Marine audio advances to meet consumer demand

Home and auto trends expand to the marine segment

Radical advancements in the marine audio segment are coming faster than ever as product development and economic conditions finally catch up with consumer demand.

The beauty of such a competitive market like electronics is that the industry isn’t talking about making things simply work in the harsh marine environment.

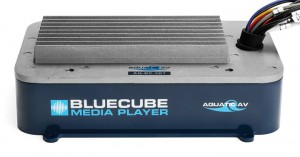

“It’s not just about being waterproof, it’s about being able to withstand vibration, shock and all of the movement of the boat on the water so that it doesn’t affect the performance of the amp. That’s a key element of design for all the manufacturers,” said David Pilvelait, COO at Home Port Marine, which represents Aquatics AV.

Now that most every manufacturer designs products for all those vibrations, shocks and moisture, they are able to integrate and capitalize on emerging trends in connectivity, design and usability.

Boaters across generations now have easy-to-use Bluetooth connections in their car and home, and are starting to demand the same kind of functionality on the water.

“When people are out there spending the kind of money they spend on a new vehicle where this kind of thing is standard, then take a look at the price of a boat. In a lot of cases they’re very similarly priced, so if they can have it in their car, why can’t they have it in their boat?” said Marine Industry Manager Matt Wood of Jensen Audio. “I think people are demanding the latest and greatest technology. The idea of having CDs or outdated audio outlets is even becoming foreign to the older consumer. I don’t see this as an age-specific issue. All ages are using this type of technology.”

As all consumers adopt and acclimate to their smartphones, manufacturers are also working those devices into their new designs and audio peripherals.

“Everybody is holding a computer now, it’s not just a telephone,” said Robert Oswell, founder and CEO of Roswell Global. “They’re walking around with one device that is a personal computer, really: It’s got their music, it’s got their radio, it’s got their GPS and their phone. Everybody on the boat is used to that connectivity and convenience.”

All those new developments have manufacturers and distributors pretty excited about the coming years.

“We’re seeing more new product development over the past year or so than we’ve seen in quite some time. It’s a very exciting time. There were record number of entries at IBEX for the NMMA innovation awards back in September, there’s a record number of new products entered in the innovation awards at the Miami Boat Show,” said Pilvelait. “We’re probably more excited than we’ve been in some time with the audio market.”

The dominant trend is clear: Consumers want more out of their marine stereo systems and the ongoing economic prosperity has them primed to buy. Let’s dig into the different facets of this evolution and see what a few big names in the segment are doing.

Connectivity

Just about everyone has a wireless gizmo of one brand or another in their pocket, and the technology is becoming much more usable as the standard way to connect to other devices. In the car and at home, consumers demanded the ability to connect seamlessly with their audio systems – now they are demanding the same on their boats.

“I think one of the things that plagued our industry was that we thought boaters were not consumers in the traditional sense, but of course they are. They demand connectivity and ease of use on land, so there’s no reason to expect any less from what they demand on the water,” said Pilvelait.

Just as it did in the home, giving deep levels of control to everyone makes for a more engaging experience.

“Everybody on the boat now can be the DJ and play their favorite song, and I think that the expectations are being set at home and in the auto industry, and now you’re going to see more and more of it in boats,” said Oswell. “You know, it’s a lot of fun when everyone can get on the boat and interact with the system in a new way.”

New developments within Bluetooth technology have also shaped new products. By tapping into a more robust Bluetooth protocol, Jensen Audio is rolling out a deeper way to connect with an audio system.

“Our app control will allow for – regardless of the brand whether it’s a Jensen brand, a Marine Audio brand or a Polk brand – we are going to allow for a free downloadable app to the consumer to take over 100 percent control of their audio systems from their smartphone or tablet,” said Wood. “Essentially anything you can do by pressing a button on a stereo, you’ll be able to control from your phone or tablet.”

He said the new module that includes the newer protocol ID3 (updated from the A2DP and AVRCP protocols) allows users to control the standard play, pause and fast forward functionality, but will also allow for more complicated controls to manage EQ, fade and bass treble. The new modules will be included in 2016 with no price increase for OEMs or consumers.

Roswell is betting on the continued growth of Apple’s iOS platform by creating devices that work well with the ubiquitous iPhone.

“We’re now a wireless Apple licensee with one of our companies as well, developing connectivity, easy to play devices within Apple’s system. I think another fuel that you’re going to see more and more of in the future is quality, ease of connectivity and ease of installation. That’s going to be a future driver for our products – the way the dealer, the OEM and the consumer interact with the product is a big focus for our development team,” said Oswell.

Oswell said that skipping the head unit altogether has also been an extremely successful move.

“Our CyBox eliminates the need for a head box completely in the boat. It’s a little Bluetooth module with three direct line-ins to go to three different amplifiers and it’s a very, very inexpensive way to direct line-in to your amplifiers and eliminates the need for a head unit. No more radio, no more receiver in most retrofit applications because everybody already has their computer in their hand,” said Oswell. “We just introduced it last year and every time I bring it in it’s sold out.”

Pilvelait said that he expects there to be a lot more connectivity products in the pipeline from all audio manufacturers.

