Washington Update

A closer look at the key issues facing the marine industry

It’s easy to be frustrated or turned off by the partisan politics, government shutdowns and other Washington goings-on that make the headlines in our nation’s capital.

While we could choose to ignore Washington, the reality is that Washington is not going to ignore the boating industry. From tax issues to healthcare reform to environmental regulations, what happens in Washington affects our industry every day.

One of the best ways to keep up on the issues and help shape policy is to attend the annual American Boating Congress, coming up in May. (Read more here)

The following are some of the key issues affecting the industry this year and how they are progressing.

Ethanol

The ethanol issue is one on which the industry and its partners have made significant progress in the last few years.

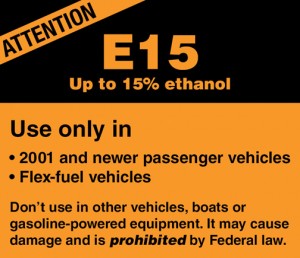

The biggest concern for the industry when it comes to ethanol is E15, a fuel blend of 15 percent ethanol that is becoming more prevalent at gas stations, especially in the Midwest. Although not approved for use in marine engines, there is significant risk of misfueling if boaters don’t understand the risks.

Three recent studies seem to back that up. In a BoatUS survey, 63 percent of its members said they fill their boats at roadside gas stations and a study last year found that many stations selling E15 were not displaying all of the required warning labels. At the same time, AAA reported that 95 percent of its members were not aware of E15.

Three recent studies seem to back that up. In a BoatUS survey, 63 percent of its members said they fill their boats at roadside gas stations and a study last year found that many stations selling E15 were not displaying all of the required warning labels. At the same time, AAA reported that 95 percent of its members were not aware of E15.

It’s been a major policy issue for not only the marine industry, but also a diverse coalition of groups including snowmobile manufacturers, dairy farmers and poultry farmers, because of the concerns about corn being diverted from food to fuel.

That group scored a significant victory when the Environmental Protection Agency announced last fall its proposal to reduce the amount of ethanol required to be blended into gasoline and diesel fuel in 2014 under the Renewable Fuel Standard. Passed as part of the Energy Independence and Security Act of 2007, the RFS sets the levels of biofuels that have to be used in the nation’s fuel supply – levels that have been called “unattainable” by the National Marine Manufacturers Association. The boating industry alone submitted more than 1,600 comments in favor of the proposal.

“That’s the first time any administration has taken action to step back and say, hey we might not actually meet these goals,” said Nicole Vasilaros, NMMA’s director of regulatory and legal affairs.

In fact, The Hill – an influential Washington newspaper and website – named the EPA’s decision one of the top five lobbying victories of 2013.

Much remains to be done, though, as the EPA’s decision is only a stopgap measure. Congressional action is needed to modify the Renewable Fuel Standard for the long term, Vasilaros said.

“At the end of the day Congress is the only body that can actually do reform,” she said. “These short-term fixes by EPA are welcome, but they’re just short term.”

With engine makers designing for the next generation of sterndrive engines, and outboards being rethought for 2015 and beyond, those manufacturers need to know about the fuel that will be in the marketplace, she said.

There’s also still considerable support for the ethanol industry in Washington, especially among senators and representatives from states like Iowa, Minnesota and Illinois where corn is being grown to feed the ethanol demand. Shortly after the EPA’s announcement, 22 senators signed a letter arguing against the changes. Unlike many issues in Washington it tends to be a regional, not partisan issue.

A number of bills were introduced in Washington last year to address ethanol and the Renewable Fuel Standard. The most recent was the bipartisan S. 1807, the Corn Ethanol Mandate Elimination Act of 2013, introduced by Sen. Dianne Feinstein, D-Calif., and Sen. Tom Coburn, R-Okla., in December. The bill, which has eight other Democratic and Republican co-sponsors, would eliminate the corn ethanol mandate and encourage the use of other biofuels. It was referred to the Committee on Environment and Public Works before Congress left on its winter recess.

Following the bill’s introduction, more than 40 groups including NMMA, BoatUS and the Marine Retailers Association of the Americas issued a letter in support of it.

“The next step is what is the vehicle that will move through Congress and gain momentum,” Vasilaros said.

While there is still work to do on the ethanol issue, where it stands today versus just a few years ago reflects the progress the industry and others have made on the issue.

