Dealers lean on brokerage during downturn

In a recent survey, more than 260 dealers shared their thoughts on the advantages of brokerage.

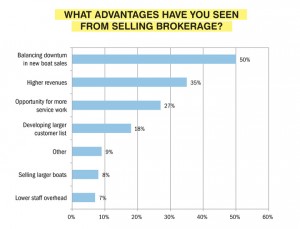

In a recent survey of dealers where 80 percent of respondents sell brokerage boats, half said one advantage of brokerage is balancing the downturn in new boat sales, according to a survey conducted in May by Boating Industry in partnership with Dominion Marine Media.

An increase in revenue and opportunities for more service work, which were selected by 35 percent and 27 percent of dealers respectively, rounded out the top three.

“I think that since 2008 any dealer standing is doing brokerage sales,” one dealer remarked.

Although half of the dealers cited the importance of brokerage during the downturn, about 51 percent of those who sell brokerage boats have done so for more than 15 years. About 74 percent of the 268 dealers who responded to the survey said they have been in business for 15-plus years.

The most often selected disadvantage of brokerage was the different sales structure, which accounted for 44 percent of responses. About 43 percent chose “Other,” and of those responses, the most common write-in answer was either that there were no disadvantages or that the margins do not outweigh the time demands of the sales staff.

“You have to sell the deal to both the buyer and the seller,” one dealer wrote in.

When asked about the marketing tools most effective in selling brokerage boats, the overwhelming favorite was listing websites, which were chosen as most effective by 76 percent of dealers. Online/mobile ads were chosen as most effective by 18 percent of dealers.

Listing websites were also ranked first as the most effective marketing tool for non-brokerage sales, mentioned in 48 percent of responses. Boat shows and online/mobile ads rounded out the top three and were listed as most effective by 24 percent and 22 percent, respectively.

The least effective marketing tool for both non-brokerage and brokerage sales was television advertising. More than a third of dealers ranked the medium as least effective among the survey’s nine choices for marketing tools.

Approximately 20 percent of dealers who took the survey do not sell brokered boats. Of those dealers, 56 percent cited the nature of their local market as the reason they declined to do so. About 19 percent said the size and value of the boats discouraged them from selling brokerage.

Of all respondents, less than a quarter of dealers had annual revenue less than $1 million. About 47 percent reported an income between $1 million and $5 million, with approximately 12 percent generating more than $10 million in annual revenue.

Nearly half of total respondents sold primarily to customers using their boats on freshwater. About 31 percent work in primarily saltwater markets, with 22 percent saying their customers represent a mixture of the two.

Approximately 21 percent of respondents were located in Florida. New York came in second at 6 percent, while 5 percent of dealers came from either Wisconsin or Texas and the rest were a mix from around the country.

Discussing their best advice for selling brokerage, many dealers advised diligence in upfront work, such as managing the seller’s expectations during the inspection, completing the necessary repairs, which are paid for by the seller, and ensuring the boat’s paperwork and additional paperwork related to the brokered sale are in order.

“You need to have a clear, concise structure, so that both the sellers and the buyers are completely aware of the deal and understand it,” one dealer said.