Pontoons, outboards expected to lead 2014 growth

Survey shows readers expect increases in most segments

The boating industry should continue to grow in most categories next year, but pontoons and outboards look to be particularly strong.

That’s according to the latest monthly survey of Boating Industry readers. We surveyed dealers, manufacturers, suppliers and others in December to get their views on the outlook for 2014 in what will be a recurring feature in Boating Industry. We also asked respondents to identify their primary business. For simplicity’s sake we’ve divided them into two groups of “dealers” (boat and engine dealers, marinas, boatyards and other retailers) and “manufacturers” (manufacturers, suppliers, service providers, distributors, etc.).

That’s according to the latest monthly survey of Boating Industry readers. We surveyed dealers, manufacturers, suppliers and others in December to get their views on the outlook for 2014 in what will be a recurring feature in Boating Industry. We also asked respondents to identify their primary business. For simplicity’s sake we’ve divided them into two groups of “dealers” (boat and engine dealers, marinas, boatyards and other retailers) and “manufacturers” (manufacturers, suppliers, service providers, distributors, etc.).

The same old song

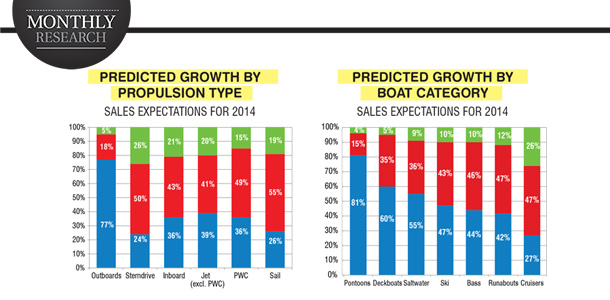

Just as they have the last several years, survey respondents expect outboards to be the propulsion of choice again in 2014.

More than three-quarters of BI readers predicted industry-wide sales growth for the segment this year – and 25 percent said sales should grow by more than 10 percent. That would be even better than 2013 will probably end, as outboard unit sales were up 8.8 percent nationwide year-over-year through September, according to the latest figures from Info-Link.

Only 5 percent think outboard sales will be down this year. (For more on the outboard market, be sure to check out this month’s Market Trends article.)

The industry seems to be much less optimistic about other propulsion segments. It’s no secret that sterndrive sales have continued to struggle, with units down 7.8 percent through September 2013, according to Info-Link. And that was on top of multiple years of double-digit declines to close out the last decade.

With that in mind, it’s probably not surprising that only 24 percent of respondents expect sales growth in sterndrive engines this year. It’s the smallest group expecting sales increases of any segment and the only segment where more expect a decline (26 percent) than an increase.

While not on par with the 77 percent calling for an increase in outboard sales, more than 36 percent do expect a sales increase in inboards this year. That follows an impressive 12.7 percent growth in unit sales for 2013 as the ski and watersport segments stayed strong. About 21 percent expect to see inboard sales decline this year.

As for non-powered boats, 26 percent are calling for an increase in sales and only 19 percent predicting a decline in 2014.

Dealers and manufacturers are fairly uniform on their views for the outboard, inboard sterndrive and sail segments, but there’s definitely a difference of opinion on the outlook for jet power in 2014 – for both jet boats and personal watercraft.

For both of those segments, the manufacturer side of the industry is much more optimistic about the potential for growth. Forty-three percent of manufacturers expect the jet boat segment to be up in 2014. That’s compared to 33 percent of dealers. And while 23 percent of dealers expect that market to decline, only 18 percent of manufacturers do.

There’s a similar split on PWCs, with 42 percent of manufacturers predicting market growth this year, compared with 29 percent of dealers.

With BRP’s departure from the sport boat market in 2012, jet boat sales have been especially volatile the last two years, up 30 percent in 2012 and down 27.3 percent in 2013. Chaparral and Rec Boat Holdings are both entering the jet boat market with new products in 2014, so another year of sales growth wouldn’t be unexpected, either.

PWC sales have grown slightly each of the last two years, 3.6 percent in 2013 and 5.5 percent in 2012, according to Info-Link.

