Evolution vs. Revolution

Two engine manufacturers take different design paths and aim to bring innovation to the sterndrive market

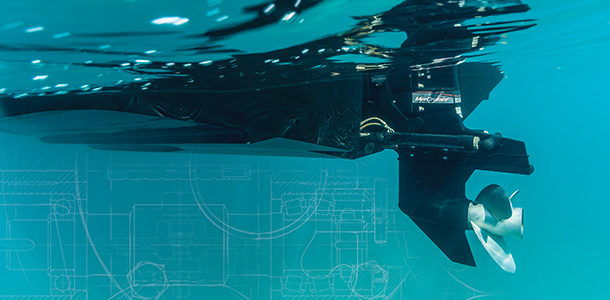

As the economy is slowly improving, the sterndrive segment is seeing more innovation and change. With this innovation comes a turning point for marine engine manufacturing.

The automotive industry has long dictated the exoskeleton of sterndrive engines. Auto engines of the past were comparable to marine engines in functionality but recent years have shown a wide divergence in auto engine design and marine requirements.

This puts engine manufacturers in the boating industry at an impasse: They can continue using auto engines as a base and innovate new technologies based on a previously built model, or they can develop independent products from the ground up.

Time will only tell which plan is best for the industry or if the design practices will make a difference to customers, but for now new products and technologies are creating a conversation amongst engine manufacturers, OEMs and dealers.

Purpose-built from the ground up

The corrosion prevention requirements for marine engines are vastly different from what an auto engine will ever need in its lifetime. Additionally, in a marine application, an engine needs all of the torque and power to be used continuously, in contrast with a truck going down the highway at 65 or 70 miles per hour using only a fraction of its total horsepower.

Facundo Onni, category director of Mercury outboards and MerCruiser, likens steering a boat to driving a pickup truck, towing a boat and going 80 miles per hour uphill at a 30-degree angle, noting this “doesn’t happen very often” in an auto application.

In order for engine manufacturers to meet the needs of developing auto technologies for their consumers and be in compliance with recent requirements, new models are coming out in shorter periods of time and the marinization of those engines will happen more often, thus will be more expensive for Mercury’s customers, Onni said.

In order for engine manufacturers to meet the needs of developing auto technologies for their consumers and be in compliance with recent requirements, new models are coming out in shorter periods of time and the marinization of those engines will happen more often, thus will be more expensive for Mercury’s customers, Onni said.

This incited Mercury’s decision to move away from “marinizing” auto engines and create a purpose-built sterndrive engine, the Mercury MerCruiser 4.5L, V6, 250 hp, which is the first of its kind in the industry, according to Onni.

“We can introduce the proven technologies in the marine world that make the most sense for our application and our industry, and we can control and set that pace,” said Onni. “Developing a marine engine from the ground up allowed us to free ourselves from some of the constraints associated with having to start with an engine that was not designed for the application we wanted. The architecture was already defined. It really didn’t offer the best solution … to our marine customers.”

The customers Onni refers to are not just the end-user of the boat: Mercury also accounted for the best solution for OEMs and boat dealers. One of Mercury’s main goals was to deliver the best boating experience possible to consumers while considering the boat installation and the service dealers would need to perform, as well as minimizing costs for everyone.

The company’s cross-functional team interviewed OEMs, dealers and consumers around the world to determine what changes were necessary when designing a marine-specific engine, analyzing their data and ultimately defining the guiding principles and specifications, envisioning a V8 engine in a V6 body.

The team focused much of its attention on developing a high displacement engine that had a low friction powertrain supported by a design that allowed the engine to “breathe better,” in regards to handling the air and exhaust gases. This included a long runner scroll intake, which allows the engine to pack more air into the intake – with more air comes more power and more torque.

When asked whether Mercury saw any potential disadvantages of building their own engines from scratch, Onni was confident saying any disadvantages that could have arisen are already behind them.

“It’s much more difficult than ‘marinizing’ an engine. We chose the hard way and we have accomplished our goals,” said Onni. “We believe in [the sterndrive industry] and we are designing a portfolio and a platform of engines that is going to … meet the needs and wants of our customer.”

“It’s much more difficult than ‘marinizing’ an engine. We chose the hard way and we have accomplished our goals,” said Onni. “We believe in [the sterndrive industry] and we are designing a portfolio and a platform of engines that is going to … meet the needs and wants of our customer.”

Onni notes the new V6 engine shows an acceleration improvement from previous generations of about 8 percent and a fuel efficiency improvement of about 14 percent, which includes top-end speed. For the first time in Mercury’s portfolio, the V6 was coupled with digital throttle and shift, originally offered only in V8 engines, enabling joystick piloting. Adaptive speed control was also added, automatically maintaining a set RPM when conditions and loads change.

