Using data to improve your sales and marketing

Ask many small business owners in the marine industry how they study trends in their market and you’ll hear a similar answer.

Whether it be dealers, manufacturers, marinas or others that touch the water, all too often the answer is some variation on “We talk to our customers” or “We’re on the lake every weekend.”

While certainly important, anecdotal evidence provides only a limited picture of what’s going on in the marketplace – sort of the business equivalent of forecasting the weather by looking out the window. It’s helpful, but not exactly scientific.

Numbers that matter

Whether it’s market share, psychographic and demographic profiles or sales trends, data can help any company – large or small – be smarter about its business.

“A lot of the smaller dealers feel it’s only for the big guys that have the big budgets,” said Evan Davis, head of marketing for OneWater Marine Holdings, the 2016 Top 100 Dealer of the Year. “Businesses of all sizes need to be leveraging data. When you don’t have big budgets … mistakes are more costly. Data really helps drive your decision-making and your strategies to be more effective and to get a better return on the investments that you do make.”

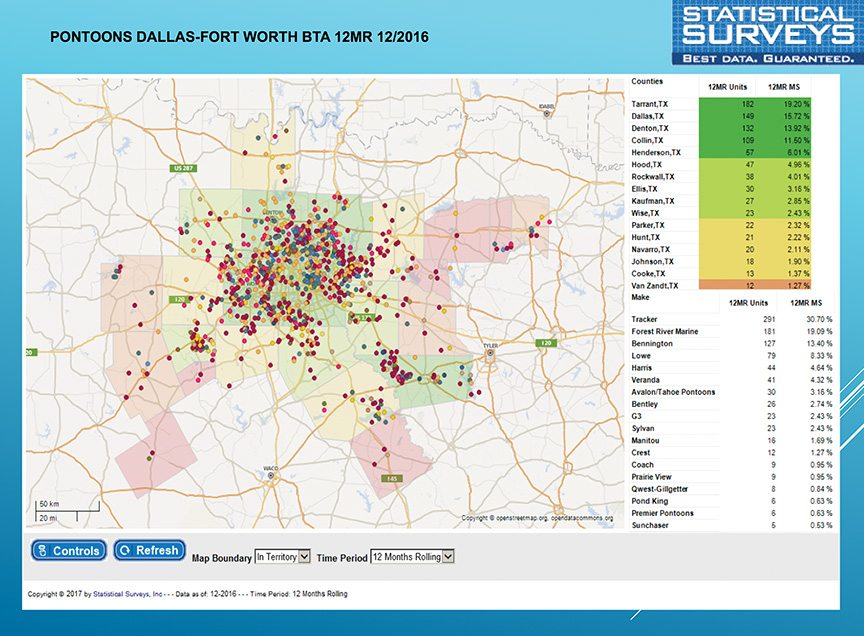

That data can come from a number of sources. Some of it needs to be tracked and created internally, such as customer profiles, while other information can be purchased from outside sources. Those sources include industry-specific companies like Statistical Surveys Inc. or Info-Link, or consumer data companies like Experian.

Info-Link tracks stats on the entire U.S. registered fleet to data mine for a number of uses from market share to behavior trends.

“We deal in fact. It’s not supposition. It’s things that we can prove,” said Peter Houseworth, director of client services. “You’re not just flying by the seat of your pants. There are a lot of small companies in the industry that do that because they’ve been around it their whole lives. It’s how decisions have been made historically.”

The good news is that more companies are getting smart about seeking out data to improve their sales and marketing efforts.

“That’s starting to change,” Houseworth said. “We’re getting much more requests for more in-depth information than we have historically.”

As more investors and venture firms enter the industry, they’re not willing to simply accept conventional wisdom, looking for proof in the numbers.

“We can look across the entire country and know my top 10 markets are [here] because we know these facts about them.” Houseworth said. “They are this big, they are growing at this rate.”

By tracking activity at the household level, it’s possible to determine long-term behavior as well.

“We can say, here is a 34-foot Sea Ray owner, this is their third Sea Ray, before this they owned this, so on and so forth,” Houseworth said.

While they may use it differently, data can serve dealers, manufacturers or anyone that touches the marine industry.

SSI has developed a number of tools to make that information easily accessible, said Ryan Kloppe, director of sales.

For example, the company’s online dealer tool allows users to “quickly discover insights for better decision making,” he said. “You can better understand what’s selling in your market – what lengths and footage, what types of products, which helps boost inventory turns. If you’re stocking the right products, that product is going out the door faster.”

That type of information is crucial to both dealers and manufacturers, so they can quickly identify areas for improvement.

“Not only do I know exactly what boat is selling, what length is selling, what propulsion is selling, but I also know … what ZIP code is a hot ZIP code and I can use it to my advantage for marketing,” Kloppe said.

Smart marketing

By using a combination of its own customer information and data from other sources, OneWater has been able to create profiles of its customers that allow it to craft marketing down to the local level.

OneWater has locations throughout the Southeast and sells dozens of brands, making this information key to its success.

“The biggest piece of what we’ve done is we’ve profiled and segmented our customers,” Davis said. “We’ve done that by brand in each region.”

Utilizing a program called PRIZM from The Nielsen Company, OneWater can take its customer data to devise profiles of those buyers.

“What they do is they’ll take that database or customer list and bounce it off large consumer databases – what do they own, what kind of cars do they drive, retail credit cards with Nordstrom’s or Neiman Marcus or anything like that,” Davis said. “There are thousands of data points they track. It’s not targeting one individual user, so we’re protecting our customers’ privacy, but it does give us a good background for our customers.”

Armed with that information, the company can then not only map where it’s current customers are, but also get a map of ZIP codes that are densely populated with other similar customers.

“My customer list will tell me where I’ve done a good job selling,” Davis said. “What this [map] shows us is where is the opportunity that I need to go out and target.”

With locations in expensive media markets like Atlanta and Dallas, that information allows OneWater to strategically shrink its target audience to those people who are more likely to respond.

“The data really drives a lot of those decisions,” Davis said. “It lets us evaluate media proposals: Is this going to be effective in reaching that market?”

Once OneWater has psychographic profiles of its customers, it can draw conclusions based on their values and attitudes, and what is important to them. Then the marketing team can create advertisements and marketing pieces using language that carries a tone and an attitude that is more likely to resonate with that particular customer for that specific brand.

“We’re able to know how we should differentiate those rather than just say ‘This one needs to be edgier’ and ‘This one needs to be more refined or classy,’” Davis said. “We can speak to specific elements or features that we think are going to resonate with this customer. Without that data we’d be flying blind and wildly guessing while now we are taking more calculated guesses.”

OneWater has also purchased registration data for competitive brands in its markets so it can conduct the same process on those brands.

“I know, for example, what the Chaparral buyer is versus my Cobalt buyer,” Davis said. “I can focus on the key points that will be more relevant to my Cobalt buyer versus the Chaparral buyer. What makes my customer different?”

It was that information that led to the company’s Pandora campaign, which was a finalist in the 2015 Best Ideas competition at the Marine Dealer Conference & Expo. (Read more in the Best Ideas White Paper at boatingindustry.com/e-white-papers.)

The research showed that while competitive buyers listened to the online streaming music service, OneWater’s buyers listen to Pandora twice as frequently.

There’s not a one-size-fits-all solutions for all companies, but knowing and tracking market and customer numbers are important for any business.

“There are so many ways the data can be used,” Davis said. “We could all use the exact same process and even get the same data results, yet all of us are going to come up with different ways to reach that audience. Small business is going to benefit from this business more than anyone else because it’s going to let them reach their exact customer in a more affordable way to get a better return on their investment.”