Marine tech pushes forward

DMS providers advance technology, plan for growth

With all of the in-house data that needs to be converted, switching dealer management system (DMS) providers is often a major undertaking that isn’t considered lightly. Even considering the high barriers to changing providers — one-time setup fees, staff training and data conversion — DMS is so critical to the functioning of most dealerships that it’s worth considering what’s available.

While you’ve been busy working on your existing system, DMS providers have seriously upped their game by releasing the most advanced, full-featured versions of software the marine industry has ever seen.

Depending on whom you choose, latest-generation features include bright, colorful touchscreen capabilities, integrated customer relation management (CRM) functionality, onboard advertising modules, seamless software updates, automated customer reminders to pick up their boats and, the buzzword of the decade, full mobile capability to untether dealership employees from their desks, desktops and laptops.

The message from the DMS industry to marine dealers is unanimous: if you aren’t taking advantage of the current crop of advanced dealership software, you and your business may be left in the Stone Age, or at least those shadowy years of the early 2000s.

IDS changing the guard

While IDS is not as high-visibility as some of its competitors in the marine market, the company estimates about 300 marine retailers and approximately 40 percent of the Boating Industry Top 20 dealers use its products, in line with its focus on servicing medium- to large-scale businesses. IDS is looking forward to its next 25 years in the industry with optimistic eyes now that the industry is solidly in rebound mode.

“We’re in an upward portion of the cycle, which is excellent – our dealer constituents had a very solid year in ’13 and are planning for a good year in ’14,” said Sean Raynor, general manager at IDS.

Similar to its own evolution, Raynor sees more family businesses facing internal succession, with younger leaders focused on using technology to move their operations forward.

“You’ve got a changing of the guard at the ownership level where it’s being handed down from the first generation to the second generation, and with that you have a higher propensity to utilize tools and software and productivity things that are going to move the business,” he said. “These younger people that we’re encountering in the marketplace are really driven to make a difference using technology in order to satisfy the needs of the customer.”

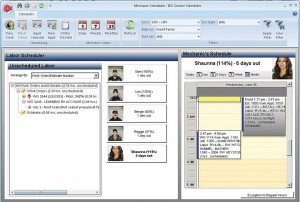

Astra G2 is the company’s marine- and RV-focused dealer management package that, Raynor said, has recently come to an advanced state of maturity after four years spent rewriting the entire suite of software. Some of the primary advantages of the updated version include an integrated CRM tool and expanded mobile capabilities that help the company maintain its focus on providing as much automation as possible for dealers.

“I would say we have some of the most automated software in the marketplace today,” he said. “When you sell a boat, the system is capable of actually automating a litany of processes around that boat purchased by the retail customer … it tells the customer the day before they need to pick it up … [and] automates a lot of processes within the business based on the events around boat purchases and boat sales.”

While acknowledging that many of the top-tier DMS providers have improved their offerings in recent years, Raynor added that IDS’ product is focused on allowing already slimmed-down companies to get more productivity out of their staffs.

To that end, Astra G2 has built-in marketing and advertising capabilities that he said have yet to be adopted by the expected number of business subscribers.

“We have some tremendous marketing capabilities within our software that we’re actually surprised the dealers don’t take more advantage of,” he said, adding that collection of customer emails should be a key focus for modern dealerships. “Collection of emails is sort of the premise for conducting some of this marketing [and it] is not being collected to the degree that we would like to see.”

Looking ahead, Raynor envisions future marine dealerships that are “device agnostic” where employees spend less time sitting at desks and more time on the dock, on the lot or with customers, wherever they may be.

He added that cutting-edge technology may soon alert businesses when customers pull in, allowing that customer’s salesperson to greet them on the lot or at the door.

“A lot of that technology already exists, it’s just putting it together and making it cost effective,” he said. “At the end of the day, it’s still a personal interaction with the people in terms of getting out on the water and enjoying it, and part of that is having a good experience with the business that you’re buying [your boat] from.”

ADP promotes business intelligence

It’s hard to miss ADP’s presence within the marine industry, with major promotions at most major events as the New Jersey-based payroll mega-giant seeks to grow its footprint in the boating industry.

Its latest marine product, LightspeedEVO, brings multiple a la carte modules — like sales, parts, service and accounting — into one package that provides clients with real-time accounting and multi-store capabilities so all locations and departments remain fully in sync with each other.

Some of its newer additions include an integrated CRM, which the company calls a Customer Experience Manager (CEM) due to its additional features like tracking leads, sending targeted marketing messages and announcements to customers and satisfaction surveys for multiple departments within a store. It has also added loyalty awards and a parts-and-unit locator product that allows dealers to check the inventory of other LightspeedEVO users.

One of its latest products is one that ADP general manager Greg Smith feels has the ability to transform the industry through shared dealer metrics. DataBack, which debuted in ADP’s previous NXT product, is a business intelligence tool that allows dealers to compare themselves with other dealers in the industry.