The new technology advancements improve the sensory aspects of boating, including enhanced NVH performance. The throttle body was turned 180 degrees to face the back of the boat, reducing noise projection. Because Mercury did not start with an auto engine, “that’s a design element that we have been able to introduce,” said Onni.

The mount systems were revamped to absorb the vibration better and the flight wheel of the engine was redesigned to reduce the shock and “shift clunk” when the boat is put into gear, a feeling any longtime Mercury engine user will recognize and likely not miss, according to Onni. The location of some components of the engine have been optimized for a marine application to improve durability.

“[The new features] are difficult to describe, but once you experience them on the boat, you say ‘Man, how did we not introduce this years and years ago?’” said Onni. “[Service items on the engine] have been logically and intuitively organized so customers can understand what pieces of the engine do they have to interact with when they service the engine or they want to maintain the engine.”

Feedback for the new V6 engine has been largely positive from Mercury’s customers.

“Having the 4.5L really benefited us, especially on our new model, the Speranza, which is a 21-foot boat. [The boat] has been a huge success,” said Ben Dorton, brand manager at Bryant Boats.

Bob Wachs, director of dealer development for Nautic Global Group, is pleased to see improvements from Mercury’s previous “hand-me-down technologies.” He wouldn’t be surprised if Volvo Penta designed similar products in the future.

Bob Wachs, director of dealer development for Nautic Global Group, is pleased to see improvements from Mercury’s previous “hand-me-down technologies.” He wouldn’t be surprised if Volvo Penta designed similar products in the future.

“I’m pretty sure there’s not a great future in relying on Detroit to make your engines for you. The signs that Mercury obviously saw were that we probably ought to control this business ourselves,” said Wachs. “Volvo is a great product. It is very well crafted, it’s very well-assembled and it delivers great customer surveys and great customer satisfaction … but technology wise I feel like the new Mercurys are really a good step forward.”

Having said that, Wachs hesitates to say either engine manufacturer’s method has a huge advantage over the other. Nautic Global Group believes both Mercury and Volvo Penta are dependable vendors building quality products that fit a number of the boat builder’s needs.

Rich history of proven products

Volvo Penta’s dedication to the sterndrive segment is unquestionable. The company introduced the industry’s first sterndrive engine, the “Aquamatic,” at the New York Motor Boat Show in 1959, an automotive engine adapted to marine technology.

More than 50 years later, Ron Huibers, president of Volvo Penta of the Americas, says the company remains 100 percent committed to its strategy of leveraging automotive gas engine technology as the basis for its marine sterndrive product offerings.

“We are continuing with what has been a proven platform,” said Huibers. “We aren’t making any hard left turns, but we are leveraging the engineering advances from the automotive industry into a sterndrive engine for today’s boater. What people have enjoyed with Volvo Penta sterndrive engines with high reliability and good performance, they will continue to get with this next generation of engines.”

Huibers highlights how working with GM gives Volvo Penta a scale to create improved fuel efficiency, performance, torque, and consistent reliability. Huibers also notes these new engines come directly off the GM production lines at a rate of more than 5,000 per day. That brings automotive quality control and economies of scale to a sterndrive market that currently runs at about 32,000 units per year.

Huibers highlights how working with GM gives Volvo Penta a scale to create improved fuel efficiency, performance, torque, and consistent reliability. Huibers also notes these new engines come directly off the GM production lines at a rate of more than 5,000 per day. That brings automotive quality control and economies of scale to a sterndrive market that currently runs at about 32,000 units per year.

“Over the past 100 years, the automotive-based engine has dominated the marine industry, for good reason,” said Huibers. “Although we all love this marine business, it’s a relatively small industry – relative to the rest of the world that consumes [four-stroke] engines.”

Volvo Penta unveiled the first two models of its new lightweight, all-aluminum gas engines at the Marine Dealer Conference & Expo in November. The 4.3-liter V6 engines, rated at 200 and 240 horsepower, are the first in what will be a complete line based on General Motors’ Gen V technology. The company will roll out the full family of V6 and V8 engines during 2015 and 2016.

“We are able to leverage the R&D and engineering resources of GM and benefit from their economy of scale to bring this impressive new technology into the marine industry,” Huibers said.

Gen V is the fifth-generation small block from GM since 1955 and provides increased technology offerings, among which include variable valve timing, which improves torque, especially at low end RPMs. Higher performance across all RPM ranges is now available with the new generation.

The engines will be all aluminum, providing a lighter engine with higher horsepower-to-weight ratios. The engines will also be freshwater cooled and include common rail direct fuel injection into the cylinders. This means compression ratios in excess of 11.5 to 1, which brings better fuel efficiency and converts the fuel into energy for better propulsion.

The new engines are designed to reduce fuel consumption by over 20 percent and meet the world’s most rigorous emission standards, including EPA and CARB, by a wide margin, according to Huibers.

“The only reason we can bring that to the marine space,” said Huibers, “is because we’re leveraging the millions and millions of engines that General Motors makes.”

