The tow boat category continues to post year-over-year sales growth

“Same old, same old” can be a fine state of affairs, especially if you sell tow boats. For the past six years the tow boat category has been a consistent winner in an industry that is, in many ways, still finding its stride in this era of economic recovery.

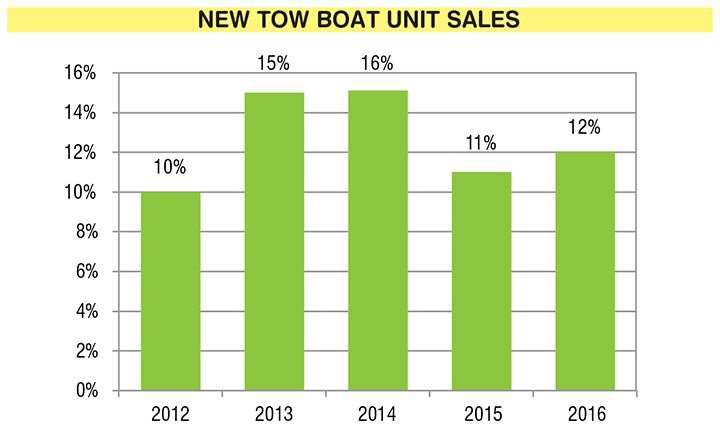

According to new data from the National Marine Manufacturers Association, the tow boat category continues to demonstrate steady, consistent year-over-year growth. From a base of 4,850 boats reported sold in calendar year /2011, the segment has marked consistent increases in unit sales every year since, with 5,500 boats sold in 2012, 6,100 boats sold in 2013, 7,100 units sold in 2014, 7,800 units in 2015 and 8,700 boats sold last year.

“Sales of tow boats have been a growth leader during the recovery,” said NMMA’s Director of Industry Statistics and Research Vicky Yu. “The category has marked double-digit growth in unit sales over the past five years.”

Grand Rapids, Michigan-based Statistical Surveys Inc. pegs unit sales for the ski/wake category as growing by 12.06 percent in 2016. This represents a pleasing increase over the 10.16 percent year-over-year growth for the category shown in 2015, but still lags behind the 15.96 percent bump seen the year before. At least some of that fluctuation can be explained by low water levels throughout the Southwest, a key market for tow boats. Some of the strongest sales gains reported by SSI in 2016 were achieved in areas that were seriously impacted by prolonged droughts that dropped water levels on local lakes below accessible levels. Basic Trading Area markets measured by SSI in Texas, Arizona, California and Utah, for example, posted year-over-year unit sales gains as high as 33.33 percent once the water came back.

All the toys

Although unit sales of tow boats continue to grow steadily, the cash value of these boats has also risen each year. NMMA pegs the collective retail value of all tow boats sold in 2016 at a whopping $818.3 million – an average of roughly $94,000 per boat.

“The market is less than 70 percent of pre-downturn units, but the average sale price per boat has gone up a fair bit, which probably brings the segment to near or above pre-downturn dollars,” said Correct Craft CEO Bill Yeargin. “The average price increase is a result of new technology – particularly related to wakesurfing – and a move to larger size tow boats.”

While Yeargin said he expects to see continued growth in the segment, unit growth could slow in the year ahead as more boat manufacturers try to tap into the surfing phenomenon.

“I would also expect the dollar growth to stabilize, now that most of the boats are already sold with surf technology,” he said. “The one wildcard is whether customers keep demanding larger boats; if that happens, the dollar sales will continue to grow at a faster pace than units.”

While larger boats obviously drive prices up, it is the steady up-featuring of all tow boats that has allowed manufacturers and dealers to grow profit margins most significantly in the face of lower volumes. Just as no one buys a car these days without air conditioning and power windows, there is little consumer interest in boats that don’t offer even a basic level of luxury features.

“Consumers want all the toys, like integrated Bluetooth connectivity, wave-shaping devices, integrated GoPro cameras, upgraded finishes, convenient board storage and incredible audio quality,” said Mastercraft Boats President and CEO Terry McNew. “So even though we’re still below the high water mark in terms of units, we’re much more profitable now. The average unit price has grown by about 50 percent since 2006, and that’s largely due to the technology we’re now including in the boats. As with automobiles, the technology increases the retail price but consumers demand it regardless.”

The upward migration in tow boat size and features has fuelled an equally lucrative uptick in the used tow boat market. NMMA pegs the number of pre-owned ski and wake boats sold in 2016 as growing by 6.8 percent over 2015, with used tow boats now representing 2.1 percent of all used boat sales. Used tow boat unit sales have increased every single season for the past five years.

The lower selling price of used tow boats makes them attractive to first-time buyers and customers with more limited financial means. But pre-owned boats may lack the more modern features that these buyers still want.

Some manufacturers have begun to address this price-feature gap with lines of less expensive tow boats that provide a limited selection of the most popular features.

“Our NXT product is targeted specifically at younger professionals and younger families,” said McNew. “The NXT has the same materials, engines, fiberglass and warranty as our other boats, it’s just thoughtfully contented so the consumer gets what they need without stretching the budget. Our research has shown that about 40 percent of NXT buyers are new to boating. These people might have bought a used boat as their first boat in the past, but because the price of used boats is almost as high as an entry-level NXT, they choose the new NXT with its full warranty and its higher resale value.”

Maryville, Tennessee-based Skier’s Choice, manufacturer of the Supra and Moomba tow boat brands, has also targeted more price-sensitive buyers with some of its models.

