Yamaha, Mercury leaders provide insight into ‘New Normal’

What’s ahead for U.S. outboard manufacturers? Recent comments from key executives at Yamaha Marine Group and Mercury Marine provide insight into why higher horsepower products were recently introduced by each company.

Yamaha Marine Group President Ben Speciale provided an industry overview during his company’s late May product launch for the 5.6L, 425-horsepower V8 XTO Offshore outboard.

“Our view of the U.S. marine industry is that it promotes a pretty healthy lifestyle,” Speciale said. From a engine and boat manufacturers’ operational perspective, the bottom associated with that lifestyle is new boat sales, he added.

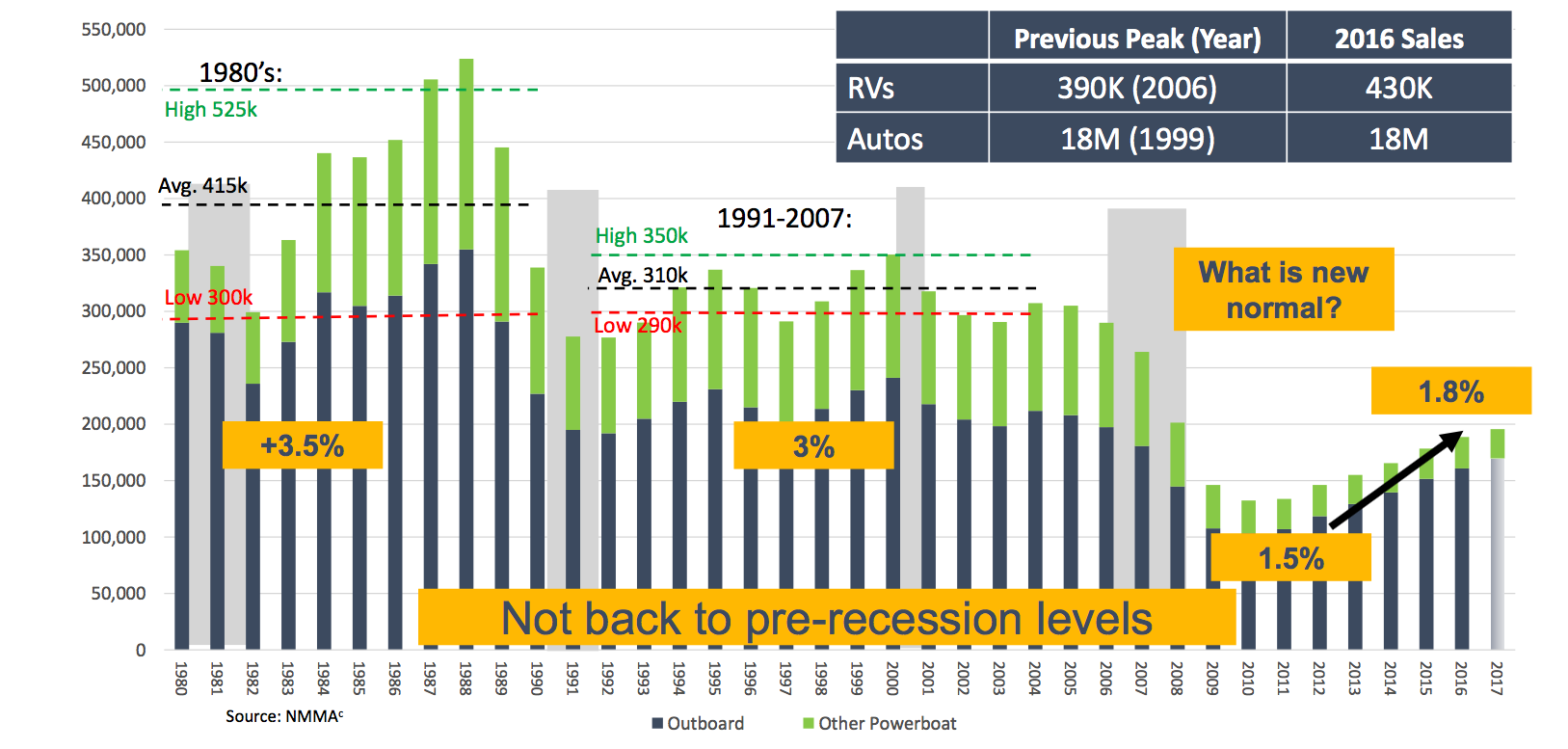

Prior to the Great Recession, the industry was producing about 310,00 new boats per year, a 3 percent replacement rate, Speciale said.

“Last year, an estimated 180,000 new boats were sold in the industry,” Speciale said. “That’s about a 1.8 percent replacement rate. The big question we have is, ‘What’s the new normal’ going forward? Is it returning to pre-recession levels? That’s what the RV and automotive industries did. From a unit point of view, we are not there yet.”

