Pontoon migration: No end in sight

Amid extremely challenging market conditions, the pontoon segment is showing some signs of life and has been held out as a hopeful bright light within an otherwise struggling industry.

Amid extremely challenging market conditions, the pontoon segment is showing some signs of life and has been held out as a hopeful bright light within an otherwise struggling industry.

In some ways, it may seem a little out of place since pontoon boat owners appear to be in the crosshairs relative to market conditions. Historically and generally speaking, pontoon boat owners fall under what many industry observers would refer to as the general recreation or “discretionary” boater. This is by no means meant to be disparaging to pontoon boat owners. They love their boats and being on the water like anyone else. In fact, most pontoon manufacturers have enhanced their product offerings over the last few years with this price-conscious consumer in mind.

As a result, pontoon boats now provide all types of options regarding participation in waterborne activities. And the pricing environment has become very competitive. The same could be said of many of the other boat types in the general recreation category, such as small aluminum and fiberglass runabouts and cruisers.

So why have pontoon boats been outperforming these segments? There has been quite a bit of dialog regarding this issue. What we most commonly hear is that pontoon boat sales are benefiting from the defection away from fiberglass boats, or they have become increasingly popular with first-time boat owners. In order to get behind this speculation, we took a close look at the performance of the pontoon boat market and then dove deeper by performing a segment migration analysis.

Taking market share

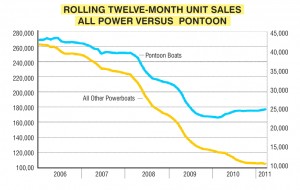

While most of the buzz about increasing pontoon boat sales has taken place in the last year or two, there is a long-term trend at work here.

Like the overall boat market, pontoon boat sales have suffered through the downturn with sales dipping by as much as 45 percent from a high of 42,000 units in 2006 to a low of 23,000 more recently. By comparison, the overall powerboat market has seen a steeper decline of as much as 60 percent during the same time frame.

Concurrently, pontoon boats have been steadily increasing as a percentage of total new powerboat sales from 13 percent to 20 percent for the 12 months ended March 2006 and 2011, respectively.

A diverse group of buyers

To look at the forces driving these numbers, we performed a migration analysis, which explores the composition of new boat buyers in terms of their boat ownership history. This enables us to determine trends and changes that are taking place with respect to buyers’ movement into and out of certain boating segments or brands.

This pontoon boat segment migration study was accomplished by identifying two groups of new pontoon boat buyers, one group that purchased in 2010 and a second group that purchased in 2006. For each group, we then isolated the boat they most recently purchased or owned prior to their new pontoon purchase. The two groups were then compared and contrasted to identify changes that indicate emergent trends within the segment.

We found the results quite interesting, but in this case, it was more about what we didn’t see than what we did see.

First-Time Boat Buyers: First-time boat buyers represent a significant percentage (about half) of all pontoon boat buyers. However, the proportion of first-time boat buyers between 2006 and 2011 did not increase, so the growth in this segment is no more or less attributable to a higher incidence of first-time buyers.

Fiberglass Defectors: It has been postulated that there has been a trend out of fiberglass runabouts into pontoon boats (which on the surface would appear to be supported by continuing declines in fiberglass runabout sales). The percentage of pontoon boat buyers that previously owned a fiberglass vessel has always been significant (in excess of 50 percent), but, here again, there has been literally no movement with respect to the composition of fiberglass to pontoon boat migration, which is something we would have expected to see if this was a key factor in pontoon sales increases.

New vs. Pre-Owned Buyers: We looked at the composition of buyers and whether there is an increasing tendency of people who previously purchased pre-owned to purchase a new pontoon boat. This would indicate that a shift has taken place, and pre-owned owners are being converted to new pontoon boat buyers at a higher rate than to buyers of other types of new boats, driving new pontoon boat sales higher. This is not the case. The percentage has not changed at all.

As a result of this analysis, we conclude that, while partially obscured from view by a challenging retail environment for all in the marine industry, consumers of all types (first-time boat buyers, repeat boat buyers, fiberglass boat owners, etc.) are simply favoring pontoons in larger numbers. This trend has been occurring at least since 2006, and it has accelerated of late.

Based on the results of our segment migration analysis, it does not appear the composition of pontoon boat buyers has changed, which is important from a long-term perspective.

In many cases, we see in migration a “segment bleed” or unbalanced conversion where growth is achieved by converting a specific subset of boaters to something else. While these trends are also important to be aware of and capitalize on, they tend to run their course as only a certain number of conversion opportunities exist.

In contrast, the pontoon dynamic observed here has a broader base and appeal. Therefore, the trend in pontoon boat sales is more likely to have room to run.