“Some of the boats in our segment now sell for more than $150,000. So the questions is, how high can prices go before consumers cry Uncle?” said Skier’s Choice National Sales Manager Chris Crysdale. “As the boats get more and more expensive, there’s a risk of creating the impression that these boats simply aren’t affordable. High prices also have the effect of slowing the product life cycle as people become less likely to trade in their old boat for a newer one.”

Surfing still drives the market

While it may have its roots firmly in water skiing and wakeboarding, today’s tow boat market is riding a wave of popularity based in the wakesurfing phenomenon. It’s one activity, said Crysdale, that appeals to boaters of all ages.

“We hear from a lot of aging Boomers who used to water ski, I mean 65, 70 year-old guys, but they haven’t been behind a boat in 25 years,” he said. “The whole surfing thing intrigues them because there’s a bigger surface area, you’re going 10 miles an hour so it doesn’t hurt when you fall, you’re not going to be all stiff and sore the next day, and they don’t have to hold onto the rope the whole time. It’s something the entire family can do, since the interest in wakesurfing goes right across generations. … Surfing is something that appeals to people of all ages, so it represents a major family activity.”

The near-universal appeal of wakesurfing – backed by a surging economy – has the potential to lift tow boat sales volumes beyond pre-downturn levels, said Malibu CEO Jack Springer.

“The tow boat industry sold about 13,400 units in 2007, and it’s selling about 8,700 units per year today. But the positive economic factors we’re seeing are strong, and they could push us back to the kind of numbers we saw before the downturn,” he said. “What will drive it there is the whole surfing phenomenon, which is still early in its life. There are so many people who still don’t know what surfing is, and I’ll tell you, it’s a rare day when someone doesn’t stop us on the water and ask what we’re doing behind the boat. There’s an immense market there, and we’re only scratching the surface.”

The flourishing interest in wakesurfing coincides well with the rise of the Millennials as a buying force in the market. Young families are attracted to the fact surfing has multi-generational appeal, making it a rare activity that brings parents, grandparents and kids together unlike any other.

Competing for the attention of these young buyers is a growing fleet of sterndrive-powered surf boats based on Volvo Penta’s Forward Drive system. For now at least, the upstarts have probably helped the tow boat market rather than cannibalized it, simply by attracting more attention to wakesurfing as an enjoyable family activity.

“We have not heard of an impact from our tow boat dealers related to the Volvo Forward Drive,” said Yeargin. “We do know that the Volvo Forward Drive is helping those in the sterndrive market, and we have had dealers approach our Bryant brand specifically because we can offer it.”

If any tow boat manufacturer has an interest in the sterndrive market, it’s Malibu, with its acquisition of Cobalt earlier this year. The company believed sterndrive-powered surf boats would become a feeder system to tow boats and Springer said that seems to be the way it’s working out.

“I give full credit to the manufacturers building these products, because they’re getting a lot of people interested in surfing and raising the profile of this activity. But the experience is still quite different than what you have in a tow boat,” said Springer. “To my view, no kid ever grows up aspiring to play minor league baseball. They grow up dreaming about playing in the majors. Tow boat wakesurfing, because of what the boat can do, is major league. As the kids are introduced to surfing, they want the best possible experience.”

With Malibu’s acquisition of Cobalt, Springer said the company has an opportunity for further expansion in that market and have something to offer in both market segments.

“If you think about what we can do now with a Cobalt boat, we can tailor the running surfaces, tailor the swim platforms, potentially add some ballast, and also put Surf Gate on those boats, that’s going to be a very compelling dynamic,” he said. “Of course we have an excellent existing relationship with Chaparral, and I don’t expect that to change. But because we own Cobalt, we have an opportunity with that product.”

A rosy outlook

On the whole, the future for the tow boat category looks very bright indeed. By every indication, the steady, sustainable growth that has categorized the tow boat segment should sustain over the next few years at least. A stable economy, growing consumer confidence, improved access to water, low fuel prices, favorable dealer inventories and growing interest in water sports overall point to sustained year-over-year growth in the high single digit to low double-digit range, as the tow boat segment continues riding the wave.

Category SWOT analysis

To truly understand the tow boat category today, we asked boat manufacturers to analyze it with a SWOT, considering the category’s strengths, weaknesses, opportunities and threats.

If there’s one strength that seems universal, it’s the growing popularity of wakesurfing – “amazing family fun” as Yeargin puts it. “Surfing is huge, and we’re just seeing the beginning of it,” adds Crysdale. “Most of the boats we sell are to families, and that’s a growing demographic.”

Price perception – the suggestion that tow boats are too expensive for most families to afford – was identified as the category’s single greatest weakness, although lower-priced entries are beginning to address that concern. Further droughts and water level fluctuations, however, remain another area of concern.

“Our country is so large there’s often a drought somewhere,” said McNew. “Access to water is always a concern.”

Opportunities to grow the tow boat category are many and diverse. Simple demographics provide an obvious opportunity for growth, as millions of Boomers begin winding down careers just as millions more Millennials begin to enter the boat market. So too is the opportunity to grow wakesurfing beyond its fresh water base and take it into coastal markets.

Innovation – always a category strength – is widely seen as representing the key to future opportunities. As tow boats grow increasingly complex, making them easier to use becomes more important than ever. Whether it’s automated systems to help operators get just the right wake, or refined control systems that make tow boats easier to drive and dock, innovation will remain a key to earning market share.

Potential threats to the tow boat segment are said to be the same issues that threaten all of boating. An aging customer base and not attracting enough new boaters is a threat, as are regulatory concerns.

“Bad decisions by people who don’t have a clue about boating are a big threat,” said Springer. “Financing is something we need to watch as well, since if it gets too expensive it will impact everyone.”