Sterndrives ramping up for a comeback

New engine technology, improving economy point to segment’s recovery

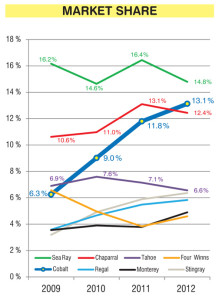

No segment of the marine industry absorbed a body blow as severe as what hit the sterndrive category in the last decade. According to the National Marine Manufacturers Association, annual sterndrive sales plunged more than 76 percent between 2004 and 2011, from 71,100 units down to 16,890 — a staggering drop that stressed engine manufacturers, boat builders, dealers and aftermarket companies alike. And, while sterndrives as a whole fell the furthest, compared with outboards, jet boats, PWC and inboards, they have also been the last segment to show signs of recovery.

What’s happened to the sterndrive market isn’t as simple as declining sales, though. During the same period, average unit costs have increased approximately $17,500 ($33,306 to $50,731) as a result of diverse factors including increased government regulations, added

creature comforts and dramatically shifting market demographics.

While sterndrives have been the last major boating segment to stage a recovery, new engine technologies from Volvo Penta and Mercury Marine are set to create a new generation of products that each company hopes will turn the tide to lift sales in this still-important category.

Leveraging global resources

Volvo Penta is one of the world’s largest, most recognizable names in the marine business. Here in the United States, Volvo Penta is the second largest manufacturer of sterndrive engines — market leader Mercury is its only competitor.

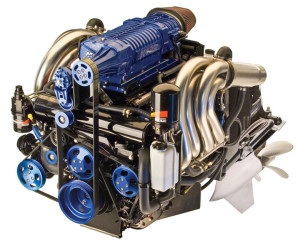

In the consumer realm, the company currently offers gasoline-powered sterndrive products in the 200- to 380-horsepower ranges, V6s and V8s. The V8 380 is Volvo Penta’s newest engine, using technology like variable valve timing and lighter weight construction that was sourced from the automotive industry.

While the new 380 has more updated technology than the time-worn, automotive engine blocks used by the sterndrive makers over the last decades, Volvo Penta’s Marcia Kull, vice president for marine sales, said this engine is a sign of drastically better products to come.

“We took a lot of the weight out of the engine package, and that also delivers better fuel efficiency — so all the things that the automotive industry has been improving over the years to meet CAFE standards … we are reaping the benefits of those engines,” she said. “As we introduce new engines in the next few years, they’ll just get better and better as a result of these advances in automotive technology.”

Reinforcing the point, Kull said recent innovation in the category has been largely focused on electronics like joystick control, cruise control and autopilot systems. From here on out, however, innovations from Volvo Penta will largely focus on the actual engines themselves, as the older V8 blocks provided by General Motors are discontinued. As the auto industry shifts and moves to new engine technology, the marine industry has no choice but to follow along. For Volvo Penta, this means lighter engines with a greater power density for a given size.

“People are moving out of V8 engines into V6 engines, because these new engines are capable of so much more — that’s what we’re going to be bringing to the marine industry in the next couple of years,” she said.

Cobalt Boats, whose entire lineup is sterndrive-powered, is an independent company that’s not exclusively affiliated with any of the engine manufacturers, allowing its customers to choose their powertrain.

Gavan Hunt, Cobalt’s vice president of sales and marketing, said the category has seen a lot of recent innovation with features like power trim assist, joystick and docking controls. In terms of the engines themselves, Hunt said Cobalt has been pleased with the performance and sales of Volvo’s newest, smaller displacement engines.

“It makes the boats lighter, which makes the boats handle better [and] makes the boats much like an automobile,” Hunt said. “You used to put a big 8.2 [liter engine] in a pickup truck, and now they put a 6.2- or a 6-liter engine. That has changed the dynamics of the vehicles and the same thing is starting to happen in boats.”

An automotive shift

With GM moving away from its familiar engine platforms, Volvo Penta and Mercury are both at a technological crossroads that will impact boat builders and customers throughout the industry for decades to come.

“Did we want to embrace those old blocks through third-party vendors and continue to make the same old stuff, or did we want to take advantage of the new automotive technologies and really push the market and deliver what, frankly, consumers expect because of their experience driving cars?” Kull asked. “We opted to go with the new automotive technology; I am absolutely convinced it was the right decision. The excitement and performance that we’re getting out of the 380 is a sign of things to come, and the market reaction has been extraordinarily strong.”

While these new, upcoming engines may not necessarily substitute V6s for V8s, today’s lighter engines are designed to provide significantly improved fuel economy. To harness more power from smaller engines, most of today’s more power-dense engines typically run at higher RPMs, but are naturally quieter than previous, heavier designs.

As car companies downsize engine offerings, some sports cars now come with sound-enhancing technology that either routes the exhaust sound into the passenger cabin or artificially creates that “performance sound” through the vehicle’s speakers. A sign of the times, Volvo Penta’s Captain’s Choice feature allows end users to route the exhaust sound out of the side of the boat for those that love the sound, or it can be turned off for customers that prefer quieter operation.

Cutting its own path

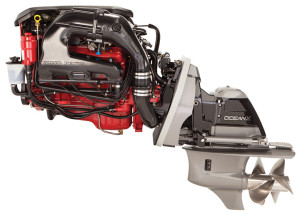

Part of the Brunswick empire, Mercury Marine is a builder of outboard, inboard, jet and sterndrive engines. Its MerCruiser sterndrive products range from the 135-hp 3.0L up to the 8.2 MAG H.O. ECT, which puts out a stout 430 horsepower. With a wide range of marine engine offerings for the consumer segment, as well as Brunswick’s portfolio of 31 boat brands, Mercury is more exposed to the North American sterndrive market than any other company.

