had dropped to 9,620. While sales of other boats also increased over the same period, the growth in annual tow boat sales since 2011 – 2,950 units – closely mirrors a corresponding decline (2,250 units) in sterndrive-powered runabouts.

Ski and wake boat sales are also growing in the used boat market. NMMA pegs the number of pre-owned ski and wake boats sold in 2015 at 19,000 units, representing a year-over-year gain of 9.8 percent over the 17,300 boats reported sold in 2014. This also marks five years of continued sales growth, with 16,800 pre-owned tow boats reported sold in 2013, 16,600 boats in 2012 and 16,000 boats reported sold in 2011.

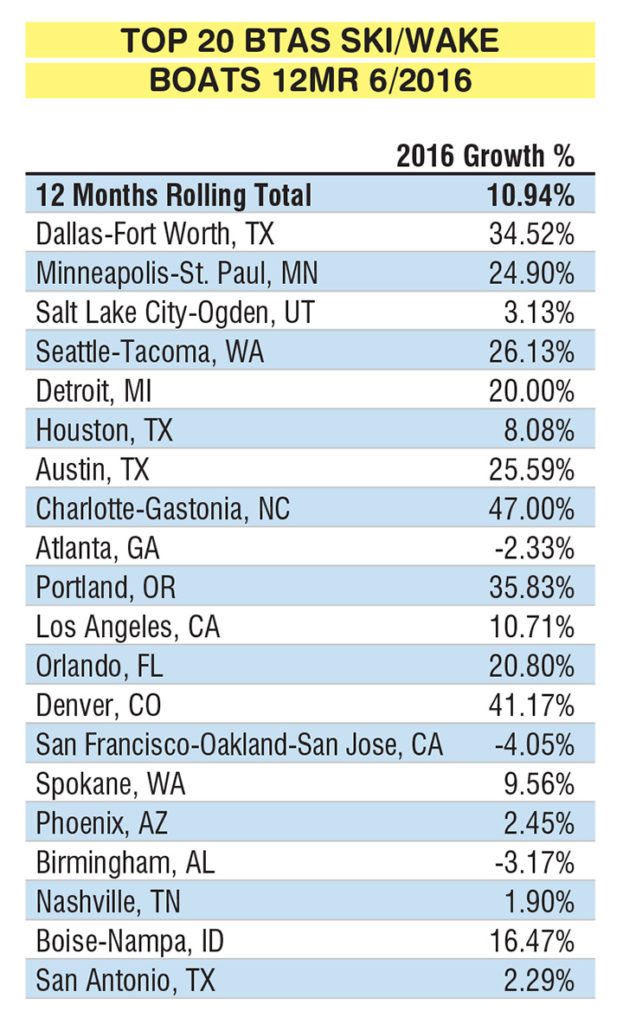

Although Statistical Surveys Inc. (SSI) measures its data differently, its figures are nearly identical to those of NMMA, showing sales of new tow boats to be up by 10.94 percent in 2016. Sales increases were reported for 17 of the top 20 Basic Trading Areas (BTAs) measured by SSI, with declines reported only in the San Francisco/Oakland/San Jose, Calif., Birmingham, Ala., and Atlanta BTAs. The sharpest decline reported, for San Francisco/Oakland/San Jose, was a drop of 4.05 percent while the average sales decline between these three BTAs was measured at 3.18 percent. By comparison, the strongest year-over-year sales gain reported was a whopping 47 percent increase for the Charlotte/Gastonia, N.C. BTA, while sales increases among the remaining 17 BTAs averaged 20.09 percent.

“The ski and wake performance sport boat category has been stronger than any other category in the fiberglass powerboat market for the last couple of years,” said MasterCraft CEO Terry McNew. “It’s had a lot of success attracting buyers from other segments, people who previously might have bought outboards or sterndrives. That’s been driven by the rapid innovation and the technology in this segment relative to the broader boat industry. There are still a lot of people coming into the ski and wake market, and they want a bit of a hybrid experience – the boat is important to them, and so is what they do behind it. Manufacturers in this segment have addressed that in a number of ways, by utilization of wave-shaping technologies and other exciting features that make the boat easy to operate, giving a buyer essentially one-touch operation. You don’t see that on other types of boats.”

Wakesurfing is driving the market

If any one element has clearly benefitted the tow boat segment, it is the continued growth in the popularity of wakesurfing. It’s an activity that appeals to boaters of all ages – aging boomers appreciate it being far lower impact than wakeboarding, while millennials enjoy being closer to the boat and being able to still talk with friends and family aboard the boat when they’re out back in the wake. The proximity is even more important in our social media-driven world, where being close enough for good cell phone photos counts more than anyone will admit.

“Surfing is still growing in a huge way,” said Malibu CEO Jack Springer. “Quite honestly, I think that’s an activity that’s just getting started, there are still a huge number of people who haven’t come into it. Wakesurfing is driving the growth of tow boats, no question about it. Our segment has done a good job of communicating the enjoyment of that premium boating experience, while keeping it accessible. We have our Malibu premium brand, along with our Axis value brand that provides a lower point of entry, particularly for younger families. And that’s critical, because if you think of it, getting a teenager into a boat and away from the video games is a huge win on every level. We’re seeing it happen because of features like enhanced electronic integration, great sound systems, and ease of operation, making it easy to dial in that perfect wake.”

