Pontoons of tomorrow

By Adam Quandt

Once looked at as simple, slow lake cruisers or all-out party barges, pontoons have increased in popularity and versatility since their entrance into the market in the 1950s, and the pontoons of tomorrow show no signs of slowing those trends.

“I would say Godfrey – having been one of the first builders to launch an aluminum pontoon application back in 1958 at the Chicago World’s Fair – we’ve come a long way baby,” Godfrey Marine director of product management and marketing Walter Ross told Boating Industry. “The big thing I see is technology: Bigger displays, more integration of technology, etc. The trend we’re seeing is ever-increasing integration across all of the different systems to work together, rather than separate.”

While national pontoon registrations were down just slightly according to some of the latest data from Statistical Surveys, Inc., the 12-month rolling numbers as of last September are some of the highest seen over the last five years. Statistical Surveys, Inc. reported that as of September 2021, 64,287 pontoons were registered. Some of the top BTAs continue to post double-digit growth year over year, including New York, which posted a 42.5% increase as of September 2021.

“We have seen and continue to see that high level of demand at the retail level. And with that we’ve invested a lot over the last couple of years – substantially more than we’ve invested the prior 20 years,” Ross said. “We’ve been increasing our capabilities and capacity. We’re growing all departments from engineering to quality. We’re just growing on all accounts and it’s made for very exciting times.”

A recent study from CDK Global focused on 17,000 new and used pontoons sold between March 2021 and February 2022, dives into the breakdown of buyers in today’s pontoon market. Throughout the study, numbers indicated that 46% of those units – with an overall average unit price of $48,917 — were sold to Baby Boomers, 37% to Gen Xers, 16% to Milennials and 1% to Gen Zers. One of the most important things to note through this data, is that despite the majority of buyers being in the Baby Boomer generation, Gen Xers and Milennial buyers are increasing rapidly.

With strong increases in sales to a wide range of buyers, pontoon manufacturers have been making some big improvements to keep up with an ever-growing demand. Last year, Barletta Pontoon Boats was gearing up to put their new 146,000-square-foot manufacturing facility online as part of the company’s 37-acre campus in Bristol, Ind.

“This new capacity to build Barlettas couldn’t come at a better time,” Barletta VP of sales Jeff Haradine said at the time of the announcement. “Although I would be less than truthful if I didn’t say we would have loved to have this a year ago. Even before the outdoor recreation surge as a result of Covid-19, our dealers and our Barletta buyers were pushing for more product. We set out to build a customer experience like no other in the industry – and the Barletta experience is exactly what today’s boat dealers and boat buyers are looking for.”

Last September, Smoker Craft Inc. – parent company of Smoker Craft, Starcraft, Sylvan, SunChaser and Starweld – announced a $12 million investment to construct and equip a new 200,000-square-foot addition to its current 600,000-square-foot production facility in New Paris, Ind. to keep up with boat manufacturing and shipping.

“This expansion will be used to increase efficiencies to the loading process and allow us to ship not only more boats to our dealers all over North America, but raise the quality of the delivered product. The warehouse portion of the project is designed to free up manufacturing space in all three of our product lines: Aluminum fishing boats, pontoon boats and fiberglass deck boats,” Smoker Craft VP of finance Tim Jones said at the time of the announcement.

More recently, BRP Inc.’s Manitou brand announced the creation of 200 new jobs at its manufacturing facility in Michigan — nearly doubling its workforce in the state — along with its soon-to-begin construction on the facility in Lansing, while adding additional warehousing capacity in St. Johns.

“The strong, sustained demand we have seen for our products is a testament to their durability and quality. BRP has continued to grow its marine portfolio with strategic acquisitions of world class brands like Manitou, Alumacraft, and Quintrex, and expanding their production capacity,” said Karim Donnez, senior vice president, Marine Group, BRP. “As with all our products, we are committed to gaining market share in this sector and we rely on Michigan’s highly skilled and experienced workforce to continue helping us in achieving our goals.”

