2020 Forecast: Everyone eying the economy, elections

By David Gee

The economy, consumer confidence and the elections. Those three things will to a large extent likely determine what kind of year boat dealers are going to have in 2020.

“Overall economic conditions” once again topped the list of biggest concerns for those Boating Industry readers who responded to this year’s industry forecast survey. About 82% of the respondents are dealers and 15% own or run marinas and boatyards.

One dealer in the northeast commented, “If we can get the tariffs and the trade wars in the rear-view mirror, then I think we can see some sales growth in the next few years.”

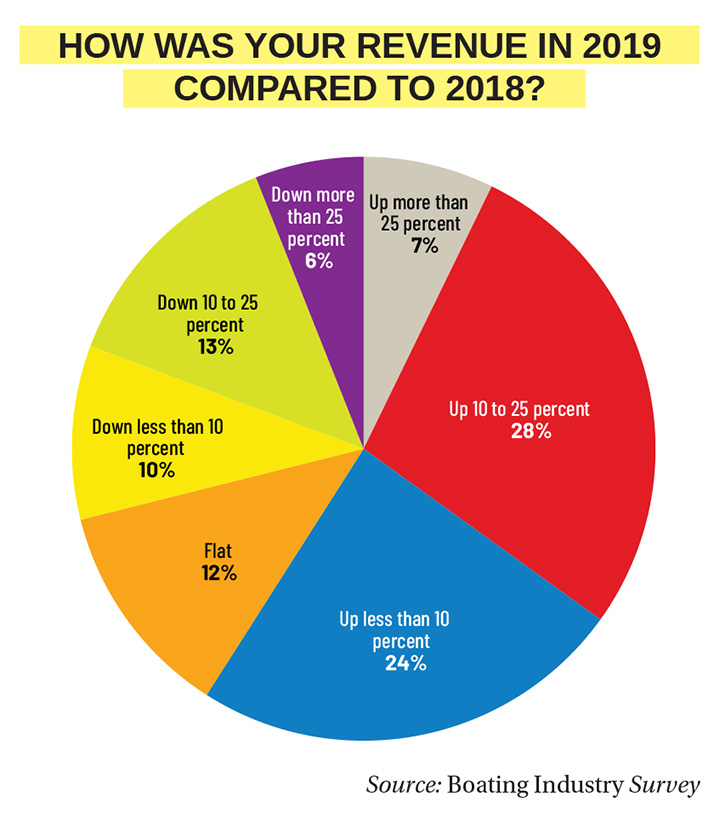

Speaking of growth, 7% of the survey respondents grew their store revenue in 2019 by more than 25%, nearly 28% grew it by 10%–25% and 24% grew revenue from 1%–10%. So that means 59% of the dealers among our readers who responded to the survey saw a revenue gain in 2019.

It’s interesting to note that back in the spring of 2019 when we did the survey for our 2019 Market Data Book, 50% of the dealers surveyed said they expected revenue growth in 2019.

So it’s a slightly rosier revenue picture in reality for many of you than you had predicted earlier.

Not just numbers

“Boating is FUN!” exclaimed one dealer principal in the comments section of our survey (see more in sidebar). “Yes, this is a business, and we all have to make money to stay in business, but we also all need to remember to sell the experience and not the product. Boating is the best family pastime there is, and I believe in the future of this industry.”

John Wooden, the founder and owner of Minnesota’s River Valley Power & Sport, a Boating Industry Top 100 dealer, and Evinrude’s 2018 National Dealer of the Year, echoed that sentiment.

“About five years ago one of our manufacturers challenged us to put the fun back into the boating business,” said Wooden during a Top 100 panel discussion at the recent Elevate Summit. “We had both been through the recession together and it wasn’t fun. So it got serious. Maybe too serious in fact. So now we put an emphasis on special events with food and fireworks and live music and other fun things that give people an exciting taste of the boating lifestyle.”

Dan Bair, CEO of Quality Boats of Clearwater, and the 2019 Top 100 Dealer of the Year, was on that same Elevate panel, and also mentioned the downturn that occurred a little over a decade ago.

“The 2008 recession was a scary time, so we are always looking closely at the economy,” said Bair. “Ever since, excess inventory has always been a big concern for us.”

When I took a look at the 2019 Boating Industry forecast a number of readers commented about a recession, saying things such as “it’s coming” or “it’s on the way.”

The simple fact is that the U.S. economy has only been in recession about 15% of the time in the post-war era (since 1945). The economist who gave the opening keynote called “The state of the boating industry and the broader economy” at Elevate puts the odds of a recession some time during 2020 at around 25%.

“Despite increasing political uncertainty, trade concerns, financial-market volatility and slowing growth both here and abroad, the next 12 months should be decent,” said Elliot Eisenberg, PhD.

And why not? Real incomes are rising, unemployment is at a 50-year low, and the U.S. has experienced the longest period of continuous economic growth since 1854. All of which leads to what? Consumer confidence.

“Consumer confidence is a core economic indicator for new recreational boat sales – if people are feeling confident, they’ll spend money,” said Vicky Yu, director of business intelligence for NMMA. “The healthy levels of consumer confidence we’re seeing are good for the economy and when the economy does well, boating does well. NMMA monitors these levels closely and is pleased to see the continued health in consumer confidence as we prepare for the 2020 boat show season.”

“We see 2020 as a ‘goldilocks’ year for the marine industry; not too hot and not too cold,” says Michael Swartz, director of equity research at SunTrust Robinson Humphrey in Atlanta, who specializes in the recreational and leisure sectors. “The U.S. consumer has rarely been healthier, the stock market and various wealth indicators are at or near all-time highs and interest rates remain at historically low levels. That said, the current economic expansion is arguably in the later innings and has become increasingly reliant on consumer spending.”