“We saw an awful lot of products at METS in Amsterdam that were focused on connectivity. Obviously, NMEA is driving a lot of this and making the experience seamless,” said Pilvelait. “I think we’re going to see a lot more of that going forward.”

Design and branding

When you plop down in the seat of a luxury automobile, it’s a sensory experience. The smell of the leather, the faint warming of the seat, the striking lines and the extravagant audio console all contribute to that experience. The same experience can be had in a boat, but that sensory experience has historically come to a boring halt with the sound system.

Josh Berry, special markets manager at Prospec said that the good economy and rosy outlook for the boating industry has created quite a shift in consumer’s buying habits. He says people are looking to spend money on a trusted name and attractive design.

“I think branding is a huge key. It used to be back in 2008, 2009 it was, ‘How much money can we save with our boat?’ and, ‘Who can get the least expensive head unit,’” said Berry. “Now, people are appreciating that a brand name comes into play to compliment their boats.”

He says that since it is such a competitive segment, contenders are pushed to deliver consistent products; so differentiating a brand means rocking the proverbial boat.

“You must have that user interface and ease of operation as well as reliability – but at this point I think we’ve established that all of us provide a reliable product,” said Berry. “Then it comes down to who is making that next jump.”

He said Prospec is taking a design-forward approach to their new components.

“We’re always looking for that next step. I think that’s cosmetics,” said Berry.

He said the segment takes many cues from the auto industry to see what buyers are looking for.

“From a styling perspective, boats are very much in tune with the auto industry. So the marine industry looks to the auto industry for colors, lines, stuff like that,” said Berry, noting that a good-looking screen is the big jump they’re taking. “The transition to a better-looking screen was one of the main priorities on our list.“

That sleek and polished screen that consumers are used to on their phones and tablets have edged their way into the auto market, and are now taking the dip into the marine industry.

“The trend now is getting away from that old-school dot-matrix kind of display and moving to a color TFT screen. It’s just getting more sophisticated, more stylized now – ultra-modern I guess,” said Berry. “I think with people wanting more out of their stereo system now and the looks play such a key role. I think eventually people will get into a nicer looking unit, in five to six years it will be standard that a color TFT screen will be part of the factory boat.”

But even a great screen doesn’t make great product: ask anyone with a knockoff tablet. That’s why Berry says they are working hard to create a user-friendly user interface to go along with the modern design.

“I think a key element in a successful audio program is user interface – how easy is the unit to understand, does the pairing process require an owner’s manual to understand or something you can understand right out of the gate,” said Berry.

To that end, Prospec is offering a major update to its PRV 350 faceplate under the Infinity brand. That new model will be available in 2016 model year boats.

Creating a line of successful products expands the brand, as Roswell has seen in the past year. Oswell says that its 16 years in the business has positioned the brand surprisingly well. Its high-end speakers, amps and tower audio accessories have people from outside tower boats seeking out Roswell products.

“We see more people choosing our brand and putting it into segments that we’ve not previously been in. We’re seeing our brand now going into fish,” said Oswell. “I have to assume that the innovation in the marine audio brand has been what’s fueling demand and pushing into new segments.”

He said he’s happy to see the brand grow beyond the tower boat market and aims to push it into more segments.

“We’re focused on designing new products for specific market segments. We’ll have a fish-specific line coming out – mostly center console and offshore guys. And of course yachts and cruisers – there’s a new product line coming out for that,” said Oswell, noting that consumers are currently buying for quality, not price. “What I’m finding is that a lot of people that are paying for higher quality, they really want a higher-quality sound. ”

Opportunities for dealers

While a lot of the movement in the audio segment is focused on selling to OEMs, the evolution has created a pair of great opportunities on the sales floor and in the service bay.

With all the new features installed at the factory, it’s an easy way to demonstrate higher value for new boats. Everyone wants new gadgets.

Beyond new boats, however, spend-happy consumers and great new, premium gadgets create the perfect profit storm for dealers with a good service department.

“One of the biggest challenges for the boat builders is cost. A lot of these systems are seen as dealer-installed options because the boat builders are trying to control the costs. When they ship a boat from the factory, they are increasingly reluctant to add to the cost,” said Pilvelait

OEMs are certainly changing their tune somewhat, but there is a still a huge market for high-end audio equipment, design-forward devices and the new line of connectivity product that enhances even current-year offerings from boat manufacturers.

“I think the emphasis at manufacturer level has actually been a boon for dealers who are good installers and have really good service departments. It’s a tremendous opportunity for dealers,” said Pilvelait.

Audio systems can be a great conversation starter for the service department to have with customers. Just asking what kind of sound system they have in their car or at home can be a jumping off point. Or customers browsing the waterproof cases in the showroom probably have a new device — one that they want to use on the boat. Why not make it easier for them to experience that device in conjunction with their boat?

Finding deals and incentives pushes that profit even further. Pilvelait recommends finding good incentives, but dealers should also not be afraid to ask about incentives or bulk deals. The segment is very competitive, so audio manufacturers might be open to working with dealers to keep their product flowing. After all, small margins require large volume.

“I think the most successful dealers going forward in this segment will offer a wide range of products to their customers,” said Pilvelait. “It requires a little more work at the dealership level to become more familiar with all the different manufacturers and all the different products, but I think that’s time well spent.”