Millennial buyers grow as a concern

Diversity still lags as industry issue

Diversity still lags as industry issue

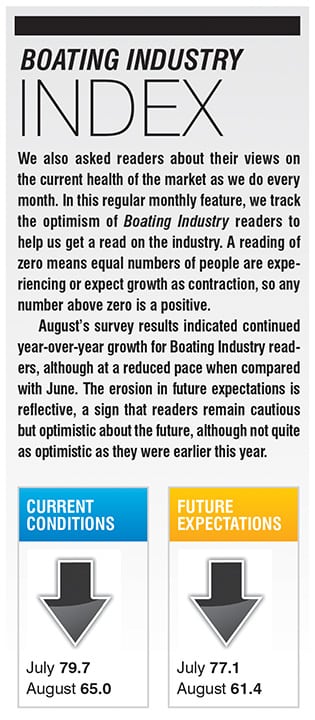

The industry has continued concern about its potential success in capturing a larger share of younger buyers as a new market segment as opposed to increasing its number of non-white buyers, according to the latest Boating Industry reader survey.

We surveyed print and digital products readers in August to find out more about their views on boating participation, average buyer age, attracting more Millennials and readers’ attitudes regarding non-white customers.

Survey respondents included a mix of individuals working in the industry including dealers, manufacturers, marina personnel and more.

Attitudes regarding new markets and challenges faced in attracting Millennials deepened slightly from a similar Boating Industry’s survey conducted last summer and the magazine’s October 2016 Millennial survey.

Millennial buyer concerns

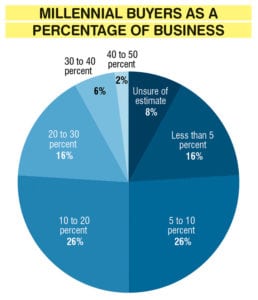

Overall, actively attracting Millennial buyers remained a market concern for 66 percent of readers in the August Boating Industry reader survey. That’s up 4 percent from last year’s survey.

Thirty-one percent of readers surveyed said they were “very concerned” about aging buyers. That compares with 22 percent of readers who shared a similar concern last fall. The number of readers who were not concerned about the issue decreased slightly, moving from 13 percent to 10 percent.

Regarding current business, 21 percent of readers surveyed in August reported they were getting more than 20 percent of their business from buyers under 35 years old. That mirrors results reported in last year’s survey. Readers are continuing to their attempts to track Millennial buyers through their marketing and customer outreach.

Fractional ownership models, boat clubs and boat sharing, increasing engagement with even more on-water events, and more education and training offered by dealerships were listed by current survey respondents as leading opportunities to attract Millennial buyers.

Those themes expanded upon reader comments from Boating Industry’s 2017 survey, which included concerns about the cost of buying, storing, and maintaining a boat. Those responsibilities may be overwhelming to Millennials, and because of urbanization, more of them are living in cities, making it difficult for them to boat.

High student loan debt, lack of financial capacity and boats being out of Millennials’ price range were other concerns, as well as the industry’s ability to profitably price products at levels that are reachable for Millennials.

Slight market awareness shift

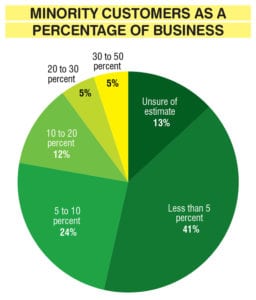

When asked about efforts to increase their non-white customers, 62 percent of survey respondents reported they weren’t actively attempting to attract this group of boat buyers. That’s down 6 percent from last year’s survey.

More than a third of those surveyed in August (38 percent) were not concerned at all about the issue, while slightly more than 9 percent reported they were “very concerned” about improving non-white customer participation rates.

That compares with 32 percent and 5 percent, respectively, with results from last year’s new market survey.

Nevertheless, minority customers continue to make up only a small portion of readers’ business – 40 percent of respondents reported in the August survey that non-white customers represented less than 5 percent of their overall business. That response was the same as last year.

Only 5 percent of respondents got more than half their business from non-white customers, and 13 percent said they weren’t sure how much of their business those buyers represented.