Asking more from your DMS

Dealer management system providers adding features, looking to the cloud and seeking total integration of dealership services

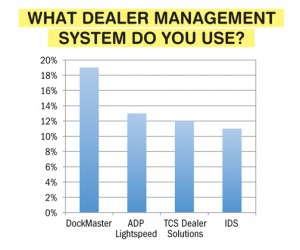

In a Boating Industry survey focused on the challenges, impacts and desires for in-house dealer management systems (DMS), one of the most intriguing findings arose from a question buried deep within. “Which DMS functions have the greatest need for improvement?” Nearly 20 percent of all respondents specifically cited the need for greater integration among the many disparate systems used by most marine dealers.

As Web 2.0 — loosely defined by social networking, Web applications and user-driven content — redefined the way dealers keep their books, connected with customers and promoted their businesses, new technology is once again on the horizon to take things to the next level. Web 3.0, as it’s called, will not be defined by user-driven content, but rather by computer-created content that’s far more powerful and useful to business owners.

Imagine your sales team helping customers build their new boats from a tablet while on the water, service techs seamlessly creating work orders with only one system, and DMS software that’s smart enough to compare your numbers to peer dealerships in real time.

Industry experts and DMS developers agree that many significant changes are afoot. From the integration of websites, the embrace of cloud and mobile computing, live analysis and add-on applications are all here, or coming soon. And, thankfully for marine dealers, eliminating the redundancy of multiple, incompatible dealership computer systems is at the top of the list.

All-encompassing integration

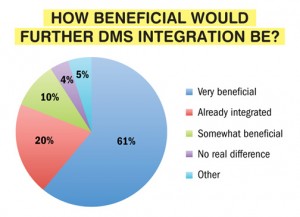

Reaching back into the survey results, a commanding 71 percent of respondents said it would be somewhat (10 percent) or very beneficial (61 percent) if DMS were integrated across all dealership operations.

Greg Smith, vice president and general manager of ADP Lightspeed, sees the next five years as pivotal in DMS, and said the company is growing at a phenomenal clip while making a major financial commitment to the marine industry.

“The good dealers are looking at all of their technology solutions and saying [they] want the ability to interact with customers, whether it’s in the sales process or in customer retention, I want that all to be seamless, an integrated workflow … so one of the things that we have done and are continuing to do is look at the various technologies a dealer uses and bring them all together so they’re seamless.”

The end goal, in Smith’s eyes, is making life easier for all dealership staff, making everyone more efficient and reducing redundancy wherever it exists.

“There is a huge opportunity for us to help dealers take their business to the next level and be more successful,” he says.

Cam Collins, president and CEO of DockMaster, echoes the integration theme, as well as the inefficiency and hassle of double- and sometimes triple-entry for certain dealerships, particularly those selling multiple brands. DockMaster sees this evolving with a different twist, using its own DMS platform as a hub for third-party add-on products — much like Apple or Android smartphone apps.

“We do not have the philosophy that we can develop every single possible feature and technology that our dealers need,” he says. “We would much rather connect with best-in-class providers who provide systems or websites or apps that enhance the use of DockMaster.”

As an example, Collins listed ARI’s FootSteps, which provides manufacturers and dealers with an electronic way to log and track in-store customer visitors, sales calls and Internet leads. He also added dealers’ interest in integrating their own websites into their DMS software.

“If you are a dealer that has an online parts store, an ecommerce site, you can tie that directly back into the DockMaster inventory database and be able to, in real-time, pull inventory out of the DockMaster system,” Collins says. “We also see a lot more connectivity with manufacturing systems and the ability to literally go to a site and build a boat online.”

Live business intelligence

Coming out of the Great Recession, another trend is dealers expecting more functionality and data analysis from their management systems. ADP’s newly released Full Customer View means when a customer’s name is entered on screen, staff can see all current transactions the customer has with the dealership, if a sales contract is in progress or any pending or recent service orders.

“I expect my management system is going to alert me when I have customer issues, or when my parts are out of balance, so it will generate alerts for things I need to address,” says Smith. “Even more than that, it will help me know where I can do better, where I can improve my business performance and take action at a management level.”

ADP’s DataBack product can calculate how a dealer’s gross margins compare with other dealers, analyze month-to-month financial trends, create detailed reports for sales, parts and service departments, as well as generate ZIP code maps that show performance throughout the local area.

Noel Lais, vice president of operations at Spader Business Management, says his company’s focus is on real-time data — revenue, gross margins and inventory, among others — and getting that data in dealers’ hands as soon as possible.

“When I started in this business 30-some years ago, 30 days after the end of the month you’d get your financial statement — that’s too late now, because things are happening so fast,” he says. “In the information world, it’s all about getting information on a more timely basis.”

These days, dealers can submit financial information to Spader using whatever DMS platform they choose and see comparisons and analysis the very next day, allowing managers to react immediately to changing conditions. A big part of its focus, through its 20 groups or data analysis, is connecting dealers to share numbers to the entire industry’s benefit.

Lais says his company’s most successful clients are those who have been paying close attention to best practices and proactive data analysis.

“Are you market-driven or are you management-driven?” he asks. “[If you are] market-driven, you’re riding the market and, if the industry’s doing well, you’re riding along with that. [If] you’re management-driven, you’re adjusting your business to what’s going on in the industry at the current time — you’ve really had to have been management-driven in the last several years to be successful with the recession.”

Connecting dealers and OEMs

Looking further ahead, DockMaster’s Collins sees a need to better connect dealers and manufacturers to reduce inefficiencies at a technical level, specifically purchase orders, and warranty registrations and claims.

“One of the things we can do as an industry is get a lot better at the whole dealer-manufacturer connection,” he says. “It’s just a matter of the technology providers getting together and solving a lot of those problems.”

It’s a timeworn idea, as the now-defunct Marine Association of Technology Exchange Standards (MATES) sought to solve this very problem well before the recession hit the industry.

Collins likens MATES to similar efforts successfully implemented by the automotive industry. Changing technology standards, however, is a challenge when many different manufacturers have their own propriety technology standards, leading to duplication within multi-line dealers.

“I think the time is right to bring this conversation back to the table,” Collins said.

State of the market

Citing improving sales numbers, smarter dealers, more tightly integrated technology systems and fewer dealerships to reap the rewards of a now-rising market, ADP’s Smith sees a coming trend of consolidation among dealers.

DockMaster’s Collins feels much better about the marine industry than he did a year ago, partly based on the excitement he saw at the Marine Dealer Conference & Expo (MDCE) held in Orlando last November.

“We probably had one of the best MDCEs we’ve ever had,” he says. “We saw a lot of strong dealer engagement and it just seems, especially in North America, that dealers in general are feeling more positive about the way things are going.”

Spader’s Lais worries about rising inventory levels, but shares his own positive prediction: “It’s going to be a gradual increase over the next several years, and I think that’s what we’re seeing. We’ve got to still pay attention to our P’s and Q’s and be management-driven, because I don’t think we’re going to be market-driven for the next several years. It’s got to be management-driven to produce the success that we’re all looking for.”