2015 Industry Outlook

From optimism to confidence

Even though boat sales bottomed out in 2011, even though the boating industry has continued to grow since then, the last couple of years have been ones of what can best be described as cautious optimism.

But with an improving economy, and another year of robust boat sales growth, that optimism is being replaced by confidence that the recovery is here to stay.

“My message is ‘We’re back,’” said Thom Dammrich, president of the National Marine Manufacturers Association.

NMMA is projecting that new boat sales will be up at least 8 percent in 2014 from 2013 when all is said and done, Dammrich said. That’s after a 2.2 percent increase in units sold from 2012 to 2013 – and 11 percent jump in retail sales – according to NMMA figures.

Growth across the board

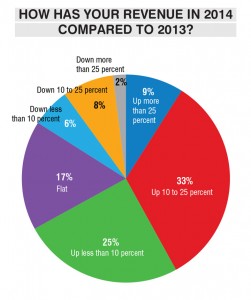

Boating Industry readers are certainly feeling that confidence in the market as well. In our reader survey – conducted in November 2014 – 67 percent of respondents said their revenue was up in 2014 versus 2013. More than 40 percent said business was up more than 10 percent from 2013. Only 16 percent reported a decrease in revenue last year.

Those numbers were consistent across all business types in the survey from dealers to manufacturers to service providers, distributors and others. The results were slightly better than 2013, when 63 percent of respondents said their revenue was up from 2012.

The one exception to the growth in new boat sales in 2014 was – stop us if you’ve heard this before – the sterndrive segment, once again stubbornly mired in a downward spiral.

According to the October Info-Link Bellwether report, the sterndrive/jet category was the only one to be down year-over-year, with unit sales down nearly 5 percent on a rolling 12-month basis.

The Bellwether report tracks boat sales across the country based on new U.S. boat registrations. Bellwether states are geographically dispersed states representing roughly half of the U.S. boat market (varies by market segment and time of year).

Sales were up in every other category when compared to October 2013, although at a slower rate than earlier in 2014.

PWC sales were particularly strong, up about 25 percent from 2013. The sport fish and ski boat segments both are showing unit sales increases of more than 10 percent from 2013, while outboard boat sales – which includes pontoons – were up just less than 10 percent in October after spending most of the year showing double-digit, year-over-year increases from 2013.

There’s little reason to expect those trends to change in 2015, said Peter Houseworth, director of client services for Info-Link.

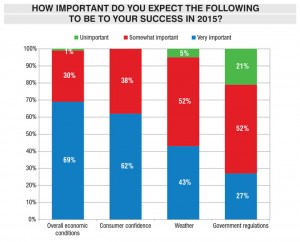

In retrospect, it’s probably not that surprising that the market grew as it did last year, as 2014 ended up being a pretty good year for the economy. And as the economy goes, so goes the boating market, Dammrich said.

“The economy is growing,” he said. “People are working, consumer confidence is [up]. Everything’s just falling our way on the economic front.”

Consider the following:

• Gross domestic product grew 3.9 percent in the third quarter of 2014, following a 4.6 percent increase in the second quarter. Those were the two strongest back-to-back quarters of growth since 2003, and makes four out of the last five quarters that GDP has grown at least 3.5 percent.

• Unemployment dropped to 5.8 percent in October and stayed there in November, the lowest rate since July 2008. Through November, the economy was on pace to add 2.89 million jobs for the year, which would make it the best year for job creation since 1999. (It’s worth noting that wage growth continues to be stagnant, though.)

• Consumer confidence is on the upswing. The Thomson Reuters/University of Michigan’s final November reading on the overall index on consumer sentiment came in at 88.8, its highest reading since July 2007.

• Gas prices stood at a national average of $2.80 a gallon at the end of November, 50 cents lower than a year earlier and the lowest level since October 2010. Not only does that address concerns potential buyers may have about the cost of fueling a boat, it also essentially creates more wealth for the average family. Through November, the lower prices have been the equivalent of a $75 billion tax cut for American households, estimates Goldman Sachs. With gas prices forecast to stay near current levels, the average family will realize an additional $1,100 of available capital.

• Home values – which represent the largest asset for most families – continue to increase as well. The last several months of the S&P/Case-Shiller National Home Price Index have shown prices settling in at about 5 percent ahead of 2013. That puts price gains in a much safer area than the unsustainable double-digit price increases of 2012 and early 2013 that fueled concerns of another housing bubble.

Beyond the overall economy, new product is also helping to attract more people to boating. Talk to anyone who sells boats, and they’ll tell you one of the biggest challenges was the lack of innovation from many manufacturers during the recession. With plenty of new boats rolled out at the Fort Lauderdale show last fall and big introductions planned by many builders for Miami in February, the good news is boat and engine manufacturers are investing again.

“If you look at the industry over time, we’re doing a much, much better job of delivering a quality product and a quality sales experience than we were doing 10, 15 years ago,” Dammrich said.

Confident for 2015

With all that in mind, it shouldn’t be a surprise that most in the industry are confident about their potential for growth in 2015.

“I think we’re going to have another year of growth,” Dammrich said. “I’ll conservatively estimate we’ll probably see about 5 percent growth next year.”

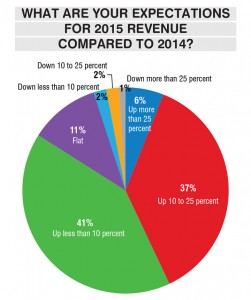

Eighty-four percent of Boating Industry readers expect their revenue to be up in 2015 compared to 2014 – with 43 percent calling for growth of more than 10 percent. Only 5 percent expect their business to be down this year.

In his conversations with NMMA members, Dammrich also hears an optimistic tone.

“You talk to individual boat builders, they’re projecting to be up 10, 12, 15 percent next year,” he said. “Some of them will be, but they won’t all be and the industry won’t be.”

Survey respondents reported a number of reasons they’re feeling confident about 2015, most centered around the draw of the boating lifestyle and an improving economy.

Dammrich echoed that sentiment.

“There’s a basic human desire to be out on the water that will continue to propel our industry,” he said.

That’s not to say there aren’t challenges facing the industry. There’s a plethora of government and regulatory issues from ethanol to Magnuson-Stevens reauthorization to tax concerns. There are demographic challenges as it relates to the age and ethnicity of boaters. And, of course, the old reliable of affordability.

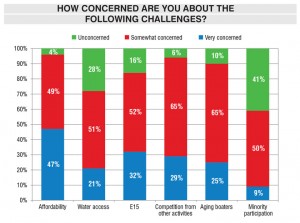

Affordability tops the list of challenges for Boating Industry readers, just as it did in 2014.

Nearly half of survey respondents said they were very concerned about affordability and its impact on boating, well ahead of every other issue. Thirty-two percent said they were very concerned about ethanol and its related issues. Competition from other activities (29 percent), aging boaters (25 percent) and water access (21 percent) rounded out the top five.

Despite demographic changes in the population that make minority engagement a top priority for many industry leaders, it’s still not a major concern for most respondents. Only 9 percent said they were very concerned and 41 percent were unconcerned with the lack of minorities participating in boating.

Visit BoatingIndustry.com for more insights and data for 2015.