2014 Industry Forecast: Dealers, manufacturers express optimism

Obstacles remain but most feel market is headed in the right direction

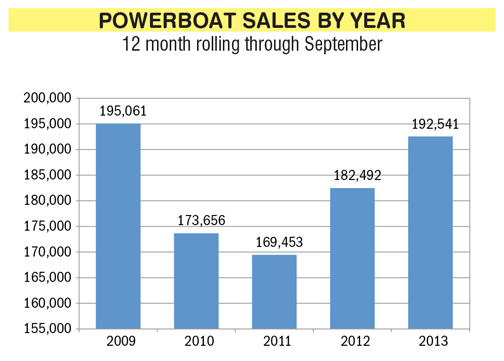

After a spring that had many worried about a double-dip, the marine industry continues to show strength headed into 2014.

“I think we’re finishing the year very strong,” said NMMA President Thom Dammrich. “We had a weak spring because of the cold weather and that led some of us to think this was going to be a pretty weak year. When the warm weather came in July in the north and Midwest, the boat buyers came out.”

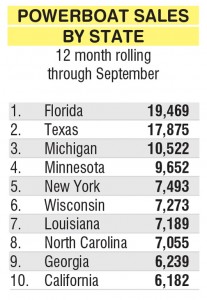

The numbers coming in from the individual states confirm that trend, said Peter Houseworth, director of client services at Info-Link.

Info-Link’s analysis of sales data shows solid growth in most of the largest boating states this year, including Florida, Michigan, Minnesota, Texas, New York and Wisconsin.

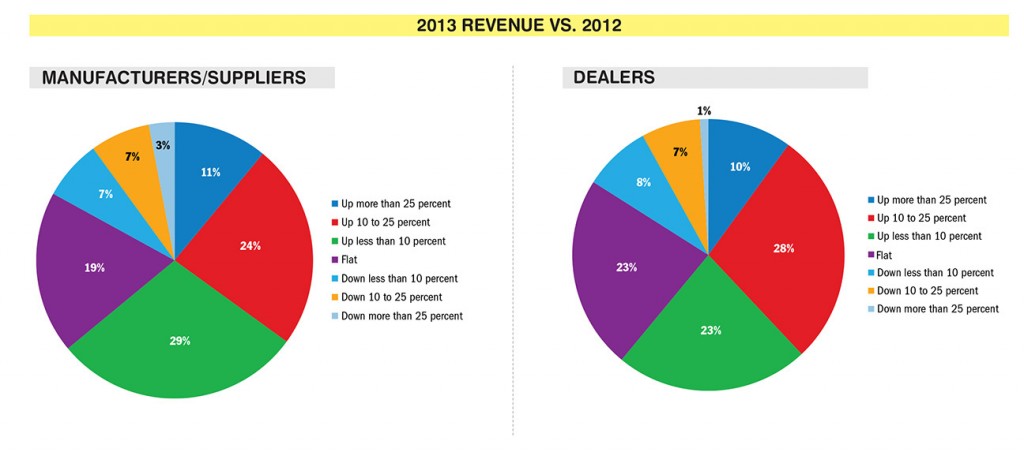

Boating Industry readers – which run the gamut from manufacturers to distributors to dealers and other retailers – also are reporting higher revenues in 2013 than 2012.

A quick note on terminology: For simplicity’s sake in this article we have divided respondents into two groups – manufacturers, suppliers and service providers (referred to as “manufacturers”) and dealers, marinas and other retailers (referred to as “dealers.”)

In a survey conducted in November 2013, 63 percent of respondents said their revenue increased in 2013 – 38 percent by more than 10 percent. Only 16 percent reported a decrease. Those numbers were steady across all types of businesses.

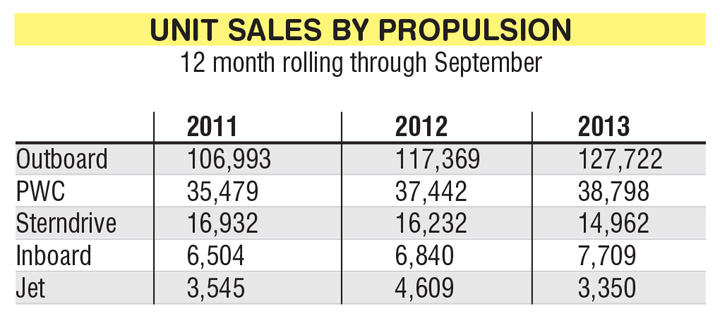

What also was consistent were the trends in different segments of the market. Pontoons continue to show great growth, while runabouts and cruisers do not, Houseworth said.

Outboard sales through September are up for the third year in a row, with an 8.8 increase from 2012 in 2013. Inboards also are showing great growth at a 12.7 percent increase. Sterndrives continue to struggle, with sales down 7.9 percent in 2013.

Jet boats appear to be a bit of an anomaly, down 27.1 percent in 2013 after a 30.3 percent increase in 2012 as the market loses and gains manufacturers. (For more on the jet boat market, read our Market Trends report.)

There’s no reason to expect those trends to change in 2014, Houseworth said.

“We don’t see anything that would suggest that some other segment is going to ignite,” he said.

More growth in 2014

As the economy goes, so goes the boating industry. If the economy continues to grow, the home market continues to be stable and interest rates remain low, 5 to 10 percent growth for the marine market would be likely, Houseworth said.