Despite the increasing demand for what’s already in the marketplace and with the help of expanding teams and facilities, innovation in the pontoon segment is no where near slowing down or remaining status quo. Builders are always looking for the next best thing to make on-water experiences better than ever before.

“Realistically, what people experience in their homes and automobiles, they are looking for that same experience on the water with their boats. Anything we can do to make that transition and that ease of use, the intuitiveness, will bode well for boat manufacturers. Because we have had a lot of new or fresh boaters added to the mix over the years and the idea is to make boating easier,” Godfrey’s Ross told Boating Industry. “People just want to spend quality time together and have fun, and not have to worry about what they have to do to get the boat running properly and seamlessly, so anything we can do to help that experience is important.”

Bring in the jets

One of the biggest stand-out innovations to come out over the last year or so was the introduction of BRP Sea-Doo’s new Switch pontoon.

Well known for pushing the limits in the personal watercraft world, Sea-Doo entered new territory in its introduction of its new jet-powered pontoon in late September 2021.

“Over the years, we have proven that BRP is able to disrupt the industry by creating new segments,” BRP president and CEO José Boisjoli said in a company press release announcing the new platform. “Our team has done it once again with the Sea-Doo Switch, which will revolutionize the pontoon market. Switch is uniquely positioned to attract new entrants and a younger generation.”

The pontoons (tri-toons), ranging from 13- to 21-feet in length, are constructed with the help of Sea-Doo’s proprietary Polytec material and paired with Rotax’s 1630 ACE for a variety of three different horsepower options — 100, 170 and 230 — offering the optimum style of fun out on the water depending on customers’ needs. At the helm, the Switch continues to set itself apart from other traditional pontoons by featuring a drive-by-handlebar system similar to that found on Sea-Doo’s PWC, along with its Intelligent Brake and Reverse system (iBR) — making it the first pontoon on the market with brakes.

The Switch also features Sea-Doo’s Intelligent Debris Free (iDF) system introduced last year. The iDF system uses a new, separate gear set to engage the driveshaft into reverse to run the impeller in the opposite direction to clear any debris that may be blocking the pump system. The system is easily engaged using the handlebar control and will run for up to 12 seconds.

“It’s a dynamic pontoon with the heart of a Sea-Doo,” said Annick Lauzon, director of global marketing for Sea-Doo and Ski-Doo at BRP. “And its quick-change deck design can be completely re-configured to fit a solo fishing trip in the morning to a family picnic at noon and a wakeboard session in the evening.”

Jet-powered innovations for the pontoon segment don’t end at Sea-Doo’s Switch.

