2017 Outlook: Steady as she goes

They say slow and steady wins the race. If this is true, the boating industry is poised for major wins.

The general tone about 2016 and going into 2017 is one of optimism and expectations for slow, steady growth to continue.

According to data from Statistical Surveys, Inc. through September 2016, year-over-year sales hovered around 5 to 6 percent growth. At the same time in 2015, sales were up around 6.8 percent.

Ryan Kloppe, director of sales at SSI, expects that sales will eventually fall within the range of the company’s prediction of 4 to 6 percent growth in 2016. While this is slower than the past two years, it is still a considerable improvement from 1.5 percent growth three years ago.

Data from Info-Link Technologies paints a similar picture. As of September 2016, unit sales were up 6.6 percent year over year.

“We’ve had four years now or almost five of year-over-year increases in the mid single-digit, low double-digit growth in the markets overall,” said Peter Houseworth, director of client services at Info-Link. “We’re on this steady, moderate growth trend that … has an underpinning of just a couple of segments that are doing fairly well.”

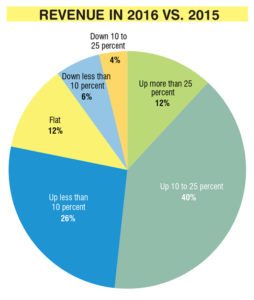

Reports from Boating Industry readers are even more positive: 78 percent of respondents to our December survey said their 2016 revenue was up from 2015, with over half of all survey respondents saying that revenue was up 10 percent or higher.

2016 was always going to be hard to predict, with an impending presidential election and everyone waiting for the other shoe to drop with interest rate increases. But the end result has been positive for the industry.

“Everyone was expecting higher interest rates, which still hasn’t come yet. All year everyone was expecting interest rates to go up,” said Kloppe.

Segment by segment

For the most part, 2016 didn’t bring much change from category to category: The segments that were performing well – pontoons, saltwater fishing boats, ski/wake boats, PWC, outboard-powered runabouts – continue to do so.

However, unit sales in the sterndrive segment dropped 1.5 percent in the period ending September 2016 according to Info-Link, compared to declines of 4.5 percent and 9.5 percent in previous years. According to SSI, sterndrive sales growth is negative overall but 20-foot-plus sterndrive boat sales were up in the period ending September 2016.

Kloppe believes the Volvo Penta Forward Drive is helping this segment recover, especially as the ski/wake category continues to experience double-digit growth.

“I think with the ski/wake segment in general doing very well, Volvo with their forward-facing I/O, that should probably help the sterndrive category a little bit as well for the future,” he said. “That surfing/wakesurfing/wakeboarding fun atmosphere is a trend that’s catching on and has continued growth.”

Ultimately, the positives in the sterndrive segment are largely due to a low number of units being sold, which is still well below their pre-recession days. When you’re down to selling 12,000 units, 240 units is a 2 percent increase.

“It’s just been decimated. That as a category, it’s amazing how much smaller it is. At one point, I think it was 50,000 units a year, and now it’s [more] like 12,000,” said Houseworth.

While all regions in the U.S. performed on track with previous years’ trends, California’s growth in 2016 was significant compared to previous years. California and Florida were among the first markets to be hit in the economic downturn, but recovery came much quicker for Florida. But with the help of more rainfall this year, California experienced 17 percent growth in 2016, according to Info-Link.

“I think we can still see some upside potential for it [to continue in 2017] just because [California’s market] was so large and it was so slow to recover, that once it starts to take hold, probably there will be more marketing resources pushed at it because there’s more activity now,” said Houseworth.

Keeping up the pace in 2017

While expectations were a bit more unpredictable in 2016, 2017 should be more stable, particularly considering it is not an election year.

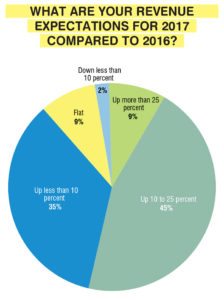

“I don’t see anything out there cataclysmic, either on the positive or the negative side, other than continued low-to-mid single-digit growth. That’s our expectation for 2017,” said Houseworth.

SSI data reflected several peaks and valleys month to month in 2016, which Kloppe expects to even out more in 2017, leading to more predictable sales growth.

While dollar sales continue to increase year-over-year and return to pre-recession levels, Kloppe cautions expecting unit sales to do the same. Prior to 2008, unit sales were as high as 400,000 per year, and Kloppe does not expect that to happen again.

“I think this is the new reality with the marine industry,” he said. “Four percent, five percent growth: Is it double-digit growth? No. But if this is predictable, it makes for good, solid growth within the industry.”