That falls right in line with NMMA’s projections, Dammrich said.

“A lot is going to depend on whether Congress gets its act together,” he said. “Can we get some level of normalcy in eliminating these recurring crises around the budget, around the government shutdowns, around the debt ceiling?”

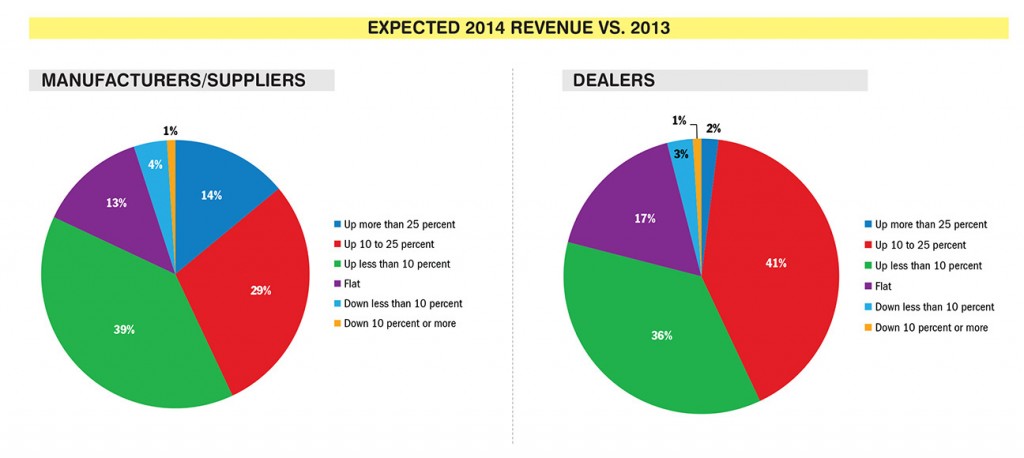

A large majority of Boating Industry readers are expecting growth as well – 81 percent of all survey respondents expect revenue to increase in 2014. Eight percent expect an increase of more than 25 percent and 43 percent expect revenue to be up more than 10 percent. Only 4 percent expect their revenue to decrease.

Manufacturers are much more optimistic about how big that growth will be than dealers are. Eighty-two percent of them expect their revenue to increase this year compared to 79 percent of dealers. The real difference, though, comes at the top level, with 14 percent of manufacturers expecting revenue to increase by more than 25 percent compared to only 2 percent of dealers.

Overall economic growth and consumer confidence will be the biggest factors in their company’s success in 2014, according to those surveyed. More than 60 percent cited those two as “very important,” ranking them much higher than weather (37 percent), regulations (36 percent) and government stalemates (29 percent).

The only major difference between manufacturers and dealers was that dealers were much more likely to be worried about the impact of weather – 44 percent said it was very important, compared to 29 percent of manufacturers.

Dammrich suggested that government issues are the most important challenge facing the industry, especially because of how they can impact other factors.

“Frankly, I think the biggest risk to our industry is in Washington, D.C., at least in the next year,” he said. “If we have more crises and more government shutdowns, it weighs on consumer confidence, it causes a contraction in the economy … and it’s not healthy for the boating industry.”

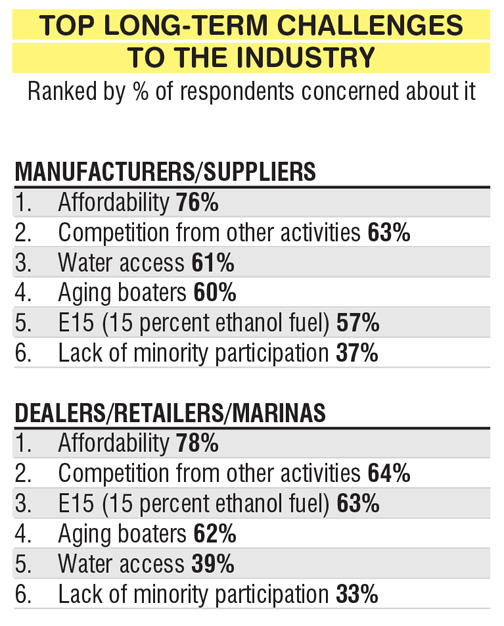

When it comes to long-term challenges to the industry, the one that most concerns Boating Industry readers is affordability. Nearly half are very concerned about it, while 77 percent are at least somewhat concerned by it. On the other hand, despite the spotlight put on the issue by industry associations and efforts such as Grow Boating, barely a third of survey respondents said they were concerned about the lack of minority participation in boating.

Those two issues cut across all businesses, but there were some notable differences between dealers and manufacturers, especially in the areas of water access and the increased use of 15-percent ethanol fuel blends or E15.

Despite the challenges, there are good reasons to be optimistic about the future of the boating industry, Dammrich said.

“The love of boating, the love of being on the water is as strong as it has ever been,” he said. “I think that we have tremendous opportunity if we can keep the industry focused on reaching out to what I’ll call underserved parts of our nation. If we could get the same penetration among those groups that we get among the white population we could double the size of the industry.”

The large investment in new product by many boat builders will also help bring more boaters back onto the showroom floor.

“New product always drives new boat sales,” Dammrich said. “That’s going to be a big deal next year.”