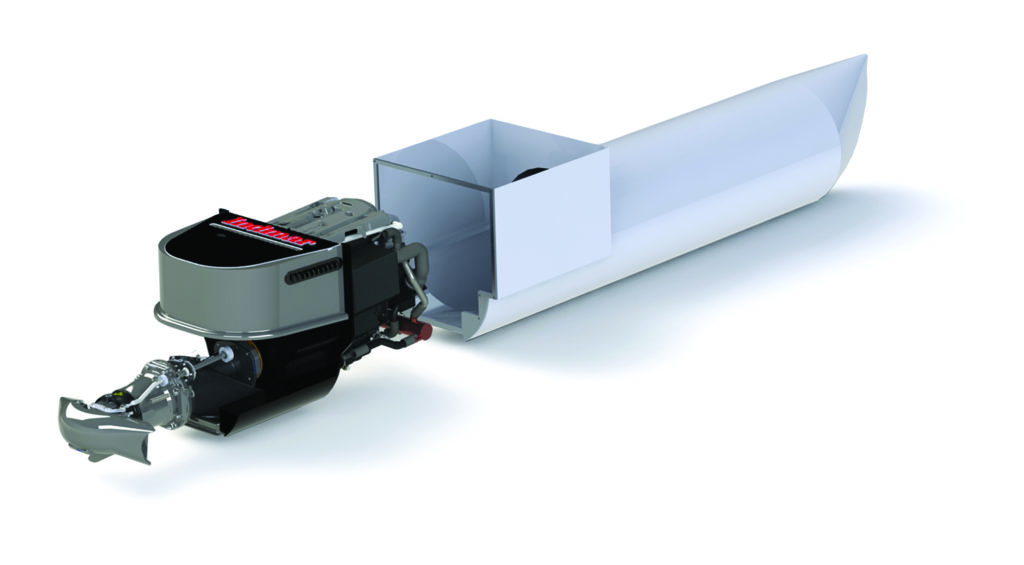

At this year’s Discover Boating Miami International Boat Show, Indmar unveiled it’s new 2.3L EcoBoost and EcoJet packages. During its introduction, Indmar VP of engineering Jason Stimmel unveiled the new platform by welcoming people to “the pontoon boat of tomorrow.”

The EcoJet package pairs Indmar’s 2.3L EcoBoost platform with jet-propulsion technology, allowing for an all-new pontoon experience.

“For the manufactures, it gives them a brand new and open canvas again to completely redesign the back end of the boat to include new furniture layouts and features. And on top of that you add the new amount of maneuverability to it with the jet engine, it’s a win all around,” Indmar director of marketing Natalie Carrera told Boating Industry.

Stimmel noted that Indmar’s history is rich in using jet technology and propulsion, which made it a clear choice for the team to go back, fix consumer complaints with old jet products and reintroduce it in a whole new way.

While the pontoon segment wasn’t the initial target for the EcoJet, Indmar said pontoon builders rushed to start a conversation following the package’s introduction. And while no official partners or builders have unveiled a new model with EcoJet yet, the new platform was on display installed in a Sylvan pontoon during the Miami show unveiling.

“We have multiple manufacturers lining up to work with the new platform, so we’re going to have to pick. Our team has done such a great job and the pontoon industry has really embraced it,” Carrera said.

With the new platform and pontoon application blazing a new trail in the industry, continued innovation is big in the eyes of the Indmar team.

“The sky is really the limit with this new platform and the opportunities it can bring. And as we move this technology forward, you can definitely expect for it to serve as a segue to add another form of alternative powertrain, i.e., electric.” Stimmel said.

It’s electric

Another new boat taking the spotlight at the Miami International Boat Show was Ingenity’s new 23E. And while marketed as an all-electric day boat, this new platform definitely draws from the pontoon segment, with striking similarities in space and layout on its top deck.

“The 23E was electronic from the beginning. Its patent-pending design is based on two halves of the boat – the hull itself houses the entire drive train (battery, motor, etc.) and the top deck is interchangeable – which allows us to look at different use cases,” Ingenity president and Correct Craft chief strategy officer Sean Marrero said.

Built on the heels of Ingenity’s Super Air Nautique GS22E, the 23E uses forward-facing sterndrive propulsion to optimize safety, performance, and low-speed maneuverability. The boat is designed for luxury, comfort, and stability and can cruise up to 14 hours at low speed with its 126-kWh range package and runs at a top speed of 30 mph.

“While there are still some technological hurdles, a lot of the challenges with electric, especially in the marine market, comes in the form of changes peoples perceptions of electric propulsion and technology,” Marrero told Boating Industry. “That’s where we’re active in trying to bring more awareness and bring more people into our family.”

In reality, there are far fewer moving parts to boats with electric propulsion. That, paired with ever-increasing connected technologies for boat maintenance and issue prevention, make these boats of the future a great candidate to bring a heightened experience on the water for end users. Overall, whether it’s electric, jet, new connected systems or something else all together, the continued innovation across the pontoon segment is only making this already strong segment stronger. And builders continue to offer endless versatility to boaters, making pontoons the boat of choice time and time again.