Next is Now

What America’s changing demographics mean for boating

It’s no exaggeration to say we are in the midst of major demographic shifts in the United States. What the average American looks like, where they live and how they behave are all changing at a rapid pace.

With these changes in generations, race and ethnicity, it also means a much different target audience for boating.

In the next two sections, we lay out some of the demographic changes that are occurring. Then, starting with “Engaging new markets,” we share insights and solutions from people across the industry on how we can make the most of this new opportunity.

The Millennial wave

This year the Millennial generation (those born roughly between 1981 and 1997) will surpass the Baby Boomers (born 1946 to 1964) as the largest living generation, according to data from the U.S. Census Bureau. By the end of 2015, there will be an estimated 75.3 million Millennials, compared to 74.9 million Boomers.

The Baby Boom generation peaked at 78.8 million in 1999. With immigration continuing to add to their generation, the number of Millennials is projected to peak at 81.1 million in 2036.

The smaller Generation X, sandwiched between the two outsized generations, is expected to peak at 65.8 million in 2018 and surpass Baby Boomers in 2028.

With those numbers in mind, it’s not surprising that in a recent Boating Industry survey, 65 percent of respondents said they were at least somewhat concerned about the aging population of boat buyers, and only 5 percent were not concerned at all. The white male Baby Boomer has been the core of the boating industry for decades, buying millions of boats, engines and accessories.

Each year, the age of the average boat buyer is about six months older than the year before, according to analysis by Info-Link. Info-Link has tracked buyer registration data back to 1997 and in that time, the average buyer age has increased by about 8 years. Although the periods don’t line up perfectly, that’s much faster than the aging of general population from the 2000 to 2010 Census, where the average age increased only 1.9 years to 37.2 years old. There are significant variations in buyer age by category (see chart), but one thing every market segment has in common is an aging buyer.

Reaching new markets

While most in the industry realize the importance of reaching a younger buyers, and bringing more Xers and Millennials into boating, they aren’t nearly as concerned about the lack of diversity.

In that same Boating Industry survey cited earlier only 28 percent said they were even somewhat concerned about the issue. It reflects what would seem to be a fundamental disconnect from the fact that a younger audience is a more diverse audience.

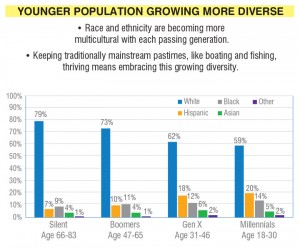

The need to reach a more diverse audience is simply about basic numbers: Only 59 percent of Millennials and 62 percent of Xers are white, significantly lower than the 79 percent of Silent Generation (65+) and 73 percent of Baby Boomers. If nothing else, demographic trends require the industry to look beyond its traditional base, says Thom Dammrich, president of the National Marine Manufacturers Association.

“Our traditional white male audience is not growing,” he said. “It’s a stagnant part of the population and it actually, as a percentage of the population, will be declining over the next decade or two. If we want to grow … we’re going to have to be more effective at reaching out to new markets, which includes deeper penetration into Hispanic, Asian and African-American markets.”

It’s why groups like the Recreational Boating Leadership Council and Recreational Boating & Fishing Foundation are making such efforts to help grow the industry in that direction – efforts that are covered in more detail on the following pages.

“We’ve always had a need to reach a younger demographic and as it turns out, that younger demographic, over the next 10 years isn’t going to be white,” Dammrich said. “If you’re talking about attracting a younger crowd, you’re also talking about a more diverse crowd.”

And the younger you get, the more diverse it gets. In 2014, the U.S. population under 5 years old was 50 percent white, 50 percent multicultural. The Hispanic population makes up the largest – and fastest growing – portion of that non-white population, representing 24 percent of those under 18.

Overall, there are an estimated 54 million Hispanics in the United States, or 17 percent of the population. It is projected by the U.S. Census Bureau that the number will be 65 million and 20 percent of the U.S. population by 2020.