Pontoon power

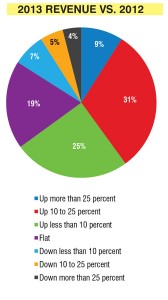

The optimism around the pontoon market shows no sign of waning, as it’s easily the category in which BI readers are most confident.

More than 80 percent expect sales to be up this year for the popular segment and 35 percent predict industry sales will increase more than

10 percent over 2013. Only 4 percent expect a decline.

Overall, respondents were more optimistic than pessimistic about every other segment as well. However, in every powerboat category, dealers proved to be less optimistic than industry manufacturers and suppliers.

• Deckboats – 70 percent of manufacturers expect an increase in 2014, compared with 50 percent of dealers

• Ski – 51 percent of manufacturers expect an increase in 2014, compared with 41 percent of dealers

• Runabouts – 49 percent of manufacturers expect an increase in 2014, compared with 34 percent of dealers

• Saltwater fishing – 62 percent of manufacturers expect an increase in 2014, compared with 47 percent of dealers

• Bass – 51 percent of manufacturers expect an increase in 2014, compared with 37 percent of dealers

• Cruisers – 33 percent of manufacturers expect an increase in 2014, compared with 23 percent of dealers

Clearly, manufacturers have a more positive outlook for 2014. It’s important to note, though, that for every category (excepting cruisers) more dealers expect sales growth than declines.

Optimistic outlook

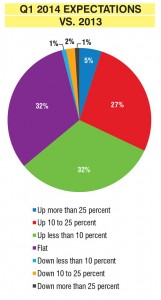

Overall, survey respondents continue to report positive year-over-year growth, with 65 percent reporting higher revenue at the end of 2013 than on 2012. Forty percent were up more than 10 percent compared to a year ago and 8 percent were up more than 8 percent. Only 16 percent reported a revenue decline.

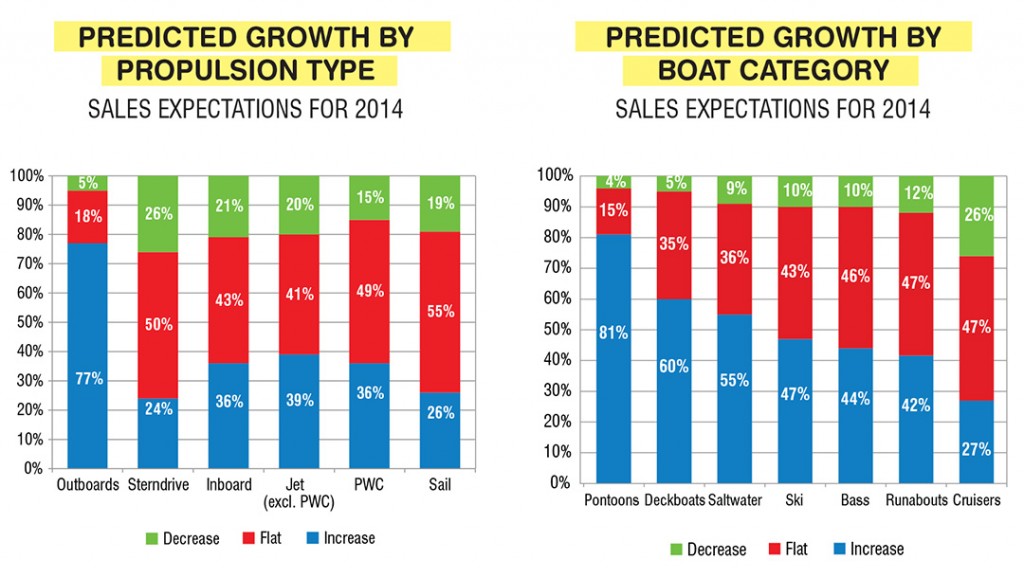

Nearly two-thirds also expect revenue growth for the first quarter of 2014 and 31 percent expect revenue to be up more than 10 percent for the first three months of the year. Only 4 percent expect revenue to decline from last year’s poor start to the season.

Those are encouraging numbers, as the National Marine Manufacturers Association closed out 2013 with an estimate that we saw 5 percent growth in new powerboat retail unit sales and an 8 percent increase in revenues, despite the late spring in most of the country.