The boom in wakesurfing is not only driving sales by attracting new boaters to water sports, it is also driving sales within the tow boat category, as skiers and wakeboarders trade in their existing tow boat for a new one that’s better suited to wakesurfing.

“The perception that the segment has benefited from wakesurfing is true,” said Correct Craft president and CEO Bill Yeargin. “Many of the tow boat segment’s previous customers are switching from wakeboarding to wakesurfing. In my opinion, the tow boat market is made up of highly brand-loyal enthusiasts who appreciate the innovation, quality and performance of tow boats. Probably the biggest part of that range are families who are looking for a great way to spend time together.”

Enter the challengers

Perhaps the strongest evidence of the importance of wakesurfing can be seen in the number of non-tow boat manufacturers who have recently added surf edition models to their lineups, built around Volvo Penta’s Forward Drive system. Manufacturers actively promote their new wake edition product as an affordable way of trying wakesurfing while still having a traditional, versatile family boat that can do many other things.

“It’s not a one-trick pony,” said Cobalt CEO Paxson St. Clair. “We’ve had tremendous feedback from our dealers on the success they’ve had with our new Surf Series product with the Volvo Penta Forward Drives. Now, the surf boats represent about one-third of our production, and we’re forecasting it to be almost half of our production as we move forward.”

Starcraft has also enjoyed strong support for its new surf boat, fueled in part by a “learn to surf” clinic the company offered at its 2016 dealer meeting so that dealers could experience the product first-hand.

“The response has been simply overwhelming,” said Peter Barrett, senior vice president of marketing and corporate development for parent company Smoker Craft Inc. “The dealers were incredibly enthusiastic, especially after trying it themselves and seeing how much fun wakesurfing really is.”

“The impact of the Volvo Penta Forward Drive has been very positive because it is bringing new people to boating,” notes Ron Huibers, president of Volvo Penta Americas. “We have heard countless stories where customers who have new Forward Drive-powered boats have taken guests out on the water and introduced them to water sports, such as the exciting sport of wakesurfing. The Forward Drive is having a significant impact on the industry because it gets more people out on the water and allows them to fully enjoy the best family activity there is.”

One would think that the arrival of new competitors would irk tow boat manufacturers, but that doesn’t seem to be the case.

“Many people in the industry are trying to connect to the wakesurfing phenomena and I understand that,” said Yeargin. “These non-tow boat companies produce good quality product that draws more attention to wakesurfing. In the end I think it helps the tow boat market, because it draws more attention to the sport which makes people who may have been in the market for a non-tow boat to consider the tow boat brands.”

McNew also welcomes the arrival of surf-style boats built on the Volvo platform.

“Because wakesurfing is done close to the transom we’ve never supported sterndrive boat builders advertising surf capabilities, just because of the proximity between the surfer and the propellers and the chance that someone could be injured,” he says. “So when Volvo Penta brought out their forward-facing drives, we applauded it because it’s so much safer. We don’t see that system as a direct threat, to the contrary we’re happy to see more boat builders introducing consumers to water sports, and reaching a broader audience than we could reach on our own. We look at it as a feeder system, almost, because it generates interest. When people want to get more serious about surfing, they’ll look at our product line.”

Forecasting future growth

With the growing popularity of wakesurfing and an apparent industry focus on promoting water sports in general, the question for tow boat builders is just how long the wave will last. After all, low double-digit or high single digit growth for five straight years is a difficult metric to sustain.

“Because the tow boat segment has been growing there is a perception in the industry that the category is doing great,” Yeargin said. “However, we are still only about two-thirds our pre-downturn numbers while the number of competitors in the segment has also increased. As a market, we are still a long way from where we were.”

While the category may well still be behind pre-downturn levels, it is gaining ground – mainly on the strength of almost continuous innovation.

“New product is always going to drive the growth,” notes Springer. “Which makes this an exciting segment to be in, because everyone in the category is bringing out new product all the time. Malibu brings out four new boats every year, with 15 to 20 new features, and that’s why our market share has increased so substantially. But there is still a lot of room for future growth. The West, and California in particular, is still lagging a bit for a number of reasons, but I believe El Niño is helping as we’ve seen some stronger activity there this year. Canada is down this year, due to the currency exchange rate and higher gas prices earlier in the season.”

“Historically California has been a great market, but currently it is only about a third of pre-downturn unit sales,” agreed Yeargin. “Texas is now the hottest market, with sales about twice the second closest state.”

With the appeal of water sports in general, and wakesurfing in particular, among younger, more active buyers, it appears that the steady growth that the tow boat category has enjoyed since 2011 should continue.

“Certainly the desire of millennials to be associated with great brands will drive future growth,” said McNew. “Even if they’re not the direct purchaser of the boat yet, they still influence the purchase. These customers value time with friends and family, and they tend to be fairly active. They appreciate living a healthier lifestyle, and getting outside to have fun rather than sit and watch TV or play video games.”