Consumer confidence in fact ranked second on the Boating Industry reader survey list of determinants for success in 2020, followed by weather.

Weather certainly played a part in 2019 results, which will be down a percentage point or so from 2018. An unseasonably wet spring in many areas of the country, among other things, resulted in fewer sales and more boats in the pipeline.

“There was a pickup in sales in July and August but it wasn’t enough to offset the softening we saw in early spring and summer,” said NMMA’s Yu.

Still, as NMMA’s president Frank Hugelmeyer told Boating Industry, “it would still mark the second highest level of new boat sales in 12 years.”

Driving the flattening in 2019 was a slowdown in the aluminum and pontoon segments, signaling that balanced inventories will be essential in 2020.

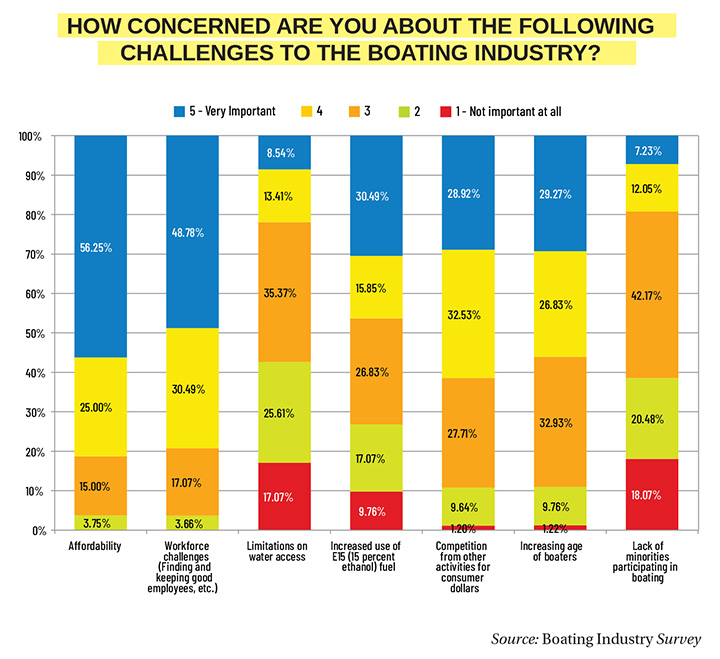

When we asked in our survey about those challenges that are most concerning, more than half of the respondents said the affordability of boating is very concerning, followed by workforce challenges, increased use of E15 fuels, the advancing age of boat owners, more competition for consumer dollars, water access and a lack of minorities participating.

And the survey says…

So we’ve heard from a few economists and NMMA about their expectations for the year ahead versus 2019? How about Boating Industry readers?

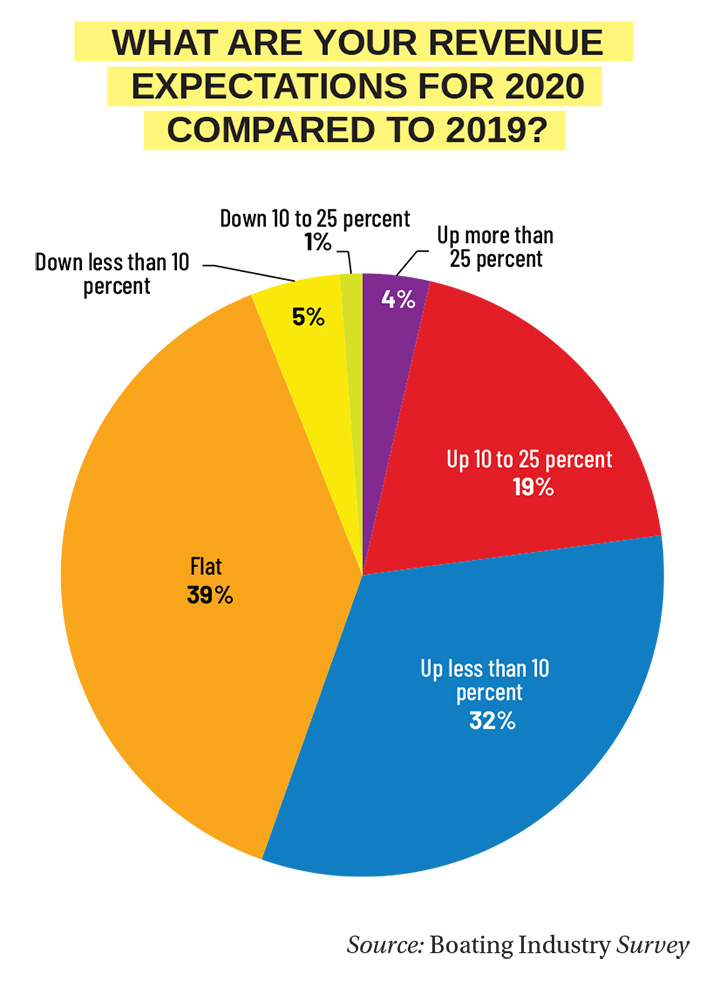

Among the dealers who responded to our survey 3.6% expect a more than 25% revenue gain, 19% forecast a 10%–25% gain, and 32% are looking for a 1%–10% gain.

“The dealers that we work with and talk to are generally optimistic about 2020 and expecting the growth that most of them saw in 2019 to continue,” stated Myril Shaw, COO of Dealer Profit Services. “Most are anticipating growth in the 3% to 5% range. That said, they are tempering their optimism with concerns about how the political climate could be disruptive and cause a slowdown or even a downturn. With the election and impeachment proceedings among other things, the dealers are acknowledging the economy could suddenly go flat and the appetite for lifestyle purchases could slow. They are proceeding optimistically while preparing for potential sudden changes and challenges.”