“A lot more needs to be done, but if you go back to the 2008, 2009 timeframe, nobody knew what this was,” said NMMA legislative counsel Jeff Gabriel. “We thought we had a Mount Everest to climb and this industry has done a wonderful job on it.”

That progress shows the importance of a concerted industry effort, Gabriel said, as it has been everyone from NMMA staff to manufacturers to dealers to boaters making sure their Congressional representatives understand the issue.

“This industry, working with a lot of stakeholder partners, has made an amazing difference in the understanding on the hill,” Gabriel said. “That comes directly out of the years of toiling and hard work that the industry has done.”

Taxes

While there’s been no major action lately, tax reform continues to be a hot issue in Washington.

For the marine industry, one of the biggest concerns in recent years have been the frequent proposals to modify or eliminate the second-home mortgage interest deduction. For many owners, the interest on loans for boats that meet certain requirements including a head and galley can be deducted.

Last summer, Reps. Mike Quigley, D-Ill., and Tim Walz, D-Minn., introduced HR 2563, the “Ending Taxpayer Subsidies for Yachts Act,” which would eliminate the second mortgage deduction for boats, but leave it intact for cabins, RVs, etc. A similar provision was included in a broader bill introduced earlier in the year by Rep. Keith Ellison, D-Minn.

There is little reason to expect action on those efforts that specifically target the marine industry and Rep. Quigley has distanced himself from the effort after getting pressure from his constituents, Gabriel said.

“It was a political stunt by Congressman Quigley, quite frankly,” Gabriel said. “He’s trying to draw an issue that’s not there. It didn’t generate enough support for it to go anywhere.”

These efforts represent a fundamental misunderstanding of who the deduction benefits – working class boat owners and factory employees, Gabriel said. The ultra-rich who purchase megayachts are already not using the deduction for a number of reasons from paying cash to maxing out their deductions to registering ownership under an LLC.

“That said, the fact that he dropped the bill and it gets mentioned has everyone highly focused on the issue and if it would ever get anywhere,” Gabriel said.

At this point, the most likely way the deduction would get eliminated is if it’s part of a larger tax reform package that included all second homes. It was specifically identified late last year as one of 12 “Top Tax Loopholes” by the Democratic staff of the Senate Budget Committee: “Stop Tax Subsidies for Yachts and Vacation Homes — Eliminate deductions used by the wealthiest Americans that subsidize yachts and vacation homes.” The change would save taxpayers about $15 billion over 10 years, it was estimated.

Healthcare reform

The high-profile website failures of Patient Protection and Affordable Care Act – aka Obamacare – have gotten plenty of coverage this year. But beyond those issues, there have also been several changes that could affect your business.

Most notably, the Internal Revenue Service announced in February that employers with less than 100 workers wouldn’t have to provide health insurance to those employees until 2016. In order to qualify for the delay, companies have to certify to the government that they haven’t released employees to get under that 100-employee threshold and that they won’t drop health plans they already offer.

Under the original act, companies with more than 50 full-time employees were going to be required to offer insurance in 2014 or face fines of up to $3,000 per employee. In July 2013, that requirement was changed to 2015 and now those companies with between 50 and 100 employees will have an additional year to comply. Larger firms have to cover at least 70 percent of employees starting next year, the IRS said.

Another exemption of interest to the boating industry included in the 227-page ruling is that employers won’t have to cover seasonal workers that are employed less than six months.

For more on healthcare reform, be sure to check out our “Preparing your company for healthcare reform” in our January issue.

Boating goes grassroots

NMMA is trying to grow the industry’s grassroots lobbying efforts through a new website, BoatingUnited.com.

NMMA is trying to grow the industry’s grassroots lobbying efforts through a new website, BoatingUnited.com.

The site, launched in February, is designed to be an online community for marine manufacturers, boating businesses, enthusiasts and supporters. The site is open to NMMA members and nonmembers.

“It’s an open community for any stakeholder with a vested interest in the industry,” said Michael Lewan, NMMA’s grassroots and government relations manager. “We really picture it as being the home of the recreational boating industry’s grassroots efforts – 80 million people we can potentially tap into. We want to give them the resources and tools to come together and present a unified and powerful message.”

Through Boating United, users can sign up to receive updates on legislation affecting the industry, learn more about specific bills and contact their members of Congress. Boating United’s “action center” allows users to send pre-drafted letters to their elected representatives or for users to write their own.