It’s a much younger population as well – the median age of U.S. Hispanics is 28 years old versus 42 years old for non-Hispanic whites.

The largest Hispanic population is centered in the areas one would expect, with cities like Los Angeles, New York, Houston and Miami among those with the greatest numbers. But this truly is a national phenomenon, as the list of those states with the fastest-growing populations demonstrates, with a top five of Alabama, South Carolina, Tennessee, Kentucky and South Dakota.

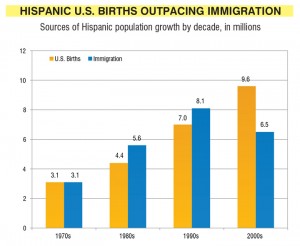

A common misconception among many in the industry is that Hispanics don’t have the means to purchase a boat. Part of this stems from the idea that this is an immigrant population, while in fact much of the growth of the Hispanic population in the United States is coming from those born here, as shown in the chart above. As of 2012, only 35 percent of the U.S. Hispanic population was foreign born.

As those families have become established in the United States they, like immigrant groups before them, have improved their income and education level.

As of 2012, the median household income of U.S.-born Hispanics was $43,400, according to the U.S. Census Bureau. While lower than the $56,000 of non-Hispanic white households, that gap is narrowing and will probably continue to do so as education levels rise. Notably, in 2012, 69 percent of Hispanic high school graduates enrolled in college – higher than the 67 percent of their white counterparts.

(It’s worth noting that the Asian population, while much smaller than the Hispanic population, is very highly educated and even more successful, with an average household income of more than $70,000.)

A change in attitude is key to reaching these new demographics of younger, more diverse buyers.

“In some cases, it’s changing biases that we don’t even know we have,” Dammrich said. “We all have a tendency to pre-judge people and that’s the hardest thing to stop doing, especially when you’re in sales. We still need to demonstrate to people that there’s a great business opportunity here and there really is.”

Engaging new markets

The changing demographics in the U.S. create a wealth of opportunities for the industry, particularly with the Hispanic market. Boating can be leveraged in such a way to appeal to their priorities.

“We understand from [our] research that boating really is a pastime that is well-suited to Hispanics. And when Hispanics are exposed to it, they really take to it,” said Gerry Loredo, business analytics director of Lopez Negrete Communications. “To me, the encouraging thing is that boating is definitely a pastime that is well-suited to Hispanic families.”

Lopez Negrete, the nation’s largest Hispanic-owned marketing firm, has been working with the RBFF on a multi-year project to help attract Hispanics to boating and fishing.

“It just hits a sweet spot within this audience of what they’re looking to do with their families,” said RBFF president Frank Peterson. “Now what we have to do is provide them with the means and tools in order to turn that into a reality for them.”

When looking at the data on Hispanics in the U.S., this population is at a life stage where they are getting married, buying houses and creating households.

“If you were to take demographics out of it and look at the profile of a boat buyer … it’s right in front of us. It’s up to us to take advantage of it,” said Peterson.

Marketing research by Lopez Negrete and others shows that the Hispanic population is looking for a different approach to marketing than the general buyer. Different images, messages and connections resonate with

this population.