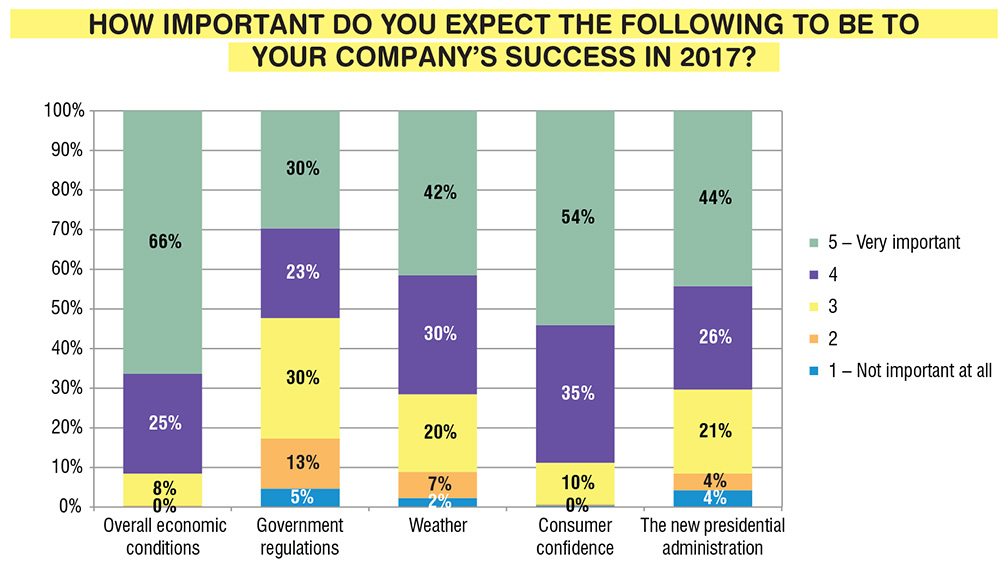

Thom Dammrich, president of NMMA, believes the slow and steady pace in the industry right now, coupled with the potential the new Congress and administration bring, could result in an underestimate of expectations. Consumer confidence rates point to this possibility, as the Consumer Confidence Index reached its highest rate in 15 years this December. Boating Industry survey respondents all agree this will be at least somewhat important to their success in 2017, with over half of respondents stating it will be very important.

“We’re going to look back someday at this as really a golden age that we’re living in right now, and it’s about to get better,” said Dammrich. “So let’s make hay while the sun shines.”

Challenges for future growth

Many of the industry’s main barriers for growth will not change in 2017: The industry will still face concerns with the Renewable Fuel Standard, access issues and government regulations. But one issue the National Marine Manufacturers Association is working to address in 2017 is visibility for the recreational industry. The NMMA began working with The Outdoor Recreation Industry Roundtable, a coalition of recreational industry associations, to get more visibility for their industries as important to the nation’s economy and the wellbeing of Americans.

“We’d like to see some investment in promoting outdoor recreation by the U.S. government as much as they promote tourism … And of course, expanded access to public lands and waters for diverse forms of outdoor recreation,” said Dammrich. “It will really be the first time that the recreation industry, broadly, has come together to work on things that benefit all forms of recreation. Because if we can get recreation a higher status and higher visibility, it will make every segment of recreation’s job easier to get what they specifically need.”

The Outdoor Recreation Jobs and Economic Impact Act of 2016 passed in 2016, which instructs the Bureau of Economic Analysis to create a recreation satellite account. This would quantify the economic contribution of recreation to the U.S. economy, a big win for the coalition for gaining recognition in policy considerations in the future.

The coalition collectively sent a letter to the Trump transition team and drafted five white papers for the new administration, Speaker Paul Ryan, R-Wis., and Senate President Mitch McConnell, R-Ky., to make the case of the recreation industry’s economic significance. The coalition is working to meet with them to discuss their plans for the coming congressional session and how the needs of the recreation industry fit, and has already met with the Department of Interior transition team.

Dammrich sees immense opportunities for the boating industry to make legislative progress in 2017. Boating Industry survey respondents agree: 91 percent of those surveyed believe the new presidential administration will be at least somewhat important to their company’s success in 2017. Forty-four percent said it would be very important.

For this reason, Dammrich sees this year’s upcoming American Boating Congress as a pivotal event to attend.

“We’ve got lots of issues and challenges, but I think we’ve got lots of opportunity with this administration and this Congress,” he said. “This is not an election year in 2017, so there will be legislation passed. This is an opportunity for our industry to really make some gains.”

The year to bring in new boaters

There is only so much growth that can occur once the regulatory and legislative issues are resolved. At some point, the industry needs to market to new customers. Without this, the industry’s growth will hit a ceiling.

“We’re looking at some of the adoption rates among the generations that come behind, and much like many other things that they are electing to postpone or delay, whether it’s getting married, having children, buying a house, [buying a boat] seems to be kind of going along with it,” said Houseworth.

Roadblocks like student loan debt are not problems the boating industry can solve. Luckily, there is anecdotal evidence that younger generations want the same things as the generations that preceded them, but are delaying the decision until they have more disposable income. However, the boating industry needs to make sure this generation eventually makes the conclusion to go boating, and that means getting them on the water now.

“We have to figure out how to market boating to the next generation the way that they want it. I don’t think you can necessarily change their behavior; it’s a very hard thing to do,” said Houseworth. “As an industry, we need to not focus on any one [way to get new boaters]. I think the focus needs to be creating pathways to boating for anybody who wants to boat.”

Dammrich pointed out that the demographic trends show that if the industry wants to reach out to younger boaters, it also means working to attract new demographics.

Eighty-eight percent of Boating Industry survey respondents are concerned about the increasing age of boaters and reaching younger buyers. However, only 63 percent of those surveyed said they are concerned about the lack of minorities participating in boating. Nearly one-fifth of respondents are completely unconcerned.

“The major disconnect there is that the Millennial generation is the most diverse generation in history. You cannot attract a younger customer without attracting a more diverse customer. So we’ve got to open our minds and we’ve got to see the business opportunity that exists,” Dammrich said.

Many of those who responded to Boating Industry’s October survey on new markets indicated they were not concerned about the lack of diversity because they believed these demographics did not have an interest in boating or couldn’t afford it.

“That is such a wrong-minded perception. There are millions of Caucasians that live in poverty and can’t afford boating either. There are millions of Hispanics and Asians and African-Americans with the financial wherewithal to own a recreational boat, and we sell what they want, which is quality time with family and friends,” said Dammrich. “We’ve got to get beyond our stereotypes and recognize that there is a really significant business opportunity by expanding our focus beyond Caucasian males. And frankly, in my opinion, it’s imperative. If we do not, we will not grow.”