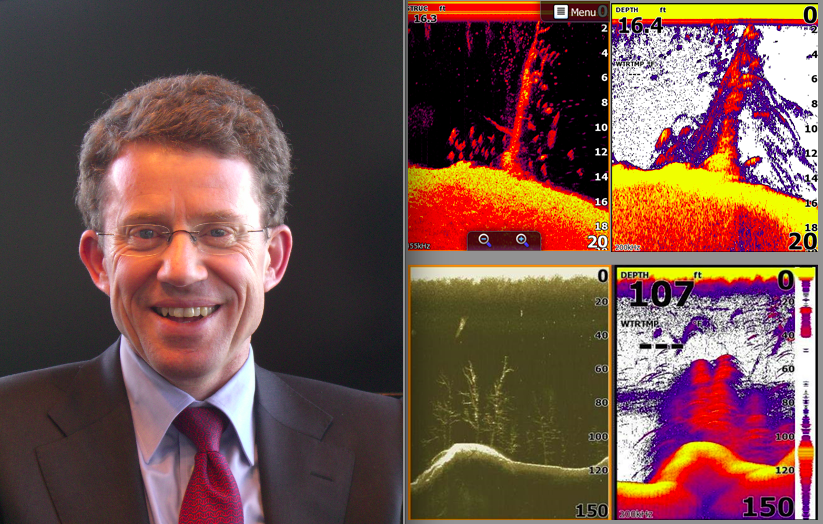

Q & A with Navico CEO Leif Ottosson

Boating Industry sits down with Navico CEO Leif Ottosson to learn why the future of marine electronics lies in present-day automobiles.

2016 was a busy year for Navico, the parent company to the Lowrance, Simrad, B&G and GoFree marine electronics brands.

Its saltwater fishing-oriented Simrad brand posted a 37 percent revenue growth in America last year, on top of 29 percent gains worldwide. Lowrance continued to strengthen its position in the freshwater fishing market, while the sailing-oriented B&G brand also posted some of its strongest revenues yet over the past year. Then came the news in August that Navico had been acquired by Goldman Sachs Merchant Banking Division and Altor Fund IV. This fresh ownership brought substantial investment, allowing Navico to fund acquisitions and R&D on a massive scale, as it moves toward its goal of completely dominating the marine electronics category.

Boating Industry sat down with Navico CEO Leif Ottosson to talk about the company’s future plans, and what kind of future it sees for marine electronics.

Boating Industry: The world of marine electronics continues to change at a rapid pace. It must be very difficult to plan for the long-term when product life cycles are now measured in months.

Leif Ottosson: Product life cycles have grown shorter, there is no question about it. We launched the Lowrance HDS in 2008, for example, and now in 2017 we’re into the fourth generation of it. But people want to have the latest capabilities. Would you want to use a cell phone from 10 years ago? No, of course not, we all want the capabilities that exist today. As a result, the product life cycle today is around three years, at least for multi-function displays. Radar, autopilots and even sonar can go a bit longer but for MFDs it’s about 36 months.

Worldwide, we’re introducing a new product every 15 to 20 days. It’s an enormous amount of work to do that, since for every product, you need to have an R&D plan, you need a manufacturing plan, you need a marketing plan, you need a supply chain plan – it’s a huge commitment. But it is new product that drives the market forward. If you want to be the leader, you have to lead.

BI: How much money does Navico devote to R&D in order to sustain that kind of pace?

Ottosson: Currently we invest between 8 and 9 percent of our revenues in R&D. It’s a comparatively high percentage, it’s a big proportion of our revenues.

If you look at the recreational marine industry today, there are five major players in our space – Navico, Garmin, Raymarine, Furuno and Humminbird. And between the five of us, we probably represent 85 to 90 percent of the total market. But it’s a very difficult market to compete in because it requires a constant, substantial R&D investment in order to stay on top. If you go back to 2010, Navico and Garmin together represented about 40 percent of the total market. Today, Navico and Garmin have about 50 percent of the market. That leaves a smaller share for the rest.

BI: Lowrance and B&G are both celebrating their 60th anniversary in 2017. What would you say has been the biggest change since they were launched in 1957?

Ottosson: The technology has changed, obviously, but boaters have also changed, and in fundamental ways. Boaters used to all be enthusiasts, in the sense that they would spend hours tinkering with the boat, and they felt that was just as much fun as actually going boating. It was part of the whole experience. Those people still exist, of course, but they no longer represent the majority of the boaters on the water.

People face huge demands on their time today, and the result of that is they don’t have the luxury of spending as much time enjoying their boat as they used to. Today, they want to take the family to the boat, enjoy that time on the water, then put it away and move on to something else. This is why we are seeing more and more concierge-type services at marinas, where the client calls up, the marina puts the boat in the water, fuels it up and has it ready and waiting for the owner to arrive. Then, at the end of the day, they pull it out of the water, clean it up, and put it away till next time. There is a growing demand for this type of service all over the world.

Because so many boaters now spend less time in their boat, the operation of everything has to be familiar and intuitive. Stepping into a boat needs to be like stepping into a car. Even if you step into a rental car that you’ve never sat in before, you still know how it all works because the approach is familiar and intuitive. Boats need to be this way too. As people spend less time boating, they want those days on the water to be easy and effortless, they don’t want to waste half of their time fiddling around and trying to figure out why something isn’t working.

This also means that there is a greater need for the boat’s electronic systems to be able to log usage and serve as a prognostic tool, so the marina that is looking after the boat can keep track of its usage and schedule all the maintenance as required.

BI: The comparison to operating a car is interesting. So how does this happen for boats?

Ottosson: We have a plan to take on greater responsibility and be a tier-one supplier to the boating industry. We are recruiting more people into determining exactly how we’re going to do that and exactly what we’re going to offer. We’re also speaking with major boat builders to confirm what their needs are. We are in serious discussions with two major boat builders, with a view to providing the electronics systems the same way that it is done in the car industry, where the supplier delivers the whole dashboard which is then installed as a single integrated component – the equipment, the wiring, all of it. It’s a complete, fully integrated system.

BI: That has to be appealing to a boat builder, since it would lower their costs and provide a turn-key solution.

Ottosson: Yes, it is an appealing proposition for them. This approach to integrated manufacturing was adopted by the auto industry in the 1990s. That’s when the tier-one suppliers took on increased responsibility for delivering complete solutions. As a result, the cost of manufacturing the car has come down by 30 percent. We keep saying that in boating we need to do something to make boats less expensive, and this approach is one way to help achieve that.

This is something we have been working toward for several years, and we have developed our products, our resources and our capabilities toward it. But it is important to be successful when you attempt something like this because if you fail, the response going forward will be “that’s been tried and it doesn’t work.” So we’re working very hard to ensure we can deliver on that promise.

BI: We assume Navico will do this as a supplier of both hardware and software? Or would it make more sense to focus on the software and outsource some of the hardware components?

Ottosson: The software is critically important, but it needs to interface properly with the end user. The only way to ensure that happens is to take complete responsibility for both the hardware and the software. Our approach is a bit Apple Computer-like, in that we feel the software and the hardware need to be designed together to ensure that the used gets the experience that was intended. It is a completely symbiotic relationship.

As a company we manufacture both hardware and software. But if I look at the profile of our engineering department today, it’s probably 70 percent software engineers and about 30 percent hardware and mechanical engineers. The hardware element in what we do is easier to copy. It is the software which is more complex and represents the greater challenge. But it is a challenge we accept, and we look forward to what the future will bring.