Speciale said there are more than 10 million registered boats in the United States. If 350,000 new boats are sold a year, that translates into a 3.5 percent replacement rate or 29 years to replace all the boats in the marketplace.

“That’s the math,” he said. “In the 1990s to 2006, lifecycle increased to 33 years. But, if the replacement rate stays at 1.8 percent, the boat lifecycle will be 55 years. That’s a really long time for boats to stay in the marketplace.”

Speciale said it’s possible for the industry to grow back to 250,000 boats a year. “There’s still a lot of runway for growth in this industry,” he said. “There also are some trends that we have to think about. When consumers buy new boats, they are buying boats with a lot higher feature content in the product. I’m not just talking about quad boats.”

If a customer is going to buy new, they are going to buy product with highly defined content, Speciale said.

“Boats are definitely getting bigger,” Speciale said. “We are seeing them in the marketplace everywhere. More sterndrives are converting to outboard power. If you live up north, you can get another 60 to 90 days out of your boat. Builders are adding a lot more capacity, and there’s a lot more growth in the 100-plus horsepower outboard business.”

Speciale used National Marine Manufacturers Association data to back up his point. In 2000, 20 percent of the products sold were sterndrive, 26 percent were outboards over 100 horsepower, and 54 percent were outboards less than 100 horsepower.

“Look at what it is today,” Speciale said. “In 2018, it’s coming in at about 4 percent sterndrive, 49 percent for outboards over 100 horsepower and 47 percent for engines less than 100 horsepower. Bigger outboards are growing, because consumers are stepping up and and boat builders are putting more feature content in product.”

In order to keep up, there is a roadmap the industry can use to get to 250,000 new boats a year, Speciale said.

“The No. 1 thing we have to do is make sure we don’t get unintended governmental regulations affecting our industry,” he said. “We need to keep speaking with a louder voice in Washington, D.C. We need to see passage of the Modern Fish Act. We need to protect anglers’ rights to access, especially saltwater.”

Yamaha’s strategy for future products is moving to the next generation of four-stroke platforms, Speciale said.

“When I’m asked, ‘When are you coming out with the next big engine?’ I reply, ‘Tell me what a boat is going to look like in 2030. What do you need in a boat in 10 years? That’s how we dial in products,” he said.

Mercury Marine’s broad new outboard engine launch announced in two phases this year speaks to parent Brunswick’s commitment to investing in innovation and product leadership.

“It has been a momentous year for new product introductions at Mercury Marine,” Brunswick Chairman and Chief Executive Officer Mark Schwabero stated in a news release issued the same day Yamaha made its latest announcement.

At the Miami Boat Show in February, Mercury introduced a number of V6 outboard engines. The company launched 12 new V8 outboards and yet another new V6 model in mid-May. These include new models in the Verado, Four-Stroke, Pro XS, Racing and Sea Pro lines of engines.

The new products will begin to ship immediately as OEMs transition to the new model year, and will fill the retail pipeline in the third and fourth quarter of the year, Mercury reported.

The introductions represent the largest product development project in Mercury’s 79-year history, and have been accompanied by major investments over the past several years to its manufacturing footprint, stated Mercury Marine President John Pfeifer.

Brunswick has invested more than $1.2 billion in Mercury’s global operations since 2009 aimed at enhancing Mercury Marine’s product range, quality, cost efficiency, capabilities and capacity, Schwabero stated.

Pfeifer pointed to recent investments such as the construction underway on Mercury’s new NVH (Noise, Vibration, Harshness) research facility, one of several major expansion projects in the last 18 months.

During that time, Mercury officially opened its new EDP paint plant, commissioned a 4,500-ton high-pressure die-cast machine, the largest in North America, and added state-of-the-art assembly lines for production of the new V6 and V8 engines, Schwabero stated, adding: “Mercury Marine and the global marine industry it serves are vital to Brunswick.”

Mercury has averaged the launch of a new major product about every six weeks for the past several years. By the end of this year, more than 80 percent of the company’s outboard revenue will come from products introduced since 2012.

“Our strategic focus on propulsion and the parts and accessories businesses will continue to drive our growth and uniquely position us to continue to lead the market and deliver on our commitments. As a result of these efforts, we are well positioned to outperform healthy demand in the global marine propulsion market,” Pfeifer added.

Interesting to hear of long term planning by Mercury and Yamaha executives, however it seems to be only about combustion engines.

Any thoughts about electric drives?

In ten years time a significant number of consumers are likely to be driving electric cars. The battery technology is advancing rapidly and will be able to cater for most boat usage.

the quickest way to make room for new boats is to give us a way to recycle our old boats. I shocked this country has not demanded the manufacture to provide this service. this is recognized in Europe as a green issue and we cannot continue to be a throw away society.