Dealers will be happy to see that all service points on the new engines are upfront and accessible, and Volvo Penta offers the longest engine warranty in the industry – five years – directly through the company. The company will roll out longer extended service intervals and recently introduced 24/7/365 technical support for its distributors, dealers and OEMs.

Understandably tight-lipped about the details, Huibers hinted at some exciting new products coming out that will define new segments for the company and hopefully increase boating participation through providing confidence to everyone on the water.

“We continue to look for ways to make boating easy and what we want to do is get more people to enjoy the boating lifestyle. We think that technology is the key component,” said Huibers. “It needs to be reliable, it needs to be easy and it needs to be fun.”

Evenly matched manufacturers

With these two different paths of engine manufacturing, how do OEMs feel? Do the options cause boat builders to suggest either Mercury or Volvo Penta has an advantage in the marketplace over the other?

For Roch Lambert, president of Rec Boat Holdings, the answer is no. Lambert has seen new products from both manufacturers and likes what he sees, and while he believes there may be a bit of a distinction between Mercury and Volvo Penta moving forward, he says the engines are comparable in basically every way.

“We like the direction they’re [both] taking,” says Lambert, “The performance of one versus another is not going to drastically change so a lot of our energy is spent more on how we utilize the sterndrive configuration.”

Dorton agrees. While he believes Volvo Penta may have an advantage with watersports customers, he would not list either engine manufacturer as surpassing the other.

“They’re so evenly matched right now that I wouldn’t say I would rather put in a Volvo than a Mercury,” said Dorton. “We really cater to the dealer on their personal ideas and preferences [of engines].”

Lambert doesn’t expect new technologies from Mercury and Volvo Penta will drive consumers back to sterndrives. The performance improvements with both manufacturers provide better engines but are not “game-changing improvements,” according to Lambert, who called it an “evolution not a revolution.”

“The consumers we’re going after are not gear heads,” said Lambert. “I really don’t think people care. They just want something that gets them from point A to point B and delivers the experience that they want to have.”

OEM concerns lie mainly with horsepower ratios, dependability, a narrowing in complexity and innovation in the segment.

Wachs says Nautic Global Group would like to see more horsepower in smaller footprints, which helps builders in terms of design. The horsepower coming out of small displacement automotive engines is not enough for the large displacement marine application OEMs need.

“Increased horsepower and increased performance in a smaller package is a great goal for all builders because that allows us to do great things in the interior of the boats that’s not [an] area we have to dedicate to that big V8 engine,” said Wachs.

One point worth considering is the growing trend toward larger sterndrive sales 25 feet and up. With a 250 hp engine, Nautic can build a 29 or 30-foot cruiser with twin engines in the back.

“The more flexibility you would have in [the horsepower ratio], the more creative we can be in different boats. If you’re limited to basic horsepower sizes … there’s only so big a boat you can build on something like that,” said Wachs.

Lambert would disagree with this sentiment. Between the three or four engine brands Rec Boat Holdings uses, Lambert says the company offers 2,200 different engine models with differences in horsepower, riser, types of drives and so on.

“The complexity we manage is crazy, so I’d certainly like them to narrow it down to as few configurations as possible,” said Lambert.

“The volume in our segment of the industry no longer justifies the complexity that we’ve brought into it.”

The biggest priority for Bryant Boats is that the engine can back up the company’s reputation for dependability, Dorton said. Because Bryan Boats crafts a hull around the outdrive and the engine, one simple modification affects so many different pieces to the boat’s construction and consistency with specs year-to-year.

“We customize our whole design to the motor [and] to the outdrive,” said Dorton. “A large part of that is having that outdrive placement in a strategic place. It’s a big deal to us if Mercury or Volvo was to change the outdrive. We’d have to completely reconsider our hull design.”

Ultimately, what Dorton wants is a greater partnership between boat and engine manufacturers to build products that cater to the new millennial and the late baby boomer buyers, particularly a craft that is both watersports-friendly and a good cruiser with ingress/egress for the older generations.

Lambert repeated this sentiment, saying he would like to see engine manufacturers focus on products that provide similar features to alternative options – pontoons on one side, ski boats on another. He highlights that those vessels do one thing extremely well but have a lot of drawbacks. How can sterndrives provide these services with their own configuration without compromising the existing incentives to purchasing a sterndrive? Answering this question will help consumers migrate back to the segment.

“Innovation has lacked in the segment and so we have not really energized the consumer,” Lambert said. “We need to create designs and stylings that are exciting and appealing … and we have to come up with technical solutions that will allow us to offer the activities that the younger crowds are looking for.”

It will take a lot of movement from both sterndrive boat and engine manufacturers and the ball is in their court to collaborate and carry the sterndrive market into the future, Dorton said.

“It’s going to take new ideas, product and marketing to get there,” said Dorton, “but you really just have to focus on the buyer.”