Friday Economic Snapshot: A mixed bag

A lot of bad things have been blamed on this winter weather, but with the latest round of mostly positive economic indicators, Mother Nature is finally getting into the springtime spirit.

The big news came from surprisingly positive job creation numbers, supported by the stock market at a record high, mortgage delinquency at the lowest level since 2008 and consumer spending jumping to a five-year high.

Employment Report

With the latest job-creation figures from the Bureau of Labor Statistics, total nonfarm payroll employment rose by 288,000, dropping the unemployment rate by 0.4 points to 6.3 percent. February’s results were also revised upward to 222,000 new jobs from 197,000.

This is the biggest monthly payroll gain in two years, and is widely being taken as a sign that the U.S. economy is putting its winter blues in the rearview mirror. The unemployment rate hasn’t been this low since September 2008.

Consumer Spending

The figures for consumer spending in March are in, and they showed a significant warm-up as households increased purchases 0.9 percent on the backs of a 0.5 percent increase in February. This beats expectations, as most economists were expecting a 0.6 percent gain.

Consumer confidence is a leading indicator that suggests the economy is picking up steam as we head into the second quarter. It is also one factor suggesting the dampening impacts of the harsh winter are moving behind us.

FOMC Statement

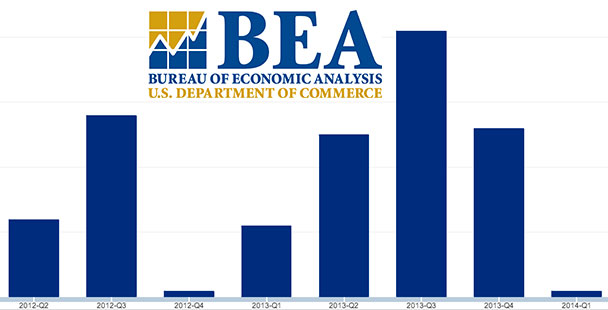

This week’s biggest shock came from the Bureau of Economic Analysis, which reported that the output of goods and services provided by labor and property in the U.S. — the GDP — increased by a scant 0.1 percent in the first quarter. That’s far below expectations, and down from the previous quarter when the GDP increased 2.6 percent.

Positive contributions came from personal consumption expenditures, while negative impacts came from exports, inventory investment, depressed state and local governmental spending and residential investment.

In its statement on economic growth, the Federal Open Market Committee predicted growth would accelerate in the months ahead.

Unemployment Claims

For the week ending April 26, seasonally adjusted initial unemployment claims increased to 344,000, a hike of 14,000 from the previous week. This unexpectedly large jump puts the 4-week moving average at 320,000, 3,000 higher than the previous week.

While these numbers were unexpectedly negative, it’s still within the range we’ve been in for several months. Business investment, hiring activity and consumer sentiment will need to improve before there are significant gains in the nation’s employment situation.