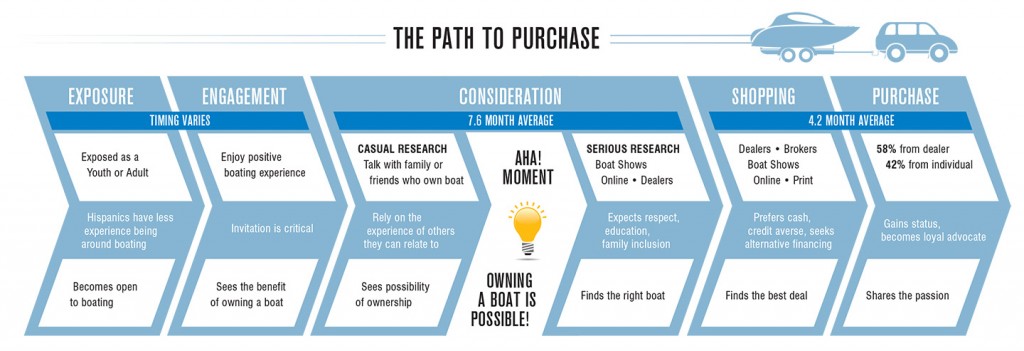

If Hispanic talent is used in advertising, Hispanic customers will be able to see themselves in the sport and reach the “AHA” moment that initiates their shopping process, as demonstrated on the Path to Purchase graphic below.

“They have to view it as a possibility,” said Lou Sandoval, co-owner and founder of Karma Yacht Sales. “Show the market that you want to pursue in your marketing collateral.”

Peterson said the use of families in advertising, versus the friend-based images that are more typical in the industry currently, helps drive home a message of togetherness, which is a huge motivator for Hispanics.

“Let them see how boating can be a great part of their lives and a great part of bringing their family together, and providing these great moments,” said Peterson. “That makes [boating] more inviting for this audience if we do that simple thing.”

A personal reference from a friend or family member goes a long way with communities not typically associated with boating. Dealerships can leverage existing customers to become ambassadors to the sport.

“Anything we can do that encourages existing Hispanic boat owners to invite their friends, extended family and take them out,” said Loredo, “They’re sort of the natural brand ambassadors for boating because they’re going to be able to offer the experience and do it in a way that’s very organic, and that’s going to lead other families to say ‘Hey I can do this, this is for me. It’s fun, it’s a really healthy and good experience for my family.’”

“If you’ve got somebody who’s your champion amongst your own dealership family, who’s right there who could help you and help open doors for you, why not? Make them feel good and help you at the same time,” said Wanda Kenton-Smith, chief marketing officer of Freedom Boat Club.

Hispanics particularly value word of mouth because there is often a lack of trust towards businesses, but a recommendation from a friend or family member is huge. Hispanics are also very loyal once they have settled on someone, which means lifelong brand loyalty for the businesses willing to invest the time and effort.

“It’s not just that you have to make a sacrifice and you need to do the education [and] that the sale is a much harder sale than the guy that’s already buying boats,” said Loredo. “But if you make that investment, they’re much more likely to buy at your place and also to buy throughout their boating career.”

Source: Recreational Boating and Fishing Foundation (recreated)

Lessons from RBFF’s mystery shopping

To effectively understand the Hispanic market and existing attitudes, RBFF and Lopez Negrete undertook two major research projects: a mystery shopping initiative and Path to Purchase research with Hispanic buyers.

What they found throughout their research were several areas of improvement for selling to Hispanic customers, one of which was the initial greeting. Dealerships need to understand how to make Hispanic customers feel welcome and comfortable from the moment they walk through the door.

“When general market clients come into a dealership, they like to come in and look around a bit, and typically the salesman will give them a little bit of space to look around and then engage them,” said Loredo. “Whereas Hispanics, when they come in, that seems to be off-putting to them. They come in and they’re expecting to be addressed and to have the salesman talk to them, and in many cases they misinterpret it as being unwelcome there. It’s a curious cultural nuance that we found in the research.”

Hispanic customers also need to be educated a bit more on the product during the sales process, as they do not have the same lifelong experience as the general market, and often need “hand holding.” The mystery shopping revealed that many dealerships were not providing adequate information for this customer.

“They want to know that this product is going to be safe for their family. They want to know what kind of training they’re going to get when they buy the boat,” said Peterson.

However, the mystery shopping discovered that many marine businesses were already doing a fantastic job at catering to these customers. One of these dealerships was Prince William Marina, a Boating Industry Top 100 Hall of Fame dealer. Loredo said that the mystery shopping research identified five fundamentals when selling to Hispanic audiences. While many businesses did a great job with the first impression, greeting, sales process and overall impression among customers, Prince William Marina excelled in the fifth fundamental – needs assessment.