“A dealer generally will know or can tell from their financial data how they’re doing – you know, my sales are up 10 percent, my service department is up 15, whatever it is, but is that good or bad?” asked Smith. “You may be up 10, but the rest of the industry may be up 20, so I feel good, but is there room [to improve]?”

ADP, with approximately 500 marine clients, has grown quickly by adding approximately 200 new customers within the last three years. The company is on track to add another 100 dealers in 2014, with marine being the $9 billion company’s fastest growing market segment.

After the recession, several DMS providers have gone out of business, abandoned the marine business or slowed the pace of innovation. Smith urges dealers to stay up to date with what’s available, and focus on selecting a state-of-the-art provider that has strength to move its products forward in both good times and bad.

After the recession, several DMS providers have gone out of business, abandoned the marine business or slowed the pace of innovation. Smith urges dealers to stay up to date with what’s available, and focus on selecting a state-of-the-art provider that has strength to move its products forward in both good times and bad.

“We put a lot of resources into that market and have invested pretty heavily in development and continue to develop for the marine industry,” he said. “We’re in it, we’re really committed to it.”

Partially because switching DMS providers is a significant project, Smith said another consideration for dealers considering new software is to not just look at current needs, but also look at the business plan several years into the future.

“How is my business going to grow in the next four or five years? Do I want to add additional sites? Do I want to grow my sales line? Do I want to expand my customer base?” he asked. “As you’re thinking ahead you want to make sure that the software you select is going to grow with you and be able to support your business as you expand it.”

ADP customers still using NXT are being encouraged to switch to EVO, even though the company isn’t “force marching” people to convert to the latest, marine-specific LightspeedEVO where it will focus the bulk of its development efforts.

In the wake of the Target and Neiman Marcus holiday-season data thefts, Smith said businesses must think about regulatory compliance and data security matters. He added that advanced DMS helps dealers ensure compliance in every instance, as well as helping management enforce a process with staff so owners can rest assured critical operations are taking place.

“You look at retailers like our dealerships [and], while the prize may not be as big for a hacker, I don’t think anybody can take that for granted, and we strongly encourage our dealers to use the security measures that we have in place within the dealer management system,” Smiths said. “It’s always out there, and I think any business today’s got to be very vigilant.”

Dominion bets big on touch

With its high-profile launch of DX1, Dominion’s first foray into marine DMS, the company showed the assembled marine media and top-level dealers its vision for the future of dealership technology. Based on the still-new Windows 8 user interface, Dominion’s DX1 is a bold break from the rest of the category with full-scale touch integration, combining DMS services and marketing software together in one intuitive piece.

Damir Tresnjo, vice president of technology at Dominion, has been with the company for 10 years and has spent the last two years managing the many technological challenges of creating a wide-ranging piece of software that has been designed to transform the industry.

“Traditionally you have your DMS software that runs your back office and then you have your website provider, you have your advertising provider that provides you with various advertising opportunities, you may have a company that manages your social media, all these little software [programs] that as a dealer you have to use,” Tresnjo said. “After we acquired ZiiOS, we realized that we had most of these pieces so we figured that, hey, there is an opportunity to bring this all together and that’s what DX1 is about — it’s about bringing marketing, advertising and operational side of the dealership together into one coherent offering.”

become the marine market leader.

With a staff of 70 working on DX1 day in and day out, Tresnjo said one of the team’s primary challenges has been collecting and standardizing data between different entities. He gave the example of a boat color being listed as British Racing Green in marketing, yet just called “green” within manufacturing- or sales-focused specs.

“We had to bring these two worlds together and, to be honest, I expected that OEMs will have this data for us and we wouldn’t have to do that much work, but they’re not there yet so we had to do a lot of data cleanup,” he said.

Dominion’s DX1 team focused on collecting massive amounts of data in development in order to allow many tedious functions to fall into the background so dealership staff can be more productive with their time.

In explaining further benefits, Tresnjo talks about small functions that dealers constantly have to do between several software and Internet processes that require staff and management to keep track of a sequence of data entry that has to all be remembered to maintain accuracy on the website, for example.

“All these things add up to quite a bit when you’re talking about dealerships and what they have to do,” he said.

While DX1 is still in beta mode with only a handful of dealerships running the software, Dominion’s marine team is taking the slow-and-steady approach to gain feedback and improve the software before a large-scale debut.

Even with the slow ramp-up, Tresnjo expects his team’s product to become the market leader within just a couple of years.

“I think that market is wide open,” he said. “We’re saying, listen, it doesn’t have to be $40,000 up front and X-thousand dollars a month like it is with some competitors. This can be a very cost-effective solution and you can start small and slowly use more and more of the system. That’s the beauty of the system, if you start small and you upgrade later … there is no moving data around we can just show you a few more features and you can keep going.”