Facing the same imposed evolution as the automakers move away from traditional engine platforms, Mercury is poised to take a different approach than Volvo Penta. Martin Bass, Mercury’s vice president of global category management, feels some of the latest automotive technology isn’t a clear win for marine applications when all factors are taken into account.

“So far we’ve taken a different direction [than Volvo Penta] and … we believe that the performance benefit that some of the automotive technology has inherently is offset by the added complexity and cost,” he said. “There’s no replacement for displacement, so we’ve focused on maintaining a product line that is purpose-built for marine.”

When asked for more details about future plans, Bass was understandably tight-lipped, but acknowledged that MerCruiser and Volvo Penta will be moving in different strategic directions going forward. He added that, while his company’s strategy differs, there is major investment coming into the sterndrive market over the next five years.

“It’ll be an interesting time for the industry, because there will be some different paths and technology that the companies take, and we’re very comfortable with the position we are going to take,” Bass said. “Stand by — you’re going to get a lot of good, juicy stuff.”

Future confidence

Given the dismal recent performance of the sterndrive market, major research and development investment may come as a surprise to some. For the manufacturers, however, it’s a solid sign that the industry expects the category to rebound from its lull, even if it that doesn’t mean returning to the elevated pre-recession annual sales numbers. Both companies cited inherent benefits of the sterndrive powertrain, namely low-speed maneuverability and access to the transom, which will keep this mode of propulsion at the forefront of the marine industry.

“I think the sterndrive, in particular the gasoline sterndrive product, offers a great mix of some of the elements of boat design,” said Bass. “You could easily make the argument that for a majority of consumers, the mix of boat design, performance and cost is a good mix for the gasoline sterndrive product.”

While the sterndrive market has been the last major industry segment to recover, Bass said it’s premature to say that trends seen since the dawn of the recession are permanent. He specifically emphasized the resiliency of the pontoon market that, he feels, is more a result of baby boomers retiring.

“Will the sterndrive runabout segments come back, and when will they come back? These are questions that the whole industry is struggling with,” Bass said. “Obviously Mercury is committed to those customers in a big way.”

At Volvo Penta, Kull feels its new, improved products will be the impetus to pull sterndrives out of the doldrums.

“With all segments in the marine industry, new sells,” said Volvo Penta’s Kull. “So we are very keen on our new products that are coming out, [which] we think will grow the segment. In addition to that, we’re also offering repair and maintenance agreements [and] extended warranties, all to reduce the total cost of ownership.”

Cobalt’s Hunt echoed that sentiment, saying new technology always helps customers justify making a trade, as well as helping improve the performance and perceived quality of its products.

“When there are significant technology improvements and the customer can feel it, see it and his family can feel it and see it, then it gives them a reason to buy, and that’s what we’re all striving for,” he said.

Investing during the downturn

A confluence of events impacted the marine industry and sterndrives in particular, making it difficult to pinpoint the most important factor in the segment’s rapidly declining sales figures. As customers demanded more features that they saw in consumer electronics, their homes and automobiles, boat builders had to respond to meet expectations. Concurrently, while the global economy entered a tailspin, the federal government began requiring catalytic converters to lower emissions. Using expensive precious metals, catalytic converters added a price penalty of approximately 15 to 30 percent per engine.

As the industry fell deeper into a slump, companies responded by significantly cutting costs in an effort to lower break-even points, leaving many companies anxious for further economic improvement that could lead to significant profit when the market comes back.

Leaning on the strength of the Volvo Group, Volvo Penta was able to ramp up research and development spending as the market declined.

“While the market was going down, frankly, our R&D was going up in anticipation of [introducing] new products,” Kull said. “Not necessarily voluntarily because these blocks were going away — we needed to move.”

Mercury’s Bass agreed that other factors in the sterndrive market, beyond adding catalytic converters, have been at play.

“The other things that are going on … are related to other raw material price increases relative to inflation,” he said. “You think about a fiberglass boat, and a lot of the products are petroleum based, so I think boat builders would confirm, if you looked back enough, substantial increases in costs in other raw materials.”

Like its competitor, Mercury also improved its efficiency and increased R&D spending in an effort to capitalize on an improving market. Bass said the reinvestment and pace of development has made it a rewarding time to be working behind the scenes.

“We are currently investing in the sterndrive category, as well as our other categories to a large degree — even a historical degree,” Bass said. “Any time you’re given the opportunity to think strategically about the business, where you want to take it and where the customers are going, it is a lot of fun.”

Looking forward

As the engine manufacturers work on building a new generation of engines, Cobalt is looking ahead to the remainder of 2013, which has started strong despite the persistent cold weather in the north.

“I think we’re going to have a fantastic year, and I think we’re going to grow again next year both in units and in dollars, and I do believe we’re at a sustainable level barring any very crazy circumstances,” Hunt said.

Aside from new technology, Volvo Penta sees reasons for optimism in the progress on the E15 front due to promising research into isobutanol, its continually improving diesel technology and sterndrives’ position relative to outboards.

“When the outboards started to catch up with … four-stroke technology, they started to be more competitive with sterndrives,” Kull said. “But now with the new automotive technology in the sterndrives, sterndrives are going to leap ahead of the outboards again.”

Aside from new product, Mercury is bullish on the category’s future also because of the sheer size of the decline, adding that consumers haven’t changed their habits that dramatically overnight.

“Mercury’s been in the sterndrive business for [more than] 50 years, and I think we’ve shown through our performance that we do it better than anyone else,” Bass said. “There’s no magic bullets there, but if anybody’s going to do it, we’re going to do it.”

The new stern drive on the market and looking for investors to make it the driving force in the 21st century and to make the stern drive comeback

The market darling for 2014