NMMA reports yacht growth despite market-wide declines

NMMA’s latest Monthly Recreational Boating Industry Data Summary, covering data through June 2025, shows continued pressure on retail sales as economic uncertainty and elevated borrowing costs weigh on consumer demand.

Year-to-date, new powerboat retail unit sales fell 9.7% compared to the same six-month period in 2024, with 130,956 units sold. Looking at the rolling 12-month period from July 2024 through June 2025, total retail powerboat sales declined 7.3% to 220,662 units.

Segment-level softness remained widespread year-to-date, with notable declines in retail unit sales of pontoons (-10.9%), jet boats (-14.4%), wake sport boats (-9.9%), and stern drives (-20.1%). Yachts were the only segment to post modest growth, up 1.8% over the same period.

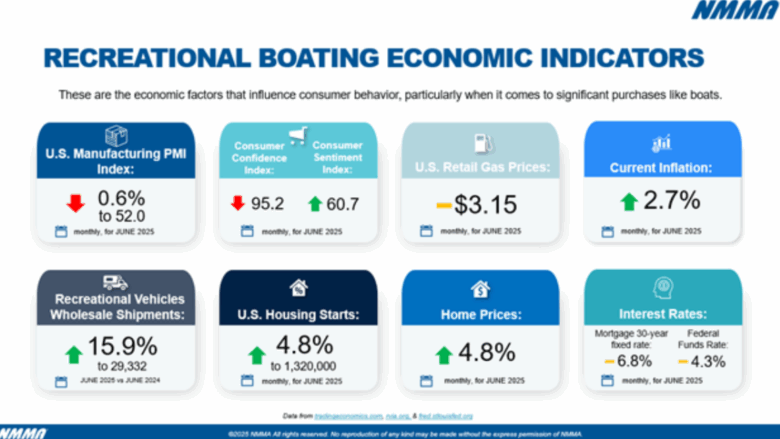

Macroeconomic indicators continued to reflect mixed signals in June. The Consumer Confidence Index registered 95.2, the Expectations Index sits well below the 80-point threshold that typically signals weaker outlooks, and inflation held at 2.7%.

These dynamics are translating into softer demand for big-ticket, discretionary items. Elevated borrowing costs, higher housing expenses, and ongoing economic uncertainty are making consumers more cautious, which directly affects purchase decisions for boats and other durable goods.