“[Needs assessment] zeroes in on matching the person with the right boat. And I think that’s going to be particularly important when we are talking to people who are newer to boating, and who are much more likely to enjoy boating with their families,” said Loredo.

When asked what tactics he used to reach these buyers, Carlton Phillips, owner of Prince William Marina, said he didn’t treat these customers any differently than anyone else who walked in his door.

“If somebody comes through that door or calls our phone, unless it’s a mistake or they’re asking for directions to somewhere else, then they are interested in a boat. Do not assume they are not a boat buyer. We assume that everyone that comes through the door is a boat buyer,” said Phillips. “When people come in, we treat them with respect.”

Prince William Marina doesn’t have any Spanish-speaking employees, which is often the blanket solution for selling to Hispanic buyers. While it certainly helps to have Spanish-speaking employees in regions where there is a high density of Hispanics, it is not necessary to reaching all Hispanic buyers.

“What Prince William Marina shows is that you don’t absolutely have to, as long as you’re very mindful and you have salespeople that are going to treat this prospect with respect,” said Peterson, “and spending that extra time to help them make the right selection for the way that they’re going to be using their boat.”

To hear more success stories from existing dealerships on reaching Hispanic buyers, visit BoatingIndustry.com/NewMarkets.

Speaking the same language

Sandoval purchased his dealership in 2002 with partner Jack Buoscio at a time when the median age of their customer was in the high 50s. During a time when the average boat buyer’s age increased by six months every year, Sandoval was able to successfully decrease the median age of a Karma Yacht Sales customer by a similar rate that the rest of the industry was increasing. The median age of his customer is now in the low 50s.

Sandoval attributes much of this success to his and Buoscio’s ages, as they represented the demographic they were hoping to attract.

“It’s human nature. You do business with people that are like you,” said Sandoval. “It makes that conversation and the connection, at least from the sales perspective, all the more simpler.”

The connection is simpler when the dealership and the customer speak the same language, figuratively and literally. While Prince William Marina proves that it is not necessary to have bilingual employees to be successful with new demographics, it can be beneficial depending on your market.

Newport Boats found that the market area surrounding its dealership contained a Mandarin-speaking population of about 30 percent, many of whom do not speak English. This led the dealer to add a page to its website written exclusively in Mandarin.

“We are one of the few boat dealers that actually puts Chinese on our website. Most of the [Chinese] clients trying to buy a boat, English is their second language. When they try to do the research online, they feel so happy,” said Vivian Wang of Newport Boats. “When Chinese people speak Chinese, they feel more confident to talk. Even though it’s only a page or introduction, they feel more motivated to make the call.”

The page includes Wang’s cell phone number, where Chinese customers can reach her directly and she can assess their needs. Once the customer feels comfortable, they make an appointment to see Wang in person.

Wang is the only Mandarin-speaking employee at Newport Boats and she recommends that dealerships with a large Mandarin-speaking population in their market area hire at least one Mandarin-speaking employee to act as a liaison. Wang also noted that Mandarin and Cantonese are two different dialects of the Chinese language and it is important to identify which dialect the surrounding population of the dealership speaks.

A significant barrier for reaching Chinese clients is the cultural difference in purchasing patterns, said Wang. Her Chinese customers prefer to pay cash for items and finish the process as quickly as possible. Often times, the amount of paperwork involved can be a deterrent for these consumers.

“Some of our Chinese clients are not always satisfied with the process because it takes so long. That’s the [biggest] concern when we get a Chinese client because they don’t understand the process of buying a boat,” said Wang. “We have a lot of paperwork in America. In Chinese people’s minds, we do things really fast and do things right away.”

Wang suggests that dealers find ways to speed up the boat-buying process for Chinese customers if possible, as they will be much happier with the business and likely to purchase again.

Wang says the web page on Newport Boats’ website is the most comfortable way for Chinese customers to get to know the dealership and feel confident to shop. They feel as though their needs are being specifically addressed.

“I get Chinese clients who come in and say ‘It’s so good that we have some Chinese introduction on the website,’” said Wang.

The issue of affordability

Sandoval noted the issue of affordability in the industry and said manufacturers are focusing too heavily on larger products that appeal to existing boaters.

“They’re trying to get that repeat buyer that is currently in the 38-footer that’s going to move up to the 45 … but we’re kind of forgetting that there is a whole bottom end of the market that’s not being addressed,” said Sandoval. “We’re making a mistake as an industry right now in turning out backs to that part of the segment.”

When addressing the problem of affordability, Loredo held up Honda Motor Company as a model for boat builders.

“That’s a company that understands they need to keep the pipeline full,” said Loredo.”

Honda’s automotive line consists of entry-level cars, such as the Civic and Fit, which are not giant moneymakers for the company. However, because those vehicles are engineered in such a way to be high quality, they create value for the customer and lifelong brand loyalty.

“When those folks go to buy their next car, they typically are making a bit more money because they’re further in their careers, and they’ll buy an Accord,” said Loredo. “And when they have kids, they’ll buy an Odyssey … or a Pilot.”

The question we need to ask ourselves is whether or not we are doing enough to keep younger families interested in boating and providing an accessible entry point.

“No one comes in off the street and buys a big, expensive boat as their first boat. People need to be brought into the industry,” said Loredo.

Alternative boating methods also work to address the issue of affordability, as they get customers on the water and make boating a part of their lives.

George Harris, president of Northwest Marine Trade Association, said this is of particular prevalence in the Northwest as many young boaters live in condos where boats cannot be stored. This is why the NMTA purchased the Northwest Paddling Festival, which is an event that offers demo opportunities.

“Our board sees paddling, kayaking [and] paddleboards as a starting point into boating,” said Harris. “Eventually these young people … will need a little bit more space. Figure out a way to make boating a part of their lifestyle [now].”

Read more about alternative boating methods at BoatingIndustry.com/NewMarkets.

The role of education

As exposure to boating leads to adult engagement in the recreation, the industry needs to place an emphasis on growing the boaters of tomorrow through youth programs.

“The people that run these programs know that boating is a great activity for kids. It’s so empowering. You can’t drive a car until you’re 16 but you can operate a boat by yourself when you’re 10,” said Harris. “A positive experience on and around the water … sets them up to be a boater when they’re 30 or 40.”

Harris co-chairs the youth education task force of the RBLC. The task force created a national database of more than 3,000 youth programs, which include yacht clubs, summer camps, community events, independent businesses and more. The database can be found at discoverboating.com/boating-courses/youth-boating-programs.

Loredo notes, however, that educational opportunities for the whole family are just as important and the industry should focus on events that stimulate the whole family’s interest.

“Purchase decisions are much more democratic in Hispanic families, and kids and spouses have much more say when we compare it to making a similar decision in a general market household,” said Loredo.

“I think we really need to start focusing on the whole unit as families. Even non-Hispanic Millennials are much more in tune with being family-oriented and inclusive with their families,” said Peterson.

Embracing change

Sandoval says it is time for the boating industry to embrace change and the opportunities that exist with new demographics, but to understand that any strategies initiated to reach new demographics will not be an overnight success story.

“While it may be more of a long-term strategy, it’s what [businesses] do today that’s going to define where they’re going to be in the long term. The steps that get them there have to be started today,” said Sandoval.

Kenton-Smith added that marine businesses should expect to fail at some things, and that’s ok. If the first initiative does fail, don’t assume that you are unable to reach those new markets.

“The whole key is to try. It doesn’t have to be a huge undertaking or budget. Just try little things and take baby steps, but do something. In 2015, choose one thing that you’re going to do and put forth the effort to try something, and follow it through. See how it works,” said Kenton-Smith. “Eventually, it’s going to pay off. … Any kind of positive traction moving